Keep knowledgeable with free updates

Merely signal as much as the Personal fairness myFT Digest — delivered on to your inbox.

The wealth of US non-public capital bosses jumped by greater than $56bn in 2024 as shares of Blackstone, Apollo and KKR hit new highs, fuelled by speedy development and their addition to the primary US inventory index.

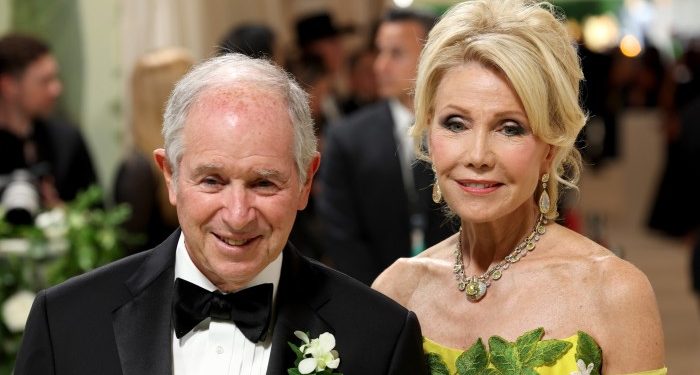

The share surge has enriched non-public fairness pioneers resembling Blackstone chief government Stephen Schwarzman and KKR co-founders Henry Kravis and George Roberts, and spawned a brand new set of billionaire dealmakers within the business forward of anticipated deregulation from the incoming Trump administration that would gas dealmaking and asset development in 2025.

Among the many seven largest listed US non-public capital corporations, beneficial properties in shares held by the business’s prime executives and founders had been over $56bn, led by the management of Blackstone, the world’s largest different supervisor, based on Monetary Instances calculations primarily based on public filings.

Blackstone’s prime leaders noticed their shares rise by $13.5bn in 2024 as its market worth soared almost 50 per cent to $214bn.

Its inventory was propelled by the expansion of its belongings, which have soared past $1tn. In September 2023, Blackstone turned the primary non-public fairness group included within the S&P 500 index.

Analysts count on Blackstone funds for rich non-public traders in actual property, credit score and personal fairness to generate profitable charges in 2025, bolstering earnings. Expectations for its efficiency have pushed its valuation to greater than 40 occasions its distributable earnings over the previous 12 months, a proxy for the group’s money move.

A lot of the development in executives’ holdings went to Blackstone chief government Schwarzman, whose inventory rose by greater than $11bn this 12 months. The holdings of president Jonathan Grey additionally gained billions in worth, placing his stake at about $7.5bn.

It has additionally meant two different prime executives — non-public fairness head Joe Baratta and chief monetary officer Michael Chae — held shareholdings price over $1bn, based on Blackstone’s proxy assertion.

KKR shares carried out the perfect of any massive non-public fairness group in 2024, as its inventory almost doubled attributable to accelerated fundraising, with almost $120bn in new capital over the previous 12 months. It was additionally added to the S&P 500 in June.

The beneficial properties imply the stakes of co-founders Kravis and Roberts each exceeded $12bn. Co-chiefs Scott Nuttall and Joe Bae have additionally seen their stockholdings soar to about $2.7bn, fuelled by KKR inventory’s 30 per cent common annual return since they assumed management in October 2021.

Apollo International, which was added to the S&P 500 in December, has additionally seen its inventory almost double in 2024, bolstering shareholdings of chief government Marc Rowan and co-founders Leon Black and Josh Harris, who each left the agency in 2021. The share beneficial properties have additionally created massive windfalls for a brand new technology of management inside Apollo who at the moment are paid principally in inventory.

James Belardi, co-founder and chief government of Apollo’s insurance coverage unit Athene, which oversees about $350bn, noticed the worth of his Apollo shares rise above $1bn this 12 months whereas Apollo co-presidents Scott Kleinman and James Zelter held shares price greater than $500mn, based on its annual report. The duo got massive inventory grants as a part of their promotions in 2017 and had been in line to collectively lead Apollo had Rowan left to change into the US Treasury secretary below President-elect Donald Trump.

Apollo’s subsequent technology of management has additionally benefited from the leap within the share worth. In September 2023, Apollo granted $550mn of restricted inventory models to a management group of John Zito, deputy chief funding officer of credit score, Grant Kvalheim, president of Athene, and two senior non-public fairness companions, Matt Nord and David Sambur. The worth of that award has since roughly doubled to greater than $1bn.

Nevertheless, in latest months, executives like Kleinman, Belardi, Zelter and Rowan have both offered massive blocks of Apollo inventory or signalled their intent to take action.

The highest executives at Ares, TPG and Blue Owl all noticed their shares achieve by over $4bn in worth in 2024, based on FT calculations, bolstered by share beneficial properties of 50-65 per cent.

Along with inventory beneficial properties, non-public capital executives stand to earn massive windfalls from quarterly dividends on their shareholdings. Collectively, prime executives on the seven corporations have acquired almost $3bn in dividends this 12 months, based on FT calculations.