UPCOMING

EVENTS:

- Monday: BoJ Abstract of Opinions, Australia Retail Gross sales,

China Caixin Manufacturing PMI, Switzerland Manufacturing PMI, Eurozone

Flash CPI, Canada Manufacturing PMI, US ISM Manufacturing PMI. - Tuesday: US Job Openings, New Zealand Employment report.

- Wednesday: Japan Common Money Earnings, China Caixin

Providers PMI, Eurozone PPI, US ADP, Canada Providers PMI, US ISM Providers

PMI. - Thursday: Switzerland Unemployment Charge, Eurozone Retail

Gross sales, BoE Coverage Resolution, US Jobless Claims. - Friday: Canada Employment report, US NFP, US College

of Michigan Shopper Sentiment.

Monday

The Eurozone CPI

Y/Y is anticipated at 2.4% vs. 2.4% prior, whereas the Core CPI Y/Y is seen at 2.6%

vs. 2.7% prior. The inflation knowledge we received from France

and Germany

on Friday confirmed additional easing and noticed the market including to fee cuts bets

for the ECB. The market expects at the least three extra fee cuts by the top of

the 12 months which might improve in case Trump goes laborious on tariffs.

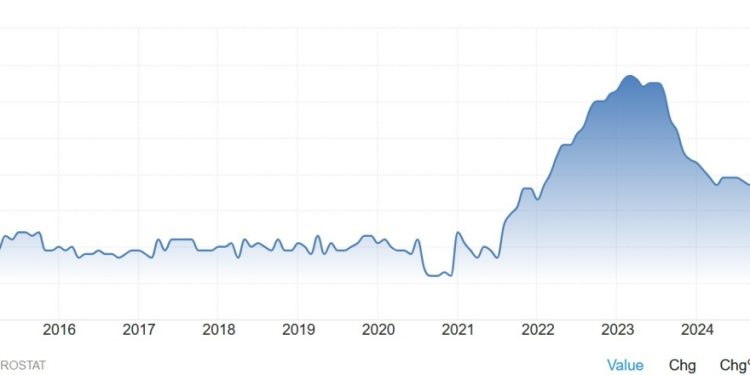

Eurozone Core CPI YoY

The US ISM Manufacturing

PMI is anticipated at 49.8 vs. 49.3 prior. The expectations are skewed to the

upside following the US

S&P World Manufacturing PMI returning in enlargement with an upbeat commentary

from the company saying that “the US companies are beginning 2025 in an upbeat

temper on hopes that the brand new administration will assist drive stronger financial

progress.

“Rising

optimism is most notable within the manufacturing sector, the place expectations of progress over the approaching 12 months

have surged larger as factories await help from the brand new insurance policies of the

Trump administration, although service suppliers are additionally getting into 2025 in good

spirits.”

US ISM Manufacturing PMI

Tuesday

The US Job

Openings are anticipated at 8.000M vs. 8.098M. The final

report shocked to the upside as fee cuts and Trump’s victory boosted

enterprise confidence and exercise. Total, the info continues to level to a

stable labour market though the low quits and hiring charges counsel that it

may be laborious to get a job however there’s additionally much less probability of shedding one.

US Job Openings

The New Zealand This autumn

Employment change Q/Q is anticipated at -0.2% vs. -0.5% prior, whereas the

Unemployment Charge is seen growing additional to five.1% vs. 4.8% prior. The Labour

Value Index Y/Y is anticipated to ease to three.0% vs. 3.4% prior, whereas the Q/Q fee

is seen at 0.6% vs. 0.6% prior.

The RBNZ received

inflation again inside the goal band and it’s now specializing in progress very similar to the Financial institution of Canada. The market expects

one other 50 bps lower on the upcoming assembly and a complete of 120 bps of easing by

12 months finish.

