One scoop to begin: The Pentagon, US Treasury and state division have all concluded that Nippon Metal’s $15bn acquisition of US Metal poses no nationwide safety dangers, though President Joe Biden is predicted to dam the deal.

And a rocketing valuation: Elon Musk’s SpaceX has been valued at $350bn in a brand new deal to purchase workers’ shares, making the rocket and satellite tv for pc maker the world’s Most worthy non-public start-up.

Welcome to Due Diligence, your briefing on dealmaking, non-public fairness and company finance. This text is an on-site model of the publication. Premium subscribers can join right here to get the publication delivered each Tuesday to Friday. Commonplace subscribers can improve to Premium right here, or discover all FT newsletters. Get in contact with us anytime: Due.Diligence@ft.com

In immediately’s publication:

-

TPG’s David Bonderman dies at 82

-

Mega grocery store deal devolves into authorized combat

-

Non-public fairness will get a slice of American soccer

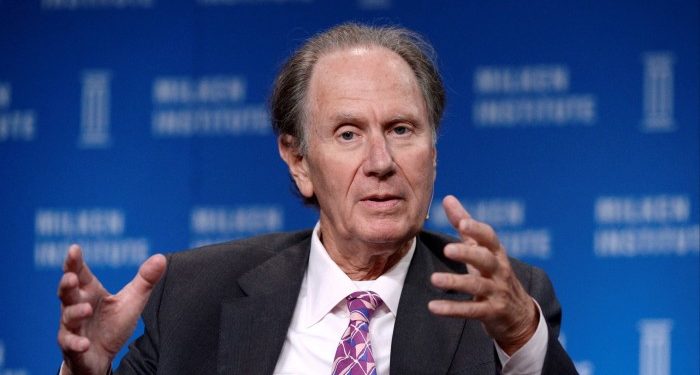

Non-public fairness pioneer David Bonderman dies

One of many pioneers of the $4tn non-public fairness business was a late bloomer in buyouts.

He spent his first 4 a long time constructing an eclectic profession that spanned arguments in entrance of the US Supreme Court docket, battles to protect New York’s iconic skyline, and even high-profile desegregation efforts as a member of President Lyndon Johnson’s administration.

The person we’re speaking about after all is David Bonderman, the co-founder of TPG and pioneer of personal fairness alongside Henry Kravis and Stephen Schwarzman, who has died at 82.

As a financier, Bonderman made a reputation for himself within the Nineteen Nineties on the daybreak of a golden period of personal fairness. Then in his late forties, Bonderman shortly earned huge windfalls restructuring troubled firms and belongings. Ultimately, he chased a few of Wall Road’s largest-ever takeovers.

However his profession began a long time earlier as a lawyer. At Tulane College within the Nineteen Sixties, Bonderman pushed for the desegregation of one of many South’s pre-eminent regulation faculties earlier than changing into a civil rights litigator below president Johnson.

After transferring to the non-public sector at Arnold & Porter, he famously defended Raymond Dirks, a inventory analyst who had been charged with insider buying and selling. He finally received an attraction on the Supreme Court docket, which catapulted him to securities regulation fame.

All of the whereas Bonderman cultivated an curiosity in preservation. He received the attention of billionaire oil man Robert Bass whereas litigating a profitable combat in opposition to the demolition of New York’s beaux-arts masterpiece Grand Central Terminal.

Bonderman discovered his approach to Texas and below Bass’s tutelage tried his hand at high-stakes dealmaking, the place he met Jim Coulter, who would ultimately grow to be his co-founder at TPG.

Bonderman and Coulter within the early Nineteen Nineties rescued Continental Airways, turning a $64mn funding right into a $700mn windfall. In addition they made a fortune reviving troubled asset portfolios after a wave of financial institution failures, creating the inspiration of TPG, which now manages almost $250bn in belongings.

By the mid-2000s, TPG was amongst a handful of huge buyout retailers that had been main a wave of ever-larger, extra leveraged takeovers that reached $20bn valuations.

Its two largest offers had been taking part within the takeover of Texas utility TXU and on line casino operator Harrah’s — two of the largest non-public fairness takeovers of all time.

Neither ended nicely. They each filed for chapter, the place almost all of TPG’s multibillion-dollar investments had been worn out.

However prior to now decade or so, the group staged a comeback with well timed investments within the likes of Uber and Airbnb — and a large presence in impression and climate-based investments.

In 2022, Bonderman and Coulter took the ultimate step in solidifying the group’s rank among the many largest non-public fairness teams: they took TPG public.

“David was an internationalist which means that he had a really broad view of the world,” Coulter mentioned in an interview with the FT. “He had an appreciation for folks and personalities of every type and he had a broad set of relationships.”

Lawsuits fly after collapse of $25bn grocery store merger

Lina Khan nabbed an enormous win on Tuesday when Albertsons walked away from what would have been the biggest grocery store merger of all time.

However the outgoing chair of the Federal Commerce Fee additionally snubbed the corporate’s controlling shareholder, Cerberus Capital Administration, who was poised to reap billions from the sale to rival Kroger.

The New York-based distressed investing and personal specialist made its first funding in Albertsons almost twenty years in the past. It has slowly grow to be the grocery store chain’s largest shareholder, with a virtually 30 per cent stake.

