Unlock the White Home Watch publication without cost

Your information to what the 2024 US election means for Washington and the world

South Korean corporations concern that President Yoon Suk Yeol’s impeachment following a failed try to impose martial legislation this month has undermined efforts to foyer Donald Trump’s incoming administration to guard their exports and investments within the US.

The US president-elect has threatened to impose sweeping tariffs and evaluation beneficiant subsidies for corporations to put money into the US, together with these for America’s allies and largest buying and selling companions.

However latest political turmoil in Seoul has left the marketing campaign to counter Trump’s commerce protectionism rudderless, in response to a number of individuals concerned within the lobbying effort who described the South Korean authorities’s diplomatic efforts as “paralysed” and “absent” within the wake of Yoon’s aborted power grab.

“There is no such thing as a one from the federal government to symbolize the Korean curiosity simply after we want it probably the most,” stated an individual representing a conglomerate that invested billions of {dollars} within the US throughout outgoing President Joe Biden’s time period.

“It isn’t attainable for us to withdraw our investments now,” the individual added. “We’re like in a hostage state of affairs.”

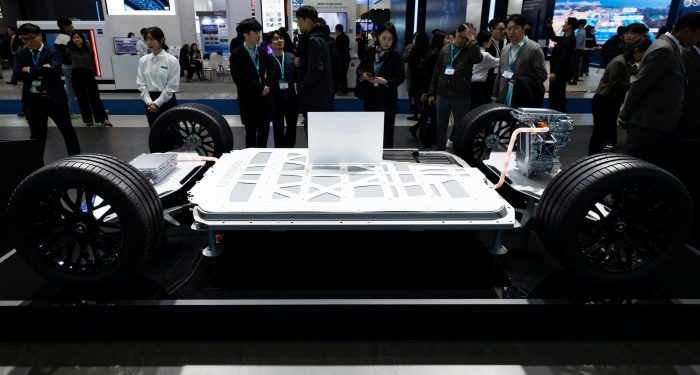

Trump-related dangers for South Korea’s export-reliant financial system vary from across-the-board import tariffs to the attainable revocation of subsidies for Korean chip, battery and electric-vehicle makers promised by Biden. The Korean semiconductor trade can also be uncovered to extra aggressive US export controls on China.

The specter of commerce disruption additionally comes at a time when Asia’s fourth-largest financial system is already wrestling with weak home demand, hovering personal borrowing and intensifying competition from Chinese exporters.

On Wednesday, South Korea’s overseas minister Cho Tae-yul acknowledged that the political turmoil had disrupted diplomatic efforts, including: “We’re totally dedicated to regaining that momentum as rapidly as attainable.”

Yeo Han-koo, a former South Korean commerce minister now on the Peterson Institute for Worldwide Economics in Washington, stated that even earlier than the political disaster, “the sensation in Seoul could possibly be described as nervousness bordering on panic”.

Korean policymakers and enterprise leaders have been “traumatised” by Trump’s first time period, stated Yeo, when the US president threatened to cancel a bilateral free commerce settlement and take away American navy forces from the Korean peninsula until Seoul contributed extra to their maintenance.

A survey of 239 corporations launched by the Korea Enterprises Federation this month discovered 82 per cent anticipated South Korea’s economy can be harmed by Trump’s anticipated protectionist insurance policies.

However Yeo urged that some Korean fears have been “overblown”, arguing that “a lot has modified” since Trump was first elected in 2016. South Korea was the largest supply of overseas direct funding within the US final yr, with corporations investing tens of billions of dollars in US manufacturing services for chips and inexperienced applied sciences.

“Greater than maybe some other nation, South Korea can argue it’s contributing to a revival in US manufacturing, and that it deserves a spot inside the partitions of Fortress USA,” Yeo stated.

South Korea’s commerce surplus with the US was $28.7bn within the first half of 2024, in response to the Korea Worldwide Commerce Organisation, and is ready to overhaul final yr’s file of $44.4bn, elevating issues that Trump, who’s delicate to US commerce deficits, may goal the nation once more.

Nonetheless, an government from considered one of South Korea’s main trade associations stated that latest conversations with individuals anticipated to serve in Trump’s administration urged that present investments would do little to sway the incoming president and his inside circle.

“We tried to attraction to them by stressing the truth that Korea was the largest overseas investor and created plenty of jobs,” the manager stated. “However we have been instructed that it doesn’t matter for Trump as he’s extra keen on what the Korean corporations will do any further. He doesn’t need to hear what they did through the Biden administration.”

One other individual conversant in the Korean lobbying effort stated one “particular concern” was the return of Peter Navarro, Trump’s former commerce envoy, as a senior financial adviser.

Trump this month praised Navarro, who beforehand accused Korean conglomerates Samsung and LG of “commerce dishonest” by relocating manufacturing to keep away from antidumping measures, for serving to renegotiate “unfair Commerce Offers like Nafta and the Korea-US Free Commerce Settlement”.

Analysts stated Korean corporations have been unlikely to take care of their scale of funding given the challenges they have been already going through, starting from excessive prices of development, labour and childcare to a scarcity of expert labour, difficulties securing visas and dependable energy provide. A weak South Korean received and lagging demand for EVs have been additionally dampening enthusiasm.

Lee Tae-kyu, senior fellow on the Korea Financial Analysis Institute (KERI), stated South Korea’s financial system may obtain a modest enhance if Trump’s tariffs centered narrowly on Chinese language exports, pointing to shipbuilding, defence and petrochemicals as areas the place Korean corporations stood to learn.

Seoul may additionally scale back its commerce surplus by shopping for extra American arms and fossil fuels, Lee added.

However Korean battery and EV makers may face a nightmare situation if Trump have been to succeed in a grand cut price with Beijing on commerce that allowed Chinese language rivals to arrange their very own vegetation within the US — one thing the incoming president has stated he would take into account.

“If Chinese language corporations are allowed to construct vegetation within the US, that might be a catastrophe for us,” stated a Korean battery trade government. “However even our authorities officers don’t appear to know who to speak to in Washington to ship our issues.”