- Bitcoin noticed leverage-driven pump as OI rose to $27.9 billion, marking a $3.3 billion hike

- Weak demand noticed Bitcoin buyers flash indicators of warning

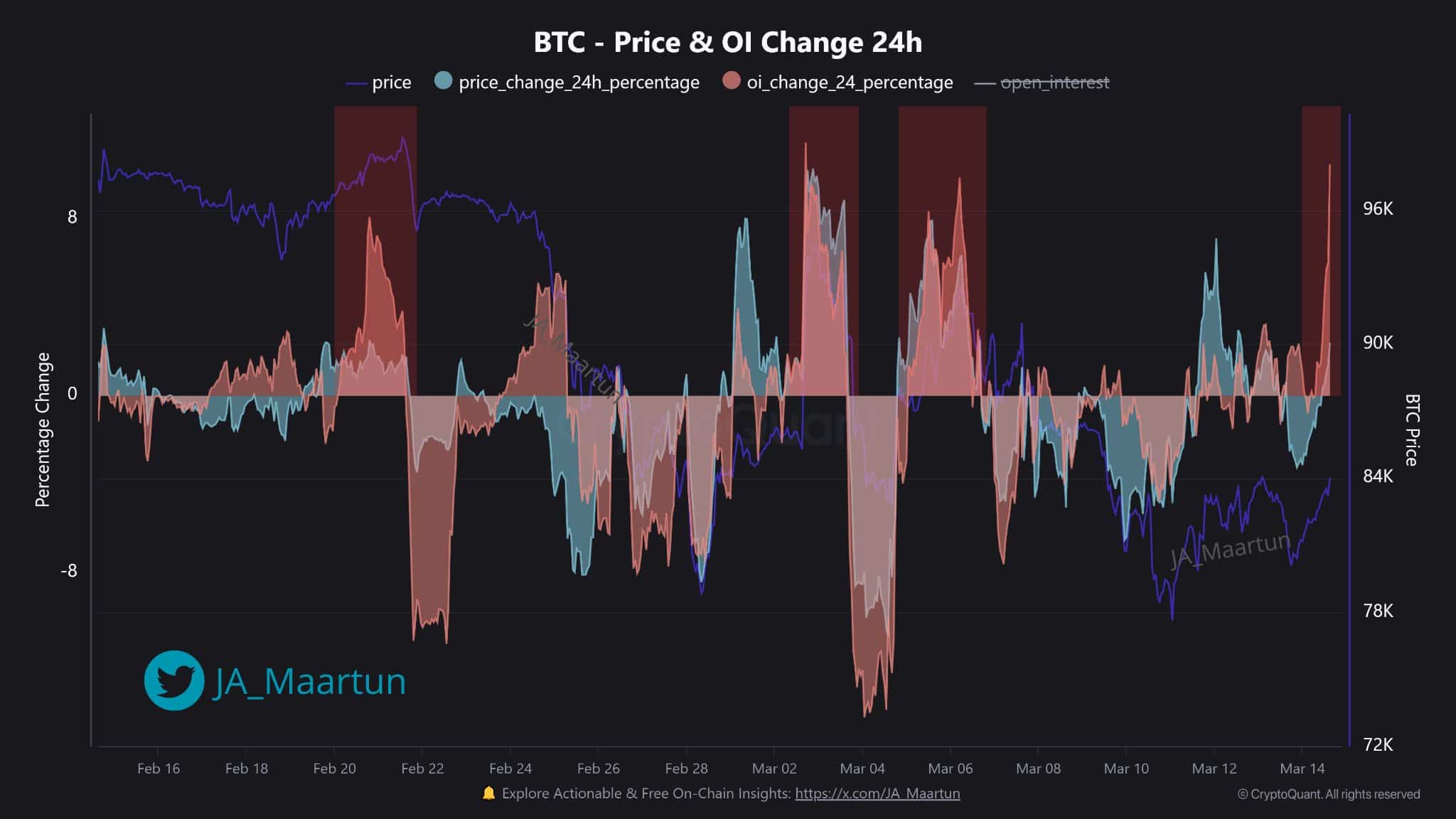

Bitcoin’s [BTC] Open Curiosity (OI) climbed to $27.9 billion, indicating a hike in leveraged market actions following a $3.3 billion pump – A 13% enhance.

Earlier upticks in Open Curiosity led to unpredictable worth fluctuations. This triggered market fluctuations that affected the cryptocurrency on each 20 February and 4 March. Actually, the leveraged-driven pump signaled merchants to handle danger.

At press time, Bitcoin gave the impression to be sustaining a buying and selling worth of roughly $83k, regardless that extreme leverage may result in market liquidations. The depreciation of lengthy positions would set off a quick pullback of the worth in the direction of the $70,000 to $80,000 vary.

