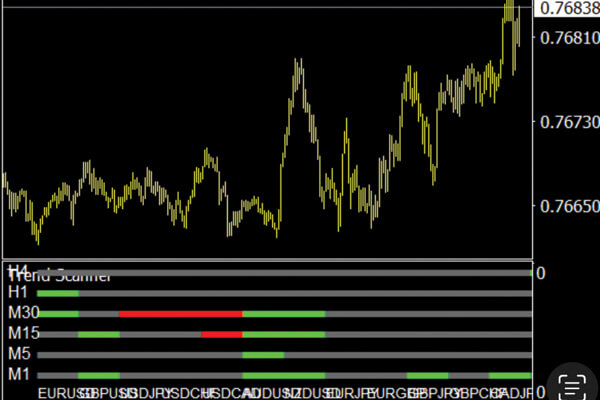

On this planet of Foreign currency trading and monetary markets, analyzing traits and figuring out worth adjustments is of nice significance. One of many highly effective instruments on this regard is the Market Pattern Scanner MT4 indicator, which permits merchants to shortly establish market traits. Through the use of this indicator, customers can pinpoint the strengths and weaknesses of traits and make higher selections of their trades. The Market Pattern Scanner MT4 indicator comes with distinctive options that distinguish it from different instruments. By leveraging this indicator, merchants can analyze previous and present traits and make correct predictions for the longer term.

Within the following sections, we are going to take a better take a look at the options and benefits of the Market Pattern Scanner MT4 indicator and study its significance within the buying and selling world.

Quantity indicators help merchants and buyers in visually monitoring the trajectory of capital motion and the corresponding worth responses to those shifts. By using these instruments, market individuals can establish areas and ranges of elevated liquidity for an asset, thereby enhancing their decision-making velocity on the subject of executing trades. Moreover, these indicators facilitate a deeper understanding of market dynamics, permitting customers to anticipate potential traits and reversals extra successfully.

What’s the greatest quantity indicator for foreign exchange?

In the case of foreign currency trading, a number of quantity indicators can show helpful for analyzing market traits and making knowledgeable selections. Listed below are the 4 greatest quantity indicators to think about:

On-Steadiness Quantity (OBV): The On-Steadiness Quantity indicator calculates the cumulative quantity by including the amount on up days and subtracting the amount on down days. This helps merchants gauge the momentum of worth actions; a rising OBV suggests that purchasing strain is growing, whereas a declining OBV signifies promoting strain.

2. Cash Circulation Index (MFI): The Cash Circulation Index is a momentum oscillator that measures the movement of cash into and out of an asset over a selected interval. The MFI takes each worth and quantity under consideration, offering insights into overbought or oversold situations. It ranges from 0 to 100, with ranges above 80 indicating overbought situations and ranges under 20 suggesting oversold situations.

3. Quantity-Weighted Common Value (VWAP): The Quantity-Weighted Common Value is a buying and selling benchmark that considers each worth and quantity. It gives a mean worth for an asset weighted by the amount traded at every worth stage. VWAP is especially helpful for establishing commerce alternatives because it helps merchants establish the true common worth of an asset all through a buying and selling interval.

4. Accumulation/Distribution Line (Accum./Dist.): The Accumulation/Distribution Line is a cumulative quantity indicator that assesses how a lot of a safety is being accrued or distributed in relation to its worth motion. It takes under consideration each the closing worth and quantity, indicating whether or not a inventory is below accumulation (shopping for) or distribution (promoting). A rising line often suggests accumulation, whereas a falling line factors to distribution.

Every of those quantity indicators provides distinctive insights into the foreign exchange market, serving to merchants to higher perceive market dynamics and make extra knowledgeable buying and selling selections.

It is doable that you’ve got looked for “foreign exchange quantity scanner indicator MT4 obtain.” If you happen to’re in search of additional particulars, kindly consult with the hyperlink under.

The right way to Examine Quantity within the Foreign exchange Market

1. Use a Buying and selling Platform: Many foreign currency trading platforms present quantity information for varied forex pairs. Search for a “Quantity” indicator or part throughout the platform to see the buying and selling quantity for particular time frames.

2. Analyze Tick Charts: Since foreign exchange markets function over a decentralized community and do not have a central change, merchants usually use tick charts that present worth actions primarily based on the variety of transactions or ticks moderately than conventional time-based charts. This can provide you insights into the amount of trades going down.

3. Quantity Indicators: Implement quantity indicators, such because the On-Steadiness Quantity (OBV) or the Cash Circulation Index (MFI), which might present deeper insights into buying and selling quantity in relation to cost actions. These indicators assist visualize how quantity correlates with worth adjustments.

The right way to Calculate Quantity in Foreign exchange

Within the foreign exchange market, quantity is historically measured by way of tick quantity, which refers back to the variety of worth adjustments or “ticks” a forex pair experiences throughout a given time-frame. Here is calculate it:

1. Determine Ticks: A tick represents the smallest worth motion of a forex pair. In foreign exchange, as costs fluctuate, each change—both up or down—counts as a tick.

2. Rely Tick Actions: To find out the amount for a selected interval, rely the whole variety of ticks throughout that timeframe. For example, if a forex pair moved up or down in worth 200 occasions inside one hour, the amount can be 200 ticks.

3. Monitor Timeframes: Completely different timeframes can yield totally different quantity readings. For instance, tick quantity might range when noticed over a 5-minute chart versus a 1-hour chart, so it’s important to make use of the timeframe that aligns along with your buying and selling technique.

4. Use Software program Instruments: Some buying and selling software program and platforms can robotically calculate the tick quantity for you, saving you the guide effort and offering real-time updates.

In abstract, whereas the foreign exchange market doesn’t measure quantity in a standard sense like inventory markets, using tick quantity can present precious insights into market exercise and liquidity, aiding merchants of their decision-making processes.

In conclusion, the Foreign exchange Quantity Scanner Indicator MT4 is a precious software for merchants in search of to boost their buying and selling selections. By offering insights into market dynamics and liquidity, this indicator helps merchants establish traits and make extra knowledgeable selections. Using the Foreign exchange Quantity Scanner Indicator MT4 can considerably enhance a dealer’s potential to navigate the complexities of the foreign exchange market and capitalize on worthwhile alternatives.