UPCOMING

EVENTS:

- Monday: China Caixin Manufacturing PMI, Switzerland

Manufacturing PMI, Eurozone Flash CPI, Canada Manufacturing PMI, US ISM

Manufacturing PMI. - Tuesday: Eurozone Unemployment Price, Canada-Mexico-China

Tariffs Deadline, Trump Congress Speech. - Wednesday: China Two-Periods, Australia This fall GDP, China

Caixin Providers PMI, Switzerland CPI, Eurozone PPI, US ADP, Canada

Providers PMI, US ISM Providers PMI. - Thursday: China Two-Periods, Switzerland Unemployment

Price, Eurozone Retail Gross sales, ECB Coverage Announcement, US Jobless Claims. - Friday: Canada Employment Report, US Non-Farm Payrolls.

Monday

The Eurozone CPI

Y/Y is predicted at 2.3% vs. 2.5% prior, whereas the Core CPI Y/Y is seen at 2.6%

vs. 2.7% prior. There’s some danger aversion within the markets, so a gentle report

will doubtless ease a few of these fears round inflation and provides the ECB extra

confidence to maintain with the coverage easing. Greater than anticipated figures although

would doubtless preserve the markets on the sting. The market is anticipating a complete of

87 bps of easing by year-end.

Eurozone Core CPI YoY

The US ISM

Manufacturing PMI is predicted at 50.8 vs. 50.9 prior. The current S&P International

US PMIs confirmed one other uptick on the Manufacturing entrance with the index rising

to an 8-month excessive. The company famous that many producers additionally reported that

the rise in manufacturing and demand was partly linked to front-running potential

price will increase or provide shortages linked to tariffs, though future sentiment

remained comparatively elevated in manufacturing by current requirements.

US ISM Manufacturing PMI

Wednesday

There’s no

consensus on the time of writing for the Switzerland CPI though the prior

launch confirmed the Core measure rising to 0.9% vs. 0.7% prior. We haven’t obtained

any notable information level or remark from central financial institution officers, however the market

is for certain of a 25 bps minimize in March and is pricing round 60% chance of

one other 25 bps minimize by year-end.

Swiss Core CPI YoY

The US ADP is

anticipated at 140K vs. 183K prior. This report can be seen in gentle of the

current progress scare, so the market gained’t like draw back surprises. On the opposite

hand, robust information is probably going to supply some help to the chance sentiment (all

else being equal).

US ADP

The US ISM

Providers PMI is predicted at 52.9 vs. 52.8 prior. The S&P International survey

confirmed some notable weak point within the Providers sector with the index cratering to

a 25-month low. The company famous that service suppliers generally linked the

downturn in exercise and worsening new orders progress to political uncertainty,

notably in relation to federal spending cuts and potential coverage impacts on

financial progress and inflation outlooks. Optimism concerning the coming yr slumped

to its lowest since December 2022.

US ISM Providers PMI

Thursday

The ECB is

anticipated to chop rates of interest by 25 bps bringing the coverage fee to 2.50%. We

will get the Eurozone Flash CPI report a few days earlier than the assembly so

that may doubtless form their future sentiment. There’s been a rising concern

amongst some central financial institution officers about easing charges too quick amid excessive

companies value inflation (which has been caught round 4% since November 2023)

and tight labour market.

European Central Financial institution

The US Jobless

Claims proceed to be probably the most vital releases to observe each week

because it’s a timelier indicator on the state of the labour market.

Preliminary Claims

stay contained in the 200K-260K vary created since 2022, whereas Persevering with Claims

proceed to hover round cycle highs though we’ve seen some easing lately.

This week Preliminary

Claims are anticipated at 235K vs. 242K prior, whereas Persevering with Claims are seen at

1883K vs. 1862K prior.

US Jobless Claims

Friday

The Canadian

Employment report is predicted to point out 17.5K jobs added in February vs. 76.0K in

January and the Unemployment Price to tick larger to six.7% vs. 6.6% prior. Jobs

information has been beating expectations by a giant margin within the final couple of months

because the aggressive BoC easing gave the financial system a lift. The CAD although stays

on the mercy of the tariffs threats with the markets watching what occurs on

Tuesday because the deadline expires.

Canada Unemployment Price

The US NFP is

anticipated to point out 153K jobs added in February vs. 143K in January and the

Unemployment Price to stay unchanged at 4.0%. The Common Hourly Earnings Y/Y

is predicted at 4.1% vs. 4.1% prior, whereas the M/M determine is seen at 0.3% vs.

0.5% prior. The Common Weekly Hours Labored is seen at 34.2 vs. 34.1 prior.

I personally assume

that the current risk-off sentiment has been triggered by the soar to a 30-year

excessive within the long-term inflation expectations within the last College of

Michigan Shopper Sentiment report. That may haven’t brought on the selloff in

the inventory market if it wasn’t for weak US Flash PMIs launched simply quarter-hour

earlier.

So, it type of

compounded the impact on expectations that the Federal Reserve might react too

slowly to a slowdown within the financial system because of the constraint of excessive inflation

expectations which might finally result in extra financial ache.

Subsequently, the

best-case situation can be benign employment information coupled with decrease than

anticipated wage progress information. Conversely, weak employment information and excessive wage

progress figures would doubtless set off one other selloff within the inventory market and

renewed risk-off flows.

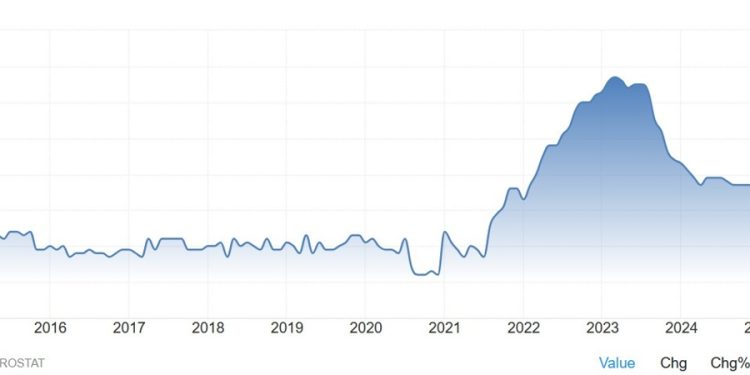

US Unemployment Price