Shortly after the election, markets have been in a fantastic temper and it is simple to see why. You had a Republican sweep with the promise to increase present tax cuts and possibly even ship extra. Since then, the robust math on the US deficit has eroded a few of that optimism and Congress hasn’t moved notably fast. That is elevating some questions on the fiscal entrance however two different questions loom massive.

1) The Trump Put

In his first time period, Trump was obsessive about the inventory market. Even within the depths of covid, he handled it like a private scorecard, all the time bragging about it or blaming declines on others. In the end, it led to good good points all through his time period regardless of all the same old Trump rhetoric. The Trump put was the concept that he did not actually imply a lot of the issues he stated and that preserving inventory markets and GDP development excessive was the overriding purpose. That was the Trump put.

In his first two months in workplace, Trump 2.0 has been totally different. Members of his cupboard are speaking a few detox and short-term ache. He nonetheless references the inventory market however can also be doing and threatening issues which are problematic. The ten% drop within the S&P 500 since February speaks for itself.

I do not suppose the Trump put is gone but it surely definitely does not look as sturdy.

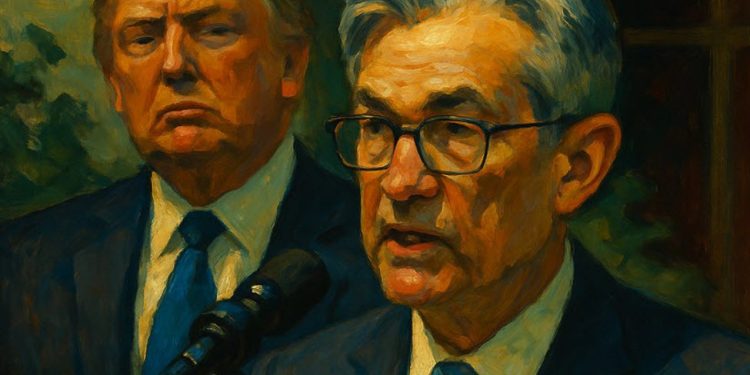

2) The Fed put

In his first time period, Trump began with comparatively low inventory market valuations and ample fiscal house. He performed that hand properly. This time, he arrived with excessive valuations and a excessive deficit — not so fairly. One enchancment although was the Fed, the autumn cuts put some juice into the economic system however extra importantly, with Fed funds at 4.25-4.50%, there was loads of room to chop. The market was additionally seeing falling inflation and an extended runway, notably if something went mistaken within the economic system.

Now it is much less clear that ammunition is offered. This week we noticed the Fed’s Musalem crack open the door to fee hikes, whereas Daly indicated she was dropping confidence in her forecast for 2 cuts this 12 months. Right this moment’s inflation numbers have been barely hotter than anticipated and there’s a rising chance that the Fed will not be capable of reduce in any respect — even when the economic system stumbles. The Fed put is perhaps gone.

Now a lot of that is Trump’s personal doing with tariffs but it surely’s illustrative of why inventory markets are struggling and will fall additional.