Good morning. Tesla introduced yesterday that it’s recalling most of its Cybertrucks — sending the shares down further, regardless of Secretary of Commerce Howard Lutnick’s useful suggestion that traders purchase the inventory. However one other Elon Musk firm, X, née Twitter, has shot back up to its authentic $44bn valuation, after dropping to an estimated lower than $10bn someday final yr. Is Musk higher at social media than vehicles? E-mail us: robert.armstrong@ft.com and aiden.reiter@ft.com.

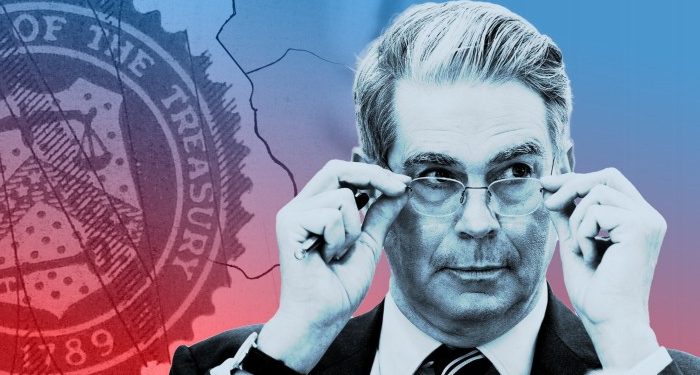

Scott Bessent’s debt maturity drawback

Treasury secretary Scott Bessent has a troublesome option to make this yr.

Previous to taking workplace, he and a few of Donald Trump’s different financial advisers criticised his predecessor Janet Yellen’s dealing with of the Treasury market. Yellen had shifted the combo of Treasury issuance in the direction of short-term payments and away from long-term bonds. It was “quantitative easing by one other identify”, the critics stated. In a widely circulated paper, incoming chair of the Council of Financial Advisers Stephen Miran argued that issuing extra short-term Treasuries artificially lowers longer-term yields, permitting the federal government to run up greater deficits and stimulate the economic system with out spooking bondholders.

However two months into his time period, Bessent is doing precisely what Yellen did. In a latest interview, he stated he would maintain the bias in the direction of payments in place, and that shifts within the maturity of the debt profile can be “path dependent”. The truth is, he’s doubling down. Treasury projections have the division sustaining Yellen’s greenback amount of long-term debt sooner or later, moderately than simply the share of issuance, despite the fact that the debt is projected to develop. “Proportionately, he will probably be issuing even much less long-term debt than Yellen,” says Darrell Duffie of the Stanford Graduate College of Enterprise.

There are two interpretations of Bessent’s resolution. First is that issuing a better proportion of short-term debt was by no means an enormous deal to start with, as many have argued. The second is that his criticism of Yellen was legitimate, however Bessent now labours underneath the identical pressures she did. It’s doubtless that the Trump administration should broaden borrowing this yr to pay for tax cuts. Bessent might need to use the Yellen technique to maintain the market calm whereas that occurs.

However there’s a pressure right here. Traders are fearful by the scale of the deficit — which has risen quick whereas curiosity funds have ballooned. If the deficit doesn’t come down, or if inflation heats up once more for another cause, a secular pattern of rising Treasury yields is feasible. Certainly, that is what many analysts anticipate, not only for the US however in most wealthy nations. If that’s the case, the Treasury will remorse not having issued extra long-term debt at immediately’s charges.

And there’s a doubtlessly worse situation. If there’s a political impasse over fiscal coverage or bond consumers balk at Trump’s fiscal plans (did somebody say vigilante?), there might be an enormous rise in bond yields. That might occur exactly as a result of the Treasury must challenge debt shortly to keep away from default. If that’s the case, they are going to face even larger borrowing prices.

In sum, for those who imagine that Yellen and Bessent have engaged in “QE by different means”, you imagine they’ve saved yields decrease within the quick time period, at the price of not locking in secure long-term financing at what would possibly transform enticing charges.

It’s doable that Bessent’s arms are already tied. If he had been to shift to longer-term issuance, the market would possibly revolt — traders are presently running away from period.

Bessent is working underneath time strain, too. The Treasury is shortly burning by way of its account on the Fed, which might hit empty this summer time. However till the debt ceiling is lifted or suspended, no new debt could be issued. That implies that as soon as the ceiling is out of the way in which, plenty of new issuance should comply with. That will be a superb alternative to increase the maturity profile of the nationwide debt — if the market will tolerate it.

