In a put up shared on X together with his 700,000 followers, market veteran CRYPTO₿IRB (@crypto_birb) outlined what he believes could possibly be considered one of Bitcoin’s ultimate main pullbacks earlier than an eventual surge to a six-figure worth goal. In his personal phrases: “BTC LAST DIPS BEFORE $273K? Right here’s why:” He backed up this declare with a collection of concise bullet factors masking market traits, technical alerts, and historic information.

Final Probability to Purchase Bitcoin Low cost?

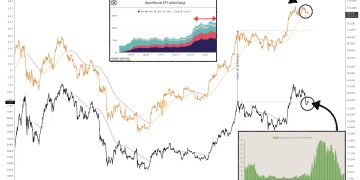

CRYPTO₿IRB’s analysis begins with an outline of the “Bull Market” surroundings, noting that each the 200-week and 50-week transferring averages are rising. These long-term traits typically replicate a broader shift in market sentiment.

He additionally references the newest information on Bitcoin exchange-traded funds, pointing to whole belongings beneath administration (AUM) of $121 billion, alongside a considerable buying and selling quantity of $746 billion. One other key metric highlighted is the Net Unrealized Profit and Loss (NUPL), which he locations at 0.54, suggesting that extra merchants are in revenue than these at a loss. He observes a seven-week correlation to the S&P 500 at 0.25, signaling solely a average linkage between Bitcoin and the standard fairness market over that interval.

Associated Studying

The analyst then addresses the “Day by day Development,” indicating that he sees Bitcoin oscillating inside a variety of $90,000 to $110,000 for now. He situates the 200-day Easy Shifting Common at about $80,200 and emphasizes that this determine is trending upward. CRYPTO₿IRB additionally explains that the proprietary 200-day BPRO indicator sits at roughly $94,400, which he views as one other signal of strengthening momentum, regardless of a 50-day RSI at 42. An RSI under 50 typically factors to cooled market momentum, but he notes that volatility seems stalled for the second, with an Common True Vary of $3,360 suggesting that worth swings have softened in comparison with earlier intervals.

Turning to his “Commerce Setup,” CRYPTO₿IRB highlights that he sees sure bearish configurations on his 12-hour BPRO CTF and HTF Trailer indicators. He describes market situations as uneven, with resistance showing across the $99,700 to $103,100 vary. This suggests that if Bitcoin fails to interrupt above that resistance stage, short-term pullbacks or sideways exercise may proceed till consumers regain management.

Relating to “Sentiment & Miners,” the analyst factors to a Fear & Greed Index studying of 51, a stage thought-about impartial. He remarks that worry sometimes spikes simply earlier than key breakouts, implying that the absence of maximum worry might point out a extra sustained climb as soon as resistance zones are cleared. He additionally classifies the continuing market cycle part as “perception,” suggesting that buyers stay cautiously optimistic with out the euphoria that always alerts main tops. One other essential issue is miners’ profitability, which he estimates stays wholesome above $88,400, a threshold that may discourage extreme miner promoting and assist reinforce worth flooring.

Associated Studying

His commentary on “Seasonality” underscores the historic efficiency of Bitcoin. He notes that February has seen a median achieve of 15.85% with optimistic returns in seven out of ten years. General, first quarters are inclined to ship round a 25% common achieve. From 2010 to 2024, Bitcoin’s annualized return stands at roughly 145%, reflecting the spectacular long-term progress that has characterised its historical past. CRYPTO₿IRB encourages merchants to “BTFD Feb–March,” which is brief for “purchase the dip,” implying that he expects engaging entry factors to emerge earlier than the market doubtlessly rallies once more.

