Shares all over the world tumbled Monday as buyers braced for per week of market tumult attributable to the anticipated announcement of but extra tariffs by President Trump on America’s largest buying and selling companions.

Since taking workplace a bit of over two months in the past, Mr. Trump has saved buyers and firms guessing with a haphazard rollout of what he calls an “America First” commerce coverage. He has threatened, imposed and in some instances then paused the beginning of recent tariffs on items coming into the USA.

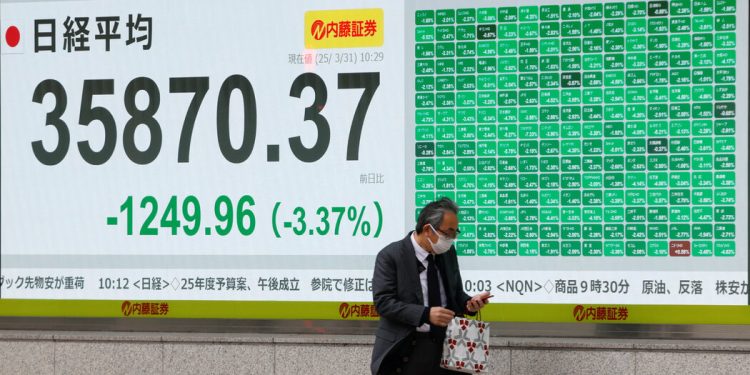

On Monday, shares in Japan and Taiwan fell greater than 4 p.c, whereas share costs in South Korea have been down 3 p.c. The Nikkei 225 index in Japan fell right into a correction, down 12 p.c from its excessive in late December. Know-how firms have been hit onerous: Chipmakers Taiwan Semiconductor Manufacturing Firm, SK Hynix, Samsung and Tokyo Electron recorded declines.

Losses in China have been extra muted. Hong Kong shares dropped greater than 1 p.c and people in mainland China have been about 0.5 p.c decrease. Mainland shares acquired some assist from a report signaling that China’s export-led industrial sector continues to broaden regardless of Mr. Trump’s preliminary tariffs.

Markets in Europe slumped, with the Stoxx 600 index falling 1.8 p.c. German automakers, that are particularly exposed to U.S. tariffs, prolonged latest losses: Volkswagen, Europe’s largest carmaker, fell greater than 4 p.c in Frankfurt.

Futures on the S&P 500, which permit buyers to commerce the benchmark index earlier than exchanges open in New York, indicated a decline of about 1 p.c. On Friday, the S&P 500 dropped 2 p.c on considerations that Mr. Trump’s tariffs may recharge inflation and dampen shopper sentiment, dragging the index all the way down to a fifth weekly fall previously six weeks.

Analysts at Goldman Sachs minimize their forecast for the S&P 500, citing “greater tariffs, weaker financial progress, and higher inflation than we beforehand assumed” in a notice on Sunday. They anticipate the index to fall an extra 5 p.c within the subsequent three months. The downturn might be deeper if the U.S. financial system slipped into recession, which the analysts give a roughly one-in-three chance.

Investor nervousness has been mirrored in different markets. The value of gold hit one other document excessive, buying and selling at round $3,150 per ounce on Monday. Gold is usually sought by buyers throughout instances of turmoil. Merchants additionally parked cash in comparatively protected U.S. authorities bonds, pushing the yield on the 10-year Treasury notice under 4.2 p.c.

Mr. Trump has imposed tariffs to make imports dearer in industries like automobiles, arguing that the commerce boundaries will spur funding and innovation in the USA. He has additionally used tariffs, and their menace, to attempt to extract geopolitical concessions from nations. He has additional unnerved buyers by saying he doesn’t care in regards to the fallout of his actions on markets or American shoppers, who should pay extra for a lot of items if import costs rise.

Over the weekend, Mr. Trump ramped up the strain, threatening so-called secondary sanctions on Russia if it doesn’t have interaction in talks to convey a couple of cessation of combating in Ukraine. The tactic echoes comparable sanctions regarding Venezuela. He stated final week that any nation shopping for Venezuelan oil may face one other 25 p.c tariff on its imports to the USA.

The threats over the weekend come on high