Keep knowledgeable with free updates

Merely signal as much as the US inflation myFT Digest — delivered on to your inbox.

US shares and bonds rallied after information printed on Wednesday confirmed underlying worth pressures on this planet’s largest financial system easing greater than anticipated, prompting traders to wager on swifter rate of interest cuts this yr.

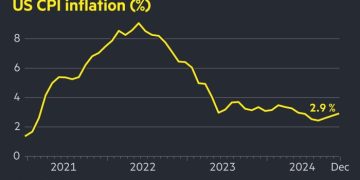

The figures from the Bureau of Labor Statistics indicated that headline annual inflation rose according to expectations to 2.9 per cent in December from 2.7 per cent in November.

However core inflation, which strips out unstable meals and vitality prices, fell unexpectedly to three.2 per cent from 3.3 per cent a month earlier than.

US equities and Treasuries gained after the info launch. Markets had dipped in current weeks as traders scaled again expectations of Federal Reserve charge cuts in anticipation of president-elect Donald Trump’s financial coverage, which some concern shall be inflationary.

“At this time’s CPI ought to present a lift to markets, relieving a number of the anxiousness that the US is at first phases of a second inflation wave,” stated Seema Shah, chief international strategist at Principal Asset Administration.

Shares and authorities bonds rallied sharply following Wednesday’s inflation information.

The S&P 500 was up 1.7 per cent throughout lunchtime buying and selling, whereas the tech-heavy Nasdaq Composite leapt 2.3 per cent. The positive aspects put shares on the right track for his or her finest day since November 6, after Trump gained the US presidential election.

The policy-sensitive two-year Treasury yield, which intently tracks rate of interest expectations, dropped 0.1 share level to commerce at 4.27 per cent, whereas the 10-year yield — a benchmark for international borrowing prices — tumbled 0.13 share factors to 4.66 per cent. Yields fall as costs rise.

A gauge of the greenback in opposition to six friends fell 0.2 per cent.

As of Wednesday morning, traders had been betting that the Fed would ship its first quarter-point charge lower this yr in July, in contrast with September earlier than the info was printed.

Fed officers have signalled that they plan to take a “cautious method” to charge cuts amid considerations that inflation could not shortly come all the way down to the central financial institution’s 2 per cent goal.

Mark Cabana, head of US charges technique at Financial institution of America, stated that the inflation figures, notably the core determine, had been prone to “modestly enhance” the Fed’s “confidence that inflation will proceed to fall”. However he added that policymakers had been most likely “nonetheless total annoyed with the slowdown within the tempo of progress on the inflation entrance”.

Most traders and analysts imagine the Fed won’t decrease charges once more at its subsequent coverage assembly later this month. US central bankers have signalled in their very own projections that they may solely lower charges by an extra 50 foundation factors this yr.

Trump, who takes workplace on Monday, has laid out aggressive plans to impose tariffs on an enormous swath of imports, implement an enormous crackdown on undocumented immigrants and enact sweeping tax cuts.

Economists have warned such plans might increase inflation additional.

“The actual query mark round inflation this yr isn’t round what the financial system can do to inflation or what the pattern is earlier than the Trump administration takes over,” stated David Kelly, chief international strategist at JPMorgan Asset Administration. “It’s what is going to new insurance policies on tariffs, immigration and monetary insurance policies imply for inflation?”