- Bitcoin’s worth actions in March 2025 have been extra steady, in comparison with altcoins

- Divergence is an indication of Bitcoin’s maturity as a steady asset, whereas altcoins face better speculative stress

In March 2025, altcoins like Cardano [ADA], Solana [SOL], and XRP noticed a pointy spike in realized volatility, with ADA hitting a report 150%, and SOL and XRP surpassing 100%.

In the meantime, Bitcoin [BTC] additionally noticed vital volatility, but it surely remained comparatively subdued at 50% – Properly beneath its historic highs.

Realized volatility displays worth variation over a set interval. The hike in ADA, SOL, and XRP volatility is an indication of bigger worth swings, whereas Bitcoin’s volatility has remained comparatively steady.

Altcoins as high-risk hypothesis

In comparison with Bitcoin, altcoins are extra inclined to speculative buying and selling, typically pushed by information, rumors, and community-driven momentum. This will result in exaggerated worth swings.

XRP has been notably delicate to regulatory information, with the continued SEC lawsuit contributing to erratic worth actions.

Throughout market uptrends, traders typically shift capital from Bitcoin to altcoins in pursuit of upper returns, additional amplifying altcoin volatility. Whereas this volatility presents better revenue alternatives, it additionally will increase the chance of great losses.

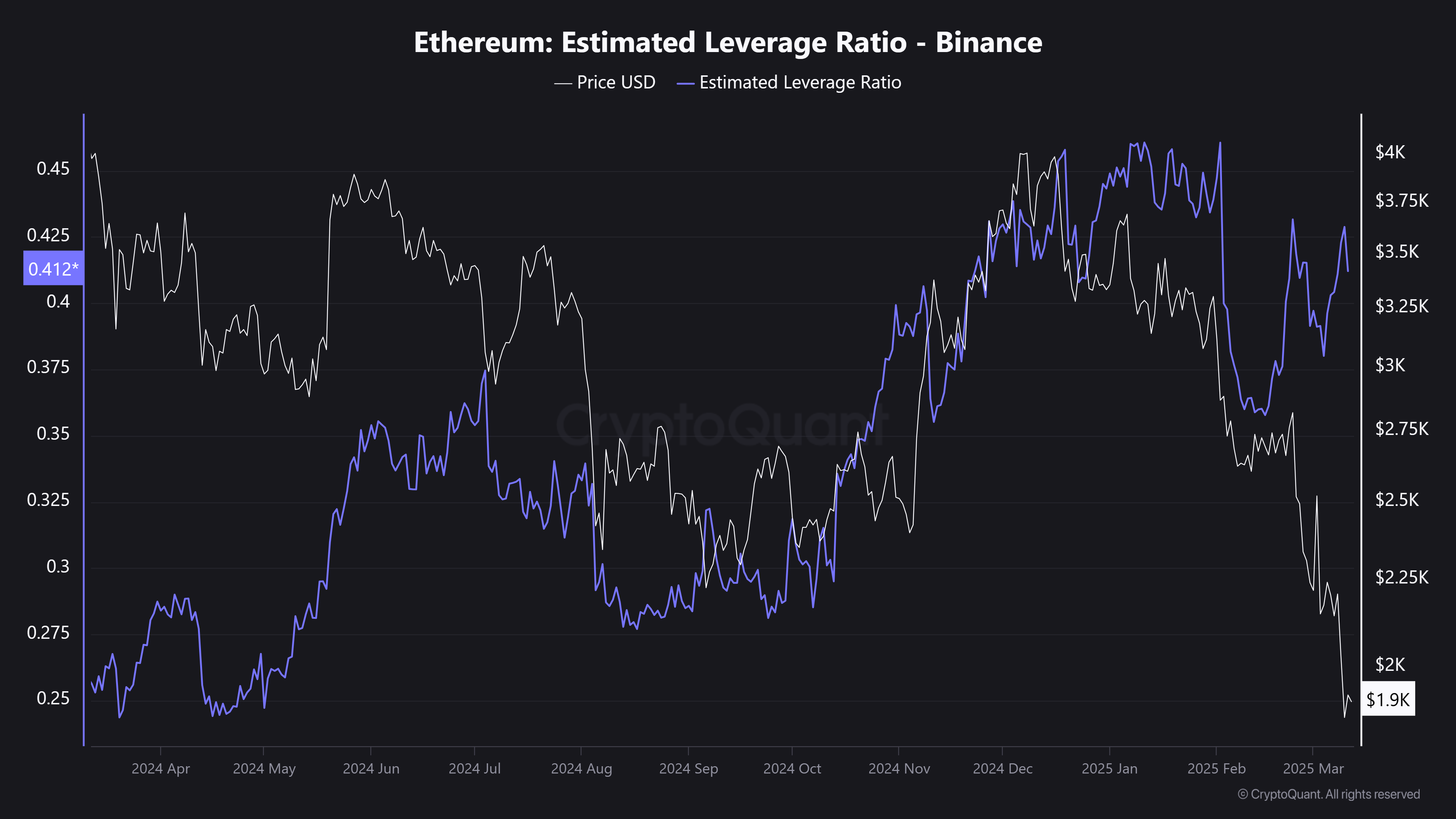

Ethereum (ETH) exemplifies this development. Regardless of dropping the $2,000 assist for the primary time since 2023 and alternate reserves rising, its Estimated Leverage Ratio (ELR) has surged to a month-to-month excessive. That is indicative of elevated threat publicity in derivatives markets.

In different phrases, merchants are aggressively leveraging positions on each side, amplifying volatility – A traditional “excessive threat, excessive reward” setup that might gasoline sharp worth swings.

This altcoin divergence is obvious in worth motion as effectively, with ADA, SOL, and XRP breaking beneath key assist zones and caught in consolidation.

Growing volatility is popping altcoin buying and selling right into a high-risk, speculative play.

Nonetheless, is Bitcoin positioning itself because the extra steady asset amid the rising uncertainty?

Bitcoin as a steady retailer of worth

Traditionally, BTC has seen volatility spikes above 100%, however March 2025’s data appeared to trace at a extra steady worth construction.

Whereas Bitcoin affords a safer haven with decrease volatility, it additionally curtails short-term revenue potential. This, in contrast to altcoins, the place amplified threat brings the lure of upper rewards.

Does this reinforce Bitcoin’s function as a long-term holding? Properly, volatility traits recommend it simply may.

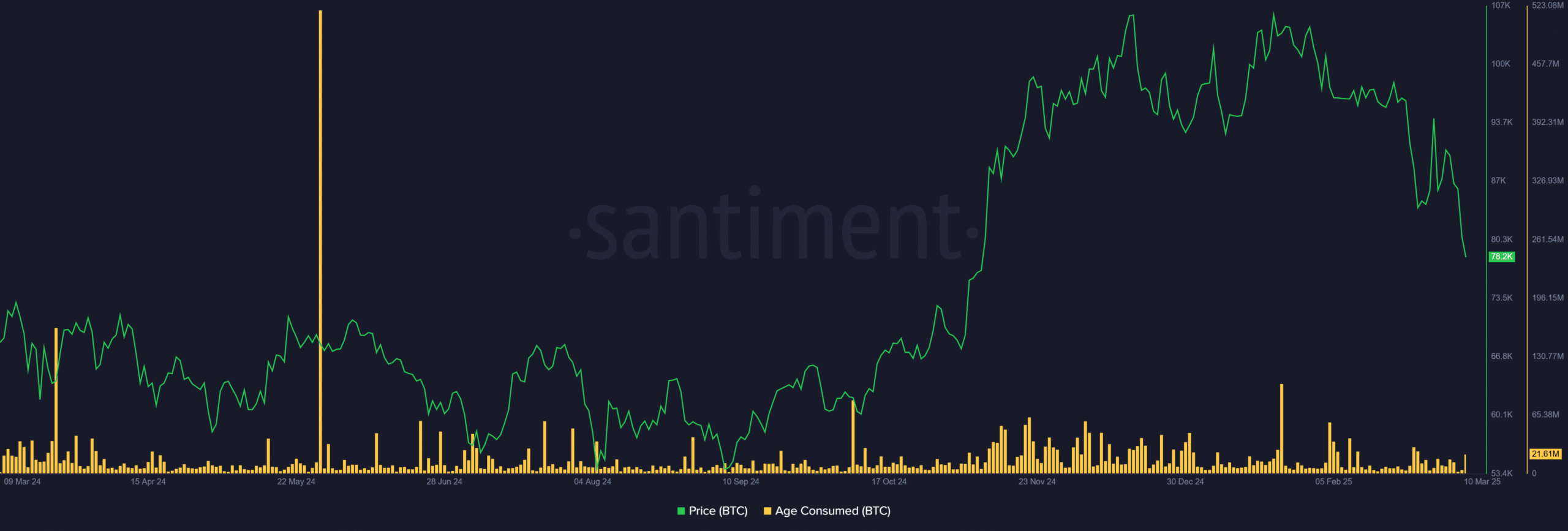

In the meantime, the Age Consumed metric – monitoring long-term holder actions – didn’t spike regardless of BTC plunging beneath $80k and erasing billions in market worth.

This prompt that seasoned traders stay unfazed, reinforcing confidence in Bitcoin’s long-term trajectory.

Clearly, volatility traits are actually shaping buying and selling methods.

With altcoins exhibiting increased risk-reward potential, they may dominate short-term hypothesis. All whereas Bitcoin continues to ascertain itself as the popular long-term retailer of worth.