Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

The British authorities sought to quell tumult in UK bond markets on Thursday by vowing to stay to its fiscal guidelines whilst borrowing prices hit their highest stage for the reason that monetary disaster.

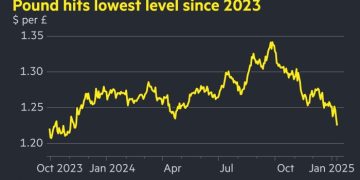

Darren Jones, quantity two on the UK Treasury, appeared in parliament to reply pressing questions on the markets turmoil after the 10-year gilt yield rose to 4.93 per cent, its highest since 2008, and the pound dropped as a lot as 1 per cent towards the greenback to its lowest for greater than a yr.

“UK gilt markets proceed to perform in an orderly approach,” Jones informed MPs. “There must be little question of the federal government’s dedication to financial stability and sound public funds. This is the reason assembly the fiscal guidelines is non-negotiable.”

Jones’ look got here after Sir Lindsay Hoyle, Speaker of the Home of Commons, accepted an pressing query from the Conservative opposition concerning the “rising stress of borrowing prices on the general public funds”.

Chancellor Rachel Reeves, who’s about to depart for a long-scheduled journey to China, dispatched Jones, chief secretary to the Treasury, to reply.

UK borrowing prices have risen sharply as traders fear concerning the authorities’s heavy borrowing wants and the rising menace of stagflation, which mixes lacklustre progress with persistent worth pressures.

“The economic system is getting into stagflation,” stated Mark Dowding, chief funding officer at RBC BlueBay Asset Administration.

On Thursday, the 10-year gilt yield rose as a lot as 0.12 proportion factors earlier than easing again to 4.85 per cent. Sterling was swept up within the sell-off, dropping to $1.224, its weakest since November 2023, earlier than staging a partial restoration.

“The sell-off in [the pound] and gilts displays a deterioration within the UK’s fiscal prospects,” stated analysts at Brown Brothers Harriman.

Jones argued it was regular for gilt costs to range and that there was nonetheless sturdy underlying demand for UK authorities bonds.

“The newest public sale held yesterday acquired thrice as many bids as the quantity on provide,” he stated.

The minister stated that the Treasury was nonetheless engaged on a multiyear spending overview due this summer time on the idea of assumptions set out within the October Price range.

Nevertheless, he acknowledged that the Workplace for Price range Accountability, the unbiased Price range watchdog, would provide you with contemporary forecasts on March 26, which might then have an effect on discussions with ministers.

The current bond market strains additionally elevate the spectre of tax rises or spending cuts. The Treasury has signalled that, if needed, it will scale back expenditure reasonably than improve taxes.

Shadow chancellor Mel Stride, who had posed the pressing query, stated Reeves ought to have attended parliament herself.

“The place is the chancellor?” he requested. “It’s a bitter remorse that at this troublesome time, with these critical points, she herself is nowhere to be seen.”

Reeves left herself a slender £9.9bn of headroom towards her revised fiscal guidelines in final yr’s autumn Price range even after asserting a £40bn tax-raising bundle that aimed to “wipe the slate clear” on public funds.

The chancellor’s key fiscal rule is a promise to fund all day-to-day public spending with tax receipts by 2029-30.

Will increase in authorities debt yields have since put that budgetary wriggle room below menace. The extent of bond yields is a vital determinant of the finances headroom, given its implications for the federal government’s curiosity invoice, which exceeds £100bn a yr.

The gilts market might undergo one other bout of promoting on Friday, analysts stated, if intently watched jobs knowledge within the US was to push yields larger on US Treasuries, dragging gilts with them.

“It could flip extraordinarily grim for gilts if we see a powerful payroll,” stated Pooja Kumra, a UK charges strategist at TD Securities.

Analysts have stated the simultaneous sell-off of gilts and the pound carried echoes of the response triggered by Liz Truss’s “mini” Price range in 2022.

However many traders assume the state of affairs is wanting the 2022 gilts disaster.

“I do anticipate issues to start out bottoming out . . . On gilts the washout already occurred final yr,” stated Geoffrey Yu, a senior strategist at BNY. “I’m not denying there are points within the UK, however to out of the blue draw comparisons to 2022, I believe that’s pushing issues.”