As Albertons grew to one of many US’s largest grocery store chains, so did Cerberus’s potential payout.

The secretive non-public fairness agency has already earned greater than $4bn in interim funds because it first invested in 2006.

The tie-up of Kroger and Albertsons was anticipated to make Cerberus’s fortune even larger. The shareholder received one other $4bn within the type of a dividend cost it earned as a part of the $25bn deal.

Had the deal closed, Cerberus would have received $8bn extra, in accordance with FT calculations on the time of the proposed merger.

On Wednesday, the state of affairs shortly devolved right into a authorized combat.

Albertsons mentioned it might sue Kroger over failing to train “greatest efforts” and to take “any and all actions” to win regulatory approval for the deal, which was blocked in a double-whammy on Tuesday by two judges, and the FTC sued to dam the deal earlier this yr.

Albertsons needs its $600mn termination payment, plus extra aid “reflecting the a number of years and a whole lot of thousands and thousands of {dollars} it dedicated to acquiring approval for the merger”.

In the meantime, Kroger mentioned Albertsons had introduced claims that had been “with out advantage” and dedicated “repeated intentional breaches and interference” all through the merger course of.

Cerberus, for its half, appears to be doubling down for the lengthy haul. Whereas the group mentioned it was “upset” by the courtroom ruling, it had “no intention” of promoting its billions in Albertsons inventory.

The NFL’s members’ solely membership

Non-public fairness has spent the previous few years angling for profitable methods to become profitable in sports activities. And this yr, they’ll sink their tooth into an untapped treasure chest: American soccer.

The primary two offers to purchase stakes in Nationwide Soccer League groups arrived on Wednesday, with credit score big Ares Administration and sports-focused non-public fairness investor Arctos.

Ares is shopping for a ten per cent stake within the Miami Dolphins, whereas Arctos led a bunch to buy a minority stake within the Buffalo Payments (owned by oil billionaire Terry Pegula).

These are definitely solely the primary of many.

NFL homeowners management who will get accepted to personal a direct stake in groups, which means Ares and Arctos have simply gained entry to one of the crucial unique members’ golf equipment within the nation.

In August, the homeowners accepted a serious overhaul to possession guidelines, which for the primary time, allowed non-public fairness teams to spend money on groups — in the event that they get the homeowners’ blessing.

The phrases for these investments are large. Ares is shopping for the Dolphins stake from billionaire actual property mogul Stephen Ross at a valuation of $8.1bn, mentioned folks briefed on the deal.

The NFL was lengthy thought-about the crown jewel of sports activities investing. The groups have unleveraged steadiness sheets, which implies they’re recession-resistant.

“It’s probably the most helpful international sports activities property from an financial standpoint,” mentioned one outstanding dealmaker.

Arctos and Ares have massive portfolios of sports activities investments, they simply hadn’t but tapped into the NFL. Arctos owns stakes within the Los Angeles Dodgers baseball crew and the Qatari-owned soccer crew Paris Saint-Germain.

Ares has accomplished offers with a number of soccer groups together with Chelsea, Olympique Lyonnais and Inter Miami, plus the McLaren Racing F1 crew.

The opposite corporations that received approval — Sixth Road and a consortium made up of Blackstone, Carlyle, CVC, Dynasty Fairness and Ludis — may quickly observe with stakes of their very own.

Job strikes

-

Deutsche Financial institution has employed Luba Kotzeva as the pinnacle of energy, utilities and vitality transition in Europe, in accordance with an inner memo seen by DD. She joins from Lazard. The financial institution additionally named Tom Moxham as head of infrastructure in Europe.

-

Financial institution of America promoted 387 workers to managing director, 16 per cent greater than final yr, Bloomberg reviews.

Sensible reads

Crypto ally Use of the cryptocurrency Tether has been linked many times to prison exercise, the FT reviews. The corporate’s shut ally, Howard Lutnick, is heading for the White Home.

Petrodollar windfall The brand new chief of Qatar’s $500bn wealth fund says the agency will deploy money “extra aggressively” because it prepares for an enormous inflow that would double its dimension, the FT reviews.

Tax dodge Most working Individuals pay taxes that assist fund Medicare, the programme that gives medical health insurance for older residents, ProPublica reviews. However not on Wall Road.

Information round-up

UK fintech Stenn collapsed after Russia cash laundering case drew scrutiny (FT)

Bain launches $4.3bn counterbid in opposition to KKR for Japan’s Fuji Comfortable (FT)

Adidas headquarters raided in second day in €1bn tax evasion probe (FT)

Two shareholder advisers aspect with Boohoo in Mike Ashley row (FT)

Macy’s cuts revenue outlook after worker hid $150mn in bills (FT)

Court docket blocks The Onion’s try to amass Infowars (FT)

Luxurious actual property brokers charged with intercourse trafficking (FT)

Financial institution of England plans harder liquidity guidelines for insurers following ‘essential gaps’ (FT)

Klarna fined $50mn and reprimanded by Swedish regulator (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please ship suggestions to due.diligence@ft.com

Beneficial newsletters for you

India Enterprise Briefing — The Indian skilled’s must-read on enterprise and coverage on this planet’s fastest-growing giant economic system. Enroll right here

Unhedged — Robert Armstrong dissects crucial market traits and discusses how Wall Road’s greatest minds reply to them. Enroll right here