New Zealand Unemployment Charge

Wednesday

The Japanese

Common Money Earnings Y/Y is anticipated at 3.8% vs. 3.0% prior. As a reminder,

the BoJ hiked rates of interest by 25 bps on the final assembly because the central financial institution

received sufficient proof of stronger wage progress.

We haven’t received

a lot by way of ahead steering aside from the same old “will elevate charges if the

economic system and costs transfer according to forecasts”. If the info retains on strengthening

although, the market may transfer ahead the expectations for a fee hike and even

value in yet one more hike by the top of the 12 months.

Japan Common Money Earnings YoY

The US ADP is

anticipated at 150K vs. 122K prior. This isn’t a dependable indicator for NFP, however

it’s been pointing to a normalising however steady job creation. It shouldn’t

be as market transferring because it was in second half of final 12 months because the market has

already repriced rate of interest expectations and it’s now nearly additional

easing in inflation.

US ADP

The US ISM

Providers PMI is anticipated at 54.2 vs. 54.1 prior. The US

S&P World Providers PMI missed expectations by an enormous margin however because the

company famous “though output progress slowed barely in January,

sustained confidence means that this slowdown may be short-lived.

Particularly

encouraging is the upturn in hiring that has been fuelled by the improved

enterprise outlook, with jobs being created at a fee not seen for two-and-a-half

years.” Anyway, the Manufacturing PMI is a greater indicator for the turns in

the enterprise cycle.

US ISM Providers PMI

Thursday

The Financial institution of

England is anticipated to chop rates of interest by 25 bps bringing the Financial institution Charge to 4.5%

with a 7-2 vote cut up. As a reminder, the BoE stored the Financial institution Charge unchanged as anticipated on the final

coverage resolution however we received a extra dovish than anticipated vote cut up as 3

voters needed a fee lower in comparison with simply 1 anticipated.

Policymakers

proceed to lean in direction of 4 fee cuts for this 12 months in comparison with three fee cuts anticipated by the market.

The latest UK

PMIs confirmed all of the indices leaping to a three-month excessive though the S&P

World famous that corporations have been slicing employment amid falling gross sales and

that value pressures reignited pointing to a stagflationary state of affairs. It

provides that though output ticked larger, it is an economic system that’s broadly

flatlining with dangers remaining skewed to the draw back.

Financial institution of England

The US Jobless

Claims proceed to be one of the essential releases to observe each week

because it’s a timelier indicator on the state of the labour market.

Preliminary

Claims stay contained in the 200K-260K vary created since 2022, whereas Persevering with Claims proceed to hover round

cycle highs though we’ve seen some easing just lately.

This week Preliminary

Claims are anticipated at 215K vs. 207K prior, whereas there’s no consensus for

Persevering with Claims on the time of writing though the prior launch confirmed a

lower to 1858K vs. 1900K prior.

US Jobless Claims

Friday

The Canadian Employment

report is anticipated to point out 25K jobs added in January vs. 90.9K in December and

the Unemployment Charge to tick larger to six.8% vs. 6.7% prior. The final

report was actually robust with wage progress easing additional. The info from

Canada has been pointing to gradual enchancment after the aggressive fee cuts

which would have probably seen the CAD getting stronger if it wasn’t for Trump’s

tariffs threats.

Canada Unemployment Charge

The US NFP is

anticipated to point out 170K jobs added in January vs. 256K in December and the

Unemployment Charge to stay unchanged at 4.1%. The Common Hourly Earnings Y/Y is

anticipated at 3.8% vs. 3.9% prior, whereas the M/M determine is seen at 0.3% vs. 0.3%

prior.

The final

report got here out a lot stronger than anticipated and led to a different hawkish

repricing in rates of interest expectations, though ultimately it marked the

prime as we received benign US inflation knowledge the next week.

The Fed is

primarily targeted on inflation now provided that the labour market stays stable and it’s not a supply of

inflation pressures given the easing wage progress and a low quits fee. The info

we received so far factors to a different robust employment report.

US Unemployment Charge