(Reiter)

Tariffs, company steering and earnings estimates

The inventory market runs on expectations. What do the following quarter’s, the following yr’s, the following 5 years’ of revenue appear to be? The machine that units the expectations has two elements: what corporations say concerning the future (recognized within the commerce as “steering”) and the earnings targets that monetary analysts, having listened to what the businesses say, collectively set up (often known as “consensus estimates”). Shares rise on sturdy steering, rising consensus estimates and estimate-beating efficiency, and fall on their opposites.

Steering is main. The principle enter to an analyst’s estimate of what an organization goes to earn is what it says it’ll earn, both immediately or by insinuation. So whereas Wall Road quantity crunchers have tried to mannequin the earnings influence of tariffs — a shifting goal as coverage evolves — they are going to be principally guessing till the businesses inform them what to assume.

So, what have corporations stated, in combination? The S&P World company credit score analysis group, led by Gareth Williams, has learn by way of the quarterly feedback of 533 world corporations attempting to determine this out. Because it seems, corporations haven’t stated a lot, or at the very least not a lot that’s helpful. He summed as much as me as follows:

What actually leapt out at me after studying 533 earnings calls was, one, tariffs are principally not in steering . . . so worst case outcomes will result in an enormous wave of earnings revisions. Two, the size of the adjustment we’ve already seen when it comes to localising provide chains and, notably for US corporations, decreasing manufacturing publicity to China. Three, corporations appear fairly optimistic that they will move tariff will increase on through costs, which is able to imply inflation or — if clients resist — margin strain.

This shouldn’t be shocking. The businesses should not together with tariffs of their steering for the excellent cause that they don’t know what the tariffs are going to be, as a result of the Trump administration retains altering its thoughts. Some corporations, similar to Walmart, have merely ignored the influence of tariffs in setting 2025 targets. Others have achieved the very best they will with the data they’ve. Right here for instance is the burrito chain Chipotle, talking at the start of February:

Our steering doesn’t embody the influence of the brand new tariffs on gadgets imported from Mexico, Canada and China. We supply about 2 per cent of our gross sales from Mexico, which incorporates avocados, tomatoes, limes and peppers. And fewer than 0.5 per cent of our gross sales from Canada and China. If the not too long ago introduced tariffs go into full impact, it will have an ongoing influence of about 60 foundation factors [0.6 percentage points] on our value of gross sales.

These are helpful figures analysts will probably be glad to have. In the event you do the arithmetic, you’ll see that this steering implies 25 per cent tariffs on the three international locations talked about. However will the tariffs find yourself at that degree? Chipotle doesn’t know, you don’t know, and President Trump doesn’t know, both.

Why does all this matter? As a result of eventually tariffs will probably be in steering, and when that occurs, consensus expectations will in all probability fall and, presumably, inventory costs should regulate. The present consensus expectation for 2025 earnings progress for the S&P 500 is 11 per cent, in line with FactSet. But when that’s principally a pre-tariff quantity, that has to come back down. Right here is Citigroup fairness strategist Scott Chronert:

We anticipate that many analysts are ready for administration steering for modelling tariffs . . . particular person firm complexity makes modelling tariff impacts tougher than one would possibly anticipate. In flip, we suspect that the Q1 reporting interval will present a damaging revision bias such that combination consensus estimates will in all probability transfer decrease for the total yr.

That must be dangerous, proper? And certainly, the proportion of estimate revisions which might be upward revisions has fallen sharply not too long ago. This chart is from Chronert’s group:

It doesn’t must be all that dangerous, although. To start with, analysts could also be nudging their numbers down even within the absence of assist from corporations, simply to be conservative. Three months in the past, the expectation was for 14 per cent progress on the S&P. And naturally the US market, which as you could have seen has been down currently, could also be forward of the analysts on this. Chronert additionally argues that when the revisions do come, the sheer aid of decrease uncertainty might give shares an rise. As we have now stated on this area earlier than, what this market is actually determined for is readability.

One good learn

FT Unhedged podcast

Can’t get sufficient of Unhedged? Take heed to our new podcast, for a 15-minute dive into the most recent markets information and monetary headlines, twice per week. Compensate for previous editions of the e-newsletter here.