UPCOMING

EVENTS:

- Monday: NY Fed Inflation Expectations.

- Tuesday: US NFIB Small Enterprise Optimism Index, US PPI.

- Wednesday: UK CPI, US CPI.

- Thursday: Japan PPI, Australia Employment report, UK GDP,

US Retail Gross sales, US Jobless Claims, US Import Costs, US NAHB Housing

Market Index, New Zealand Manufacturing PMI. - Friday: China exercise knowledge, UK Retail Gross sales, US

Housing Begins and Constructing Permits, US Industrial Manufacturing and Capability

Utilization.

Tuesday

The US PPI Y/Y is

anticipated at 3.0% vs. 3.0% prior, whereas the M/M measure is seen at 0.3% vs. 0.4%

prior. The Core PPI Y/Y is anticipated at 3.2% vs. 3.4% prior, whereas the M/M

measure is seen at 0.2% vs. 0.2% prior. The CPI coming the day after will likely be

extra necessary, however the PPI may set the sentiment going into the CPI.

US Core PPI YoY

Wednesday

The UK CPI Y/Y is

anticipated at 2.7% vs. 2.6% prior, whereas the Core CPI Y/Y is seen at 3.4% vs.

3.5% prior. The market is pricing a 65% probability of a 25 bps lower on the

upcoming assembly and a complete of 47 bps of easing by year-end. Increased than

anticipated knowledge will probably take the speed lower off the desk for now, whereas a mushy

report ought to improve the chances in favour of a lower.

UK Core CPI YoY

The US CPI Y/Y is

anticipated at 2.8% vs. 2.7% prior, whereas the M/M measure is seen at 0.3% vs. 0.3%

prior. The Core CPI Y/Y is anticipated at 3.3% vs. 3.3% prior, whereas the M/M

studying is seen at 0.2% vs. 0.3% prior.

That is essentially the most

necessary launch of the month, and one other scorching report will probably trigger

some bother within the markets with the inventory market wanting as essentially the most

susceptible proper now. Following the robust NFP report, the expectations are

now for only one charge lower this yr, which is under the Fed’s projection of two

cuts.

The repricing has

been fairly aggressive in the previous few months and the info positively made the

50 bps lower appear to be an enormous mistake. Nonetheless, the Fed has paused the easing

cycle and switched its focus again to inflation with a number of members citing inflation

progress as a key issue for the following charge lower.

The most effective

consequence can be a mushy report given the overstretched strikes within the markets attributable to the repricing in

charge cuts expectations. That might probably reverse a lot of the latest tendencies

and set off a rally in bonds, threat property like shares and bitcoin and result in a

selloff within the US Greenback.

US Core CPI YoY

Thursday

The Australian

Employment report is anticipated to indicate 10.0K jobs added in December vs. 35.6K in

November and the Unemployment Fee to tick greater to 4.0% vs. 3.9% prior. As a

reminder, the RBA softened further its stance on the final coverage resolution because it nears

the primary charge lower.

The market is

seeing a 62% probability of a 25 bps lower in February following the mushy month-to-month

inflation knowledge, though the primary absolutely priced in lower is seen in April. A mushy

report might see the market strengthening the

case for a lower in

February.

Australia Unemployment Fee

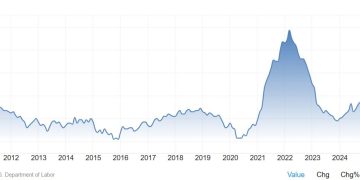

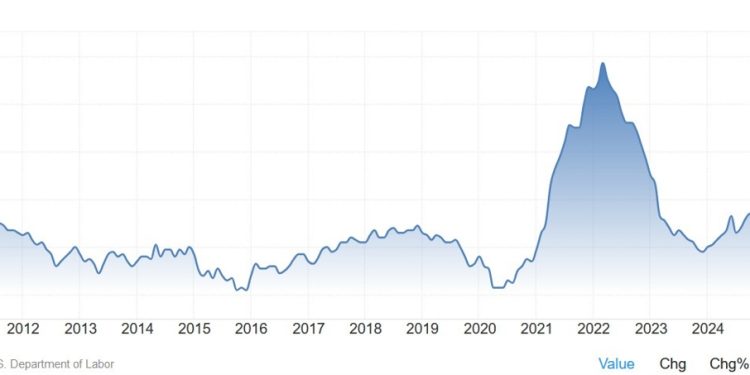

The US Jobless

Claims proceed to be one of the vital necessary releases to observe each week

because it’s a timelier indicator on the state of the labour market.

Preliminary Claims

stay contained in the 200K-260K vary created since 2022, whereas Persevering with Claims

proceed to hover round cycle highs though we’ve seen some easing not too long ago.

This week Preliminary

Claims are anticipated at 214K vs. 201K prior, whereas there’s no consensus for

Persevering with Claims on the time of writing though the prior launch noticed an

improve to 1867K vs. 1834K prior.

US Jobless Claims

The US Retail

Gross sales M/M is anticipated at 0.5% vs. 0.7% prior, whereas the ex-Autos M/M measure is

seen at 0.4% vs. 0.2% prior. The main target will likely be on the Management Group determine

which is anticipated at 0.4% vs. 0.4% prior.

Shopper spending

has been secure which is one thing you’ll count on given the constructive actual

wage development and resilient labour market. We’ve additionally been seeing a gradual pickup

in shopper sentiment which suggests that customers’ monetary state of affairs is

secure/enhancing.

US Retail Gross sales YoY