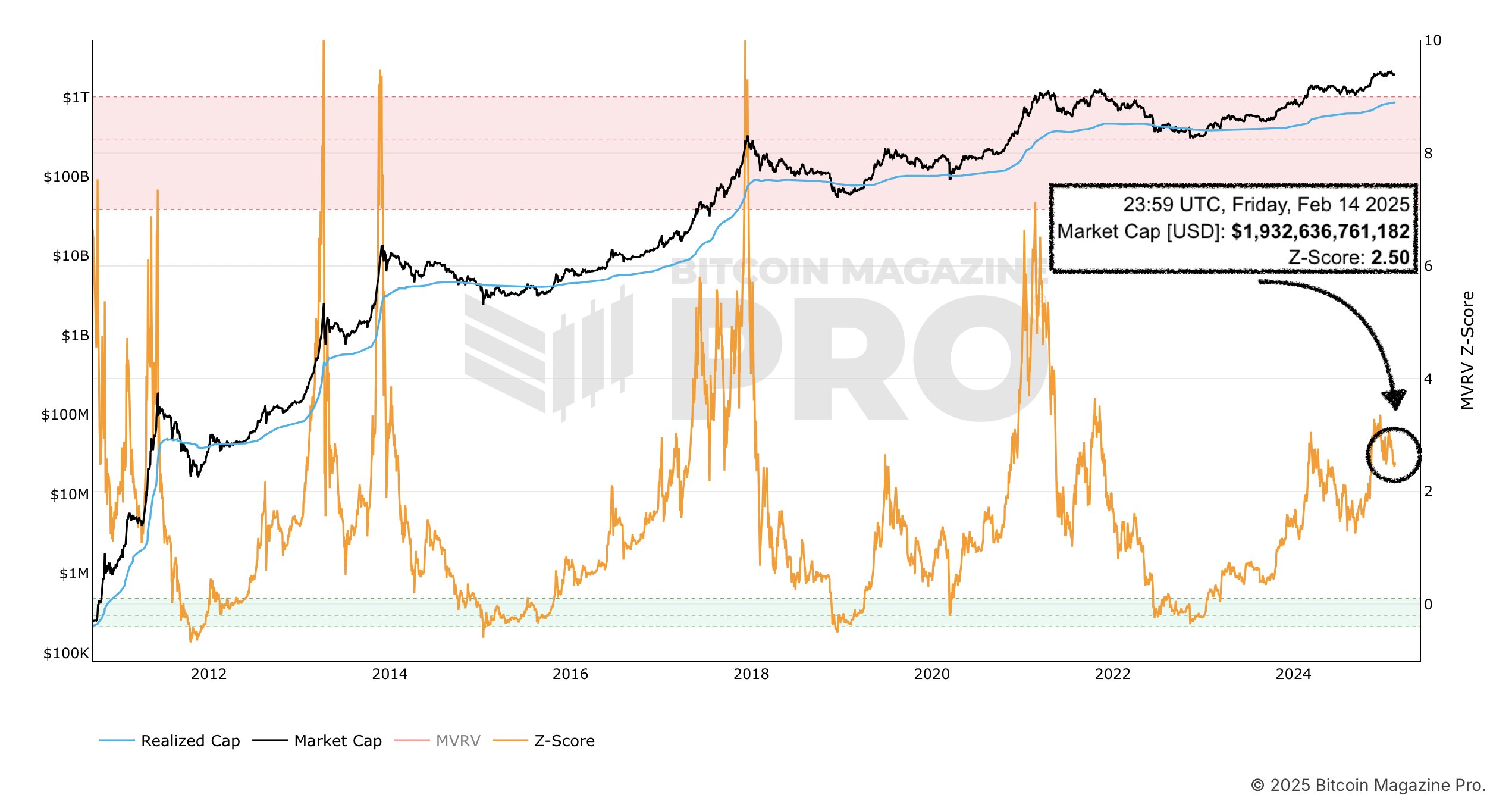

In explaining the “Macro Prime,” he seems to be to the MVRV Z-Score, a metric that compares market worth to realized worth. He warns that an MVRV Z-Rating above 7.0 historically alerts an overheated market. At present at 2.43, the rating stays effectively under that hazard zone, which leads him to venture a potential peak above $273,000 (2.88x from $95.3k).

He states: “Bitcoin will begin forming high over $273k+. Based on MVRV Z-Rating, the market peaked solely when MVRV pushed & stayed for weeks above 7.0 (2.8X from $97.5k). It’s the pre-rich part.”

At press time, BTC traded at $95,553.

Featured picture created with DALL.E, chart from TradingView.com