Editor’s Be aware: On Wednesday, the Federal Reserve held its Federal Open Market Committee (FOMC) assembly. On the assembly, the Fed introduced it could preserve rates of interest at its goal vary of 4.25% to 4.5%. It maintained its outlook for 2 fee cuts this yr.

My InvestorPlace colleague Luke Lango believes this dovishness simply gave buyers an ideal motive to purchase proper now. He’s becoming a member of us at present to share extra of this ideas… and reveal one of the best shares to purchase.

Take it away, Luke…

Thanks, Mr. Jerome Powell. This week, the U.S. Federal Reserve Board Chair instructed buyers that the central financial institution is prepared and keen to step in and help the U.S. economic system with a number of fee cuts, if want be. By doing so, he put an finish to the current market crash…

And gave of us the sign to purchase shares.

Buyers have been on edge for a month now, ever since U.S. President Donald Trump launched a commerce conflict towards the nation’s largest buying and selling companions. Given Wall Road’s anxiousness about these tariffs’ potential financial influence, shares have been persistently sliding decrease.

The White Home’s commentary incited much more worry, with Trump and others saying they’re keen to just accept some short-term financial ache – even a recession – to attain their long-term financial objectives.

Naturally, buyers have been very nervous.

However Powell and Co. simply quelled these fears, primarily telling Wall Road: “Don’t fear – we’ve obtained your again.”

And we expect this dovishness implies it’s time to back up the truck and buy the market’s dip.

This Dovishness Is Bullish

Going into yesterday’s Fed announcement, many buyers have been apprehensive that the central financial institution would shift decisively hawkish.

That’s, for the reason that final time we heard from the Federal Reserve, tariffs, federal spending cuts, and coverage uncertainty drove vital upside dangers to inflation and draw back dangers to financial progress. The Fed might have simply been hawkish in response, calling for extra inflation and fewer progress – and paring again fee lower projections.

However that didn’t occur.

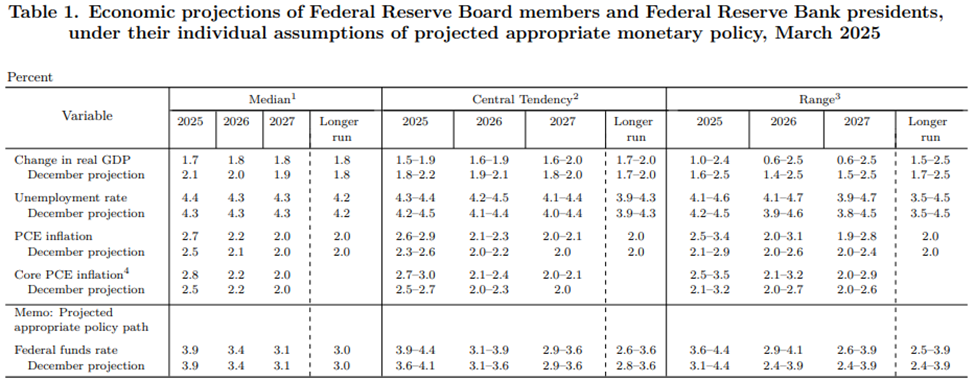

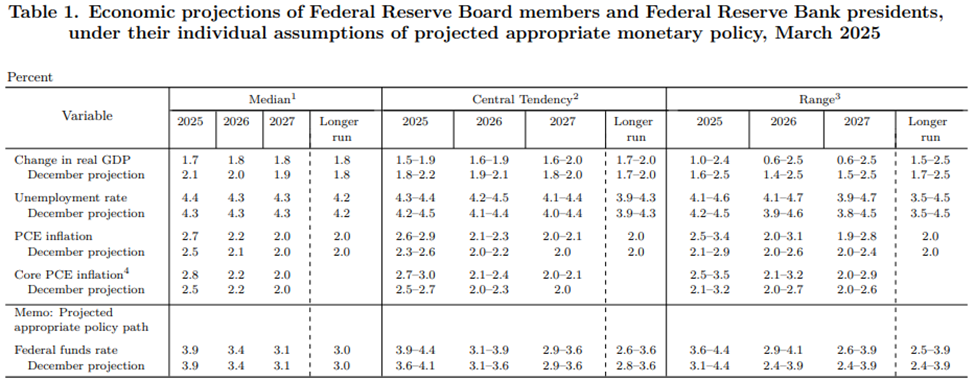

As a substitute, the Fed largely maintained its financial projections for 2025, ‘26, and ‘27, with just some minor changes to progress and inflation expectations.

It maintained its outlook for 2 fee cuts this yr.

And within the post-meeting press convention, Powell sounded largely dovish. His big-picture messaging was that he thinks the economic system will stay stable amid all these coverage modifications. But when it isn’t, the Fed is prepared and keen to step in and save the day.

The Fed Will Come to the Rescue

This reassurance from the Fed is large.

Wall Road wanted comfort that if one thing goes awry on this world commerce conflict and the U.S. economic system begins tumbling right into a recession, somebody will do one thing to assist.

The White Home has already prompt that it received’t. Its motto has remained ‘short-term ache for long-term achieve.’

However the Fed has made clear that it’s able to don its superhero cape. The central financial institution supplied steerage for extra fee cuts this yr and stated dangers to the outlook shifted from inflation to progress.

Additionally it is necessary to do not forget that the Fed Funds fee is at present at 4.25%. So, if the economic system does sluggish meaningfully within the subsequent few months, the Fed has 17 ‘fee cuts’ it might implement to reinvigorate financial exercise.

That’s comforting to Wall Road. The Fed has plenty of ammunition it might use to avert an financial slowdown. And yesterday, it prompt it’s prepared to take action if want be.

That’s all investors needed to know to rush in and buy this dip in stocks.

The truth is, have a look at what’s occurring in consequence…

The Last Phrase

Shares have rallied properly during the last two days and are actually up greater than 3% from their current lows. The S&P 500 has retaken its crucial 250-day transferring common, signaling that the worst of this selloff could also be over.

We agree with the market right here.

Shares might have crashed. However the economic system stays wholesome. We don’t assume this can be a bull-market-ending selloff; only a run-of-the-mill pullback. Shares bottomed precisely the place they need to have (proper across the 250-day transferring common). And now they’re bouncing again on a strong upside catalyst (the Fed staying dovish).

We imagine which means that the current inventory market crash is probably going over… and shares are primed for an enormous bounce right here.

In different phrases, it’s time to purchase the dip.

However the place ought to of us search for one of the best shopping for alternatives?

Effectively, we’re supremely bullish on AI. We imagine it’s the best technological revolution in three many years. This breakthrough has already created fabulous funding alternatives, permitting buyers to lock in ~990% positive factors in Palantir (PLTR) and 400% earnings in Nvidia (NVDA) over the previous two years. And a lot extra is but to return.

However right here’s the rub: the broader AI commerce is crowded. That’s why we’ve been attempting to find the subsequent huge trade breakthrough…

And we’ve discovered it in what I name AI 2.0 – a improvement that could possibly be an order of magnitude greater than something we’ve seen within the AI Growth up to now.

Regards,

Luke Lango

Editor, Hypergrowth Investor