- USD/JPY declines from highs of 155.86, settling at 154.51 amid tariff-induced volatility.

- ISM Manufacturing PMI rises, signaling strong enterprise exercise regardless of world commerce fears.

- Financial institution of Japan maintains optimistic outlook, able to navigate Trump’s protectionist insurance policies.

The USD/JPY retreated from every day highs of 155.86 hit after US President Donald Trump superior on its protectionist insurance policies, enacting tariffs in Canada, Mexico, and China. Initially, the Buck rose, however as fears pale, the pair dipped beneath its opening value by 0.44% and traded at 154.51.

Yen strengthens after preliminary drop as Trump’s new tariffs unsettle markets

Market individuals appear anxious, as portrayed by world equities buying and selling within the pink. US President Trump utilized 25% tariffs on Canada and Mexico and 10% to China. US-North American companions vowed retaliatory measures, whereas the latter, would problem this coverage on the World Commerce Group (WTO).

On the time of writing, the ISM Manufacturing PMI for January elevated by 50.9, exceeding forecasts of 49.8. It was up from December 49.2, a sign of enchancment in enterprise exercise. Digging deeper into the information, the sub-component of costs paid superior from 52.5 to 54.9, whereas the employment index improved from 45.4 in December to 50.3.

Within the meantime, in the course of the Asian session, the Financial institution of Japan revealed its January assembly Abstract of Opinions. A few of the members added that inflation expectations are heightening as costs rise above the two% inflation goal, and others mentioned that mountaineering charges can be sufficiently impartial. Policymakers said that Japan’s economic system is resilient and might navigate by way of protectionist insurance policies carried out by Trump.

This week, the US financial docket will function Fed audio system, JOLTS Job Orders information, and Manufacturing facility Orders on February 4. In Japan, the schedule is mild with the Jibun Financial institution Providers PMI remaining launch for January.

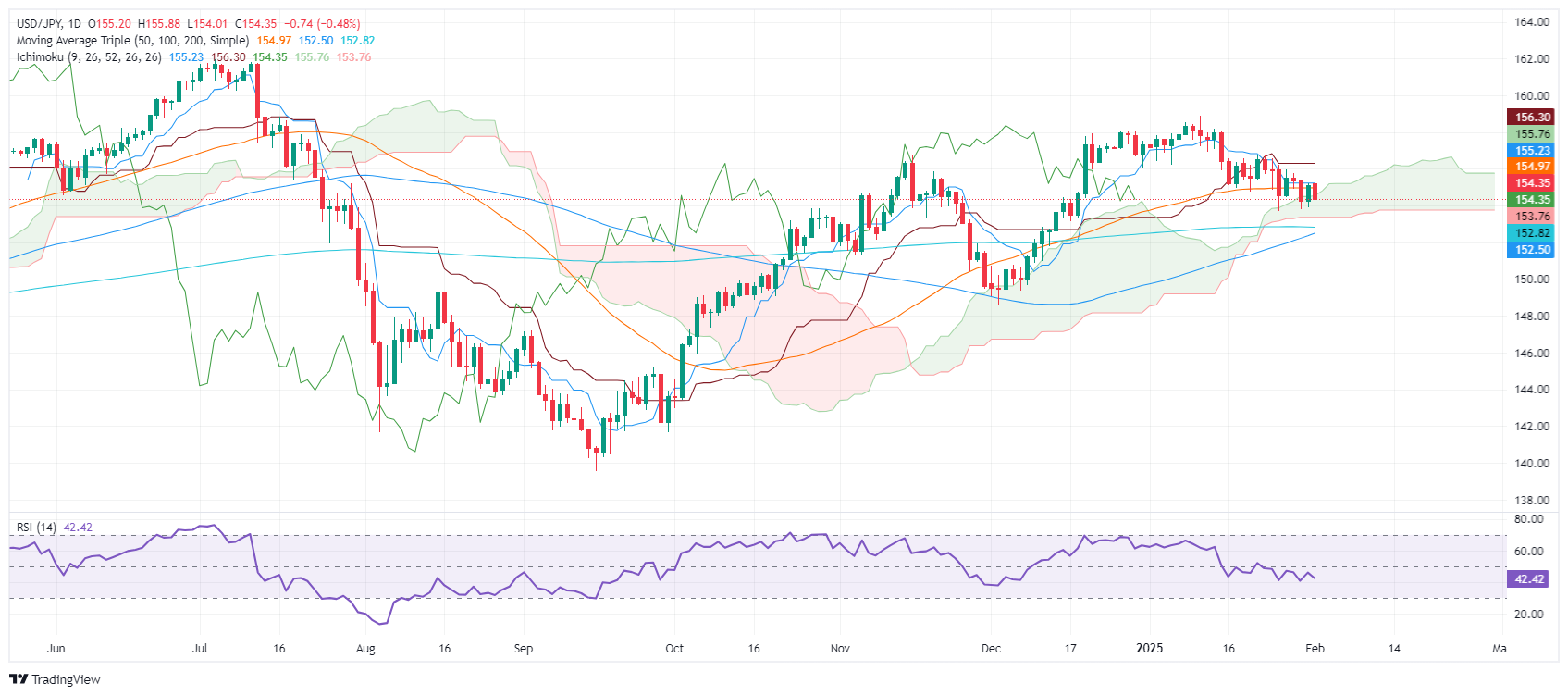

USD/JPY Worth Evaluation: Technical outlook

The USD/JPY is forming a ‘bearish candle’ with an extended higher shadow, a sign that the pair will not be discovering acceptance inside the 154.78-155.88 vary. That is bearish, as seen by value motion, with the pair extending its downtrend contained in the Ichimoku Cloud (Kumo). Sellers are eyeing the following help at Senkou Span B at 153.76.

On additional weak spot, the following help can be the 200-day Easy Transferring Common (SMA) at 152.83

Then again, if consumers obtain a every day shut above 155.00, search for additional upside. Key resistance is discovered on the Senkow Span A at 155.76.

Japanese Yen PRICE Right this moment

The desk beneath exhibits the share change of Japanese Yen (JPY) in opposition to listed main currencies in the present day. Japanese Yen was the strongest in opposition to the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.69% | 0.16% | -0.48% | -0.48% | 0.70% | 0.30% | -0.34% | |

| EUR | -0.69% | -0.21% | 0.08% | -0.09% | 0.39% | 0.70% | 0.06% | |

| GBP | -0.16% | 0.21% | -0.86% | 0.12% | 0.61% | 0.91% | 0.28% | |

| JPY | 0.48% | -0.08% | 0.86% | -0.12% | 1.32% | 1.54% | 0.67% | |

| CAD | 0.48% | 0.09% | -0.12% | 0.12% | 0.19% | 0.78% | 0.15% | |

| AUD | -0.70% | -0.39% | -0.61% | -1.32% | -0.19% | 0.30% | -0.43% | |

| NZD | -0.30% | -0.70% | -0.91% | -1.54% | -0.78% | -0.30% | -0.63% | |

| CHF | 0.34% | -0.06% | -0.28% | -0.67% | -0.15% | 0.43% | 0.63% |

The warmth map exhibits share adjustments of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, for those who decide the Japanese Yen from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will signify JPY (base)/USD (quote).