UPCOMING

EVENTS:

- Monday: China Caixin Companies PMI, German CPI, Canada

Companies PMI. - Tuesday: Switzerland CPI, French CPI, Eurozone CPI, US ISM

Companies PMI, US Job Openings. - Wednesday: Australia Month-to-month CPI, Eurozone PPI, US ADP,

FOMC Minutes. - Thursday: Japan Common Money Earnings, Eurozone Retail

Gross sales, US NFIB Small Enterprise Optimism Index, US Jobless Claims. - Friday: Switzerland Unemployment Charge, Canada

Employment Report, US NFP, US College of Michigan Shopper Sentiment.

Tuesday

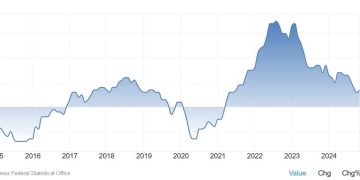

The Swiss CPI Y/Y

is predicted at 0.6% vs. 0.7% prior, whereas the M/M measure is seen at -0.1% vs.

-0.1% prior. As a reminder, the SNB cut its policy rate by 50 bps on the final resolution bringing it to 0.50%

and dropped the language signalling additional cuts within the coming quarters.

This means that

the central financial institution will possible gradual the tempo of easing which is one thing that

the market was already anticipating with two 25 bps cuts priced in for this yr.

The SNB has projected inflation to common 0.3% in Q1 2025, so that is going to

be the baseline for the subsequent assembly in March.

Switzerland CPI YoY

The Eurozone CPI

Y/Y is predicted at 2.4% vs. 2.2% prior, whereas the Core CPI Y/Y is seen at 2.7%

vs. 2.7% prior. As a reminder, the ECB cut the policy rate by 25 bps on the final resolution bringing it to three.00%.

The central financial institution

eliminated the passage saying that “it should preserve coverage charges sufficiently

restrictive for so long as needed” implying that upside inflation dangers have

light. The market sees a 92% likelihood of a fee lower on the upcoming assembly

and a complete of 102 bps of easing by yr finish.

Eurozone Core CPI YoY

The US ISM

Companies PMI is predicted at 53.0 vs. 52.1 prior. The S&P Global US Services PMI confirmed as soon as once more an acceleration in providers

exercise rising to a 38-month excessive. New orders rose at a fee not seen since

March 2022 and inflation remained subdued with costs rising on the slowest

tempo since June 2020. Positively an excellent image for the providers sector.

US ISM Companies PMI

The US Job

Openings are anticipated at 7.700M vs. 7.744M prior. The last report beat expectations with the quits fee rebounding however

the hiring fee falling again to the cycle lows. It’s a labour market the place at

the second it’s arduous to discover a job however there’s additionally low threat of shedding one.

There’s an honest probability that issues will enhance this yr although and there

have been some constructive indicators already.

US Job Openings

Wednesday

The Australian

Month-to-month CPI Y/Y is predicted at 2.3% vs. 2.1% prior. As a reminder, the RBA softened further its stance on the final coverage resolution because it nears

the primary fee lower. The market is seeing a 52% probability of a 25 bps lower in

February though the primary absolutely priced in lower is seen in April. We get the This autumn

CPI and the Employment information earlier than the February assembly which might see the

market strengthening the case for an earlier lower.

Australia Month-to-month CPI YoY

Thursday

The Japanese

Common Money Earnings Y/Y is predicted at 2.7% vs. 2.6% prior. As a reminder, the

BoJ left rates of interest unchanged as anticipated on the final coverage resolution, however

Governor Ueda delivered a much less hawkish than anticipated presser.

The truth is, he positioned

a fantastic deal on wage data to resolve on the timing of the subsequent fee hike and

added that the development will change into clearer in March or April. This made the

market to cost out the possibilities for a hike in January and push again as soon as once more to the subsequent assembly which is

scheduled for March.

Japan Common Money Earnings YoY

The US Jobless

Claims continues to be some of the necessary releases to comply with each week

because it’s a timelier indicator on the state of the labour market.

Preliminary Claims

stay contained in the 200K-260K vary created since 2022, whereas Persevering with Claims

proceed to hover across the cycle highs.

This week Preliminary

Claims are anticipated at 217K vs. 211K prior, whereas there’s no consensus for

Persevering with Claims on the time of writing though the prior launch noticed a

lower to 1844K vs. 1910K prior.

US Jobless Claims

Friday

The Canadian

Employment report is predicted to point out 25.0K jobs added in December vs. 50.5K in

November and the Unemployment Charge to rise additional to six.9% vs. 6.8% prior. The

final report noticed a robust headline quantity, however the particulars had been damaging fairly

a lot throughout the board.

CIBC

cited massive public sector job features, highest unemployment fee since 2016 and

personal sector employment development being lower than half than labour drive development. The truth is, the rise in unemployment since early 2023 has been primarily as a result of

elevated problem discovering a job. Layoffs haven’t performed a big

function because it’s normally the case in a recession.

As a reminder, the

BoC cut the policy rate by 50 bps as anticipated on the final resolution however

dropped the language indicating additional fee cuts. This means that the

central financial institution has reached the height in its dovish stance, and it’ll now gradual

the tempo of cuts conditional to the information. The market expects not less than two extra

25 bps cuts this yr with a 71% likelihood of 1 coming already this month.

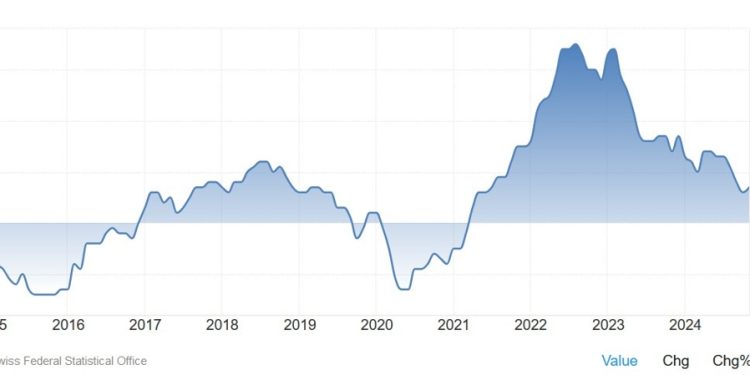

Canada Unemployment Charge

The US NFP report

is predicted to point out 160K jobs added in December vs. 227K in November and the

Unemployment Charge to stay unchanged at 4.2%. The Common Hourly Earnings Y/Y

is predicted at 4.0% vs. 4.0% prior, whereas the M/M measure is seen at 0.3% vs.

0.4% prior.

The Fed projected

the unemployment fee to common 4.3% this yr. They may possible tolerate

overshoots of 10 or 20 bps if inflation doesn’t cooperate. Nonetheless, the

focus switched again to inflation, so the subsequent CPI report goes to have a

larger affect than the NFP report.

US Unemployment Charge