Keep knowledgeable with free updates

Merely signal as much as the UK inflation myFT Digest — delivered on to your inbox.

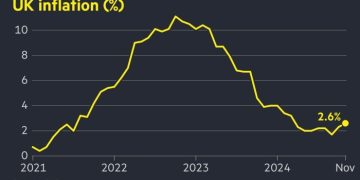

UK inflation accelerated to 2.6 per cent in November, highlighting the Financial institution of England’s problem because it grapples with persistent value pressures and a stagnating economic system.

The rise within the shopper value index was above the 2.3 per cent recorded in October however in keeping with expectations. Increased costs for motor fuels and clothes helped push inflation larger, in accordance with figures from the Workplace for Nationwide Statistics on Wednesday.

The rise comes forward of a gathering of the BoE’s Financial Coverage Committee on Thursday at which it’s extensively anticipated to carry rates of interest at 4.75 per cent, after lowering borrowing prices twice this yr.

GDP has shrunk for 2 consecutive months, whereas enterprise surveys level to weaker confidence and curtailed hiring intentions following Rachel Reeves’ tax-raising Finances in October. However the rise in inflation and a pick-up in UK wage growth has quashed hopes of an rate of interest reduce on the BoE’s closing assembly of the yr.

November’s CPI determine “extinguishes any lingering hopes of an rate of interest reduce on Thursday, whereas considerations over mounting inflation dangers, together with the latest spike in pay progress, imply {that a} February loosening just isn’t a accomplished deal,” mentioned Suren Thiru, economics director at accountants’ physique the ICAEW.

Following the discharge of the info, sterling edged down 0.1 per cent to $1.269. Buyers have all however dominated out the prospect of an rate of interest reduce on Thursday, in accordance with ranges implied by swaps markets, and count on simply two reductions subsequent yr.

Core inflation, which excludes power, meals, alcohol and tobacco, was 3.5 per cent in November, the ONS information confirmed, above the three.3 per cent recorded in October.

Providers inflation, carefully watched by the central financial institution as a gauge of underlying home value pressures, was 5 per cent in November, matching October’s determine however under analysts’ expectations of 5.1 per cent.

Governor Andrew Bailey has mentioned the BoE will proceed to ease coverage step by step however officers have pointed to the persistence of companies inflation as a motive for warning.

Clare Lombardelli, the deputy governor, told the Monetary Instances in November she was nervous that companies value inflation had continued to be “nicely above” charges in step with the BoE’s 2 per cent goal.

The November companies value studying was barely forward of the BoE’s personal 4.9 per cent forecast.

Inflation has fallen sharply from a peak of 11.1 per cent in October 2022, however the BoE now faces an uptick at a time of accelerating pressure for the economic system. Paul Dales of Capital Economics mentioned that he was now forecasting inflation might be almost a degree above the two per cent goal early subsequent yr. CPI progress was simply 1.7 per cent as lately as September.

Alongside indicators that the Finances has had a chilling impact on firms’ hiring plans, the BoE is assessing whether or not the rise in nationwide insurance coverage contributions to be paid by firms introduced by Reeves will add to inflationary pressures.

The rise in employer nationwide insurance coverage might be felt most acutely by companies companies given the burden of workers prices of their budgets. “This raises the query how a lot companies inflation can decline,” warned Andrew Wishart at Berenberg financial institution. Traditionally a 3 per cent improve in companies costs has been in step with the inflation goal, “which presently feels a good distance off”, he added.

Mel Stride, the Conservative shadow chancellor, accused Reeves of creating “a sequence of irresponsible and inflationary choices” which would go away inflation larger than forecast earlier this yr.

In a press release on Wednesday, Reeves mentioned: “I do know households are nonetheless struggling with the price of residing and right now’s figures are a reminder that for too lengthy the economic system has not labored for working individuals. I’m preventing to place more cash within the pockets of working individuals.”