When OI exceeded 10% up to now, the worth fell by 5-8%. The identical was seen again on 22 February and 06 March. The prevailing market circumstances create a gap for brief sellers to revenue from liquidations that will happen.

A sustainable worth hike above $90k may generate circumstances for added market progress. An OI flush would possibly quickly take away present worth hikes whereas merchants should be cautious about sudden adjustments in Open Curiosity.

How merchants are reacting to weak demand?

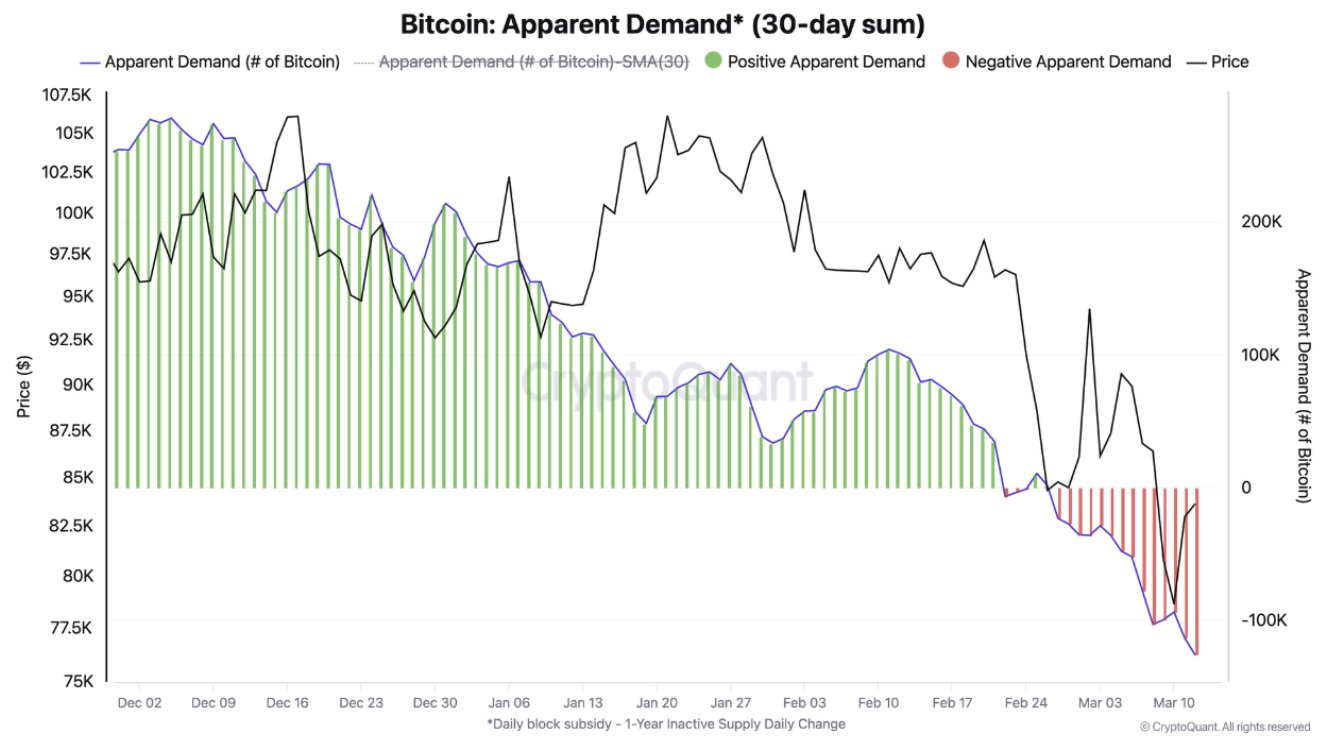

Once more, a big discount in BTC demand was seen from December 2024 to March 2025. Bitcoin buying and selling noticed a low annual demand of -100k BTC that occurred in mid-March 2025 after its most demand climbed to 105k Bitcoin in early December 2024.

The southbound in market worth, along with unfavourable demand zone construction, revealed sturdy investor warning. Circumstances turned extra unfavorable because of the 30-day sum sustaining positions underneath the demand line as BTC’s worth fell from 105k to about 77k.

This hinted on the lack of particular investor motion data, though buyers are likely to safe their capital by buying defensive property which might be much less dangerous. These encompass metals and U.S authorities bonds and steady digital foreign money USDT.

Market members are shifting investments to safer property throughout these unsure occasions as Bitcoin’s price and market demand fall. Which means that BTC holders of lengthy positions may encounter vital dangers since market circumstances seem to ascertain the muse for an anticipated bear market.

The market may additionally expose leveraged lengthy place holders to compelled sell-offs if the worth drops to under the $80K-level and demand turns into unfavourable at -100k.

This might result in main losses occurring to holders since evaluation pointed to bearishness when demand stays under -100k since final December. Merchants who invested in BTC returning to above $100k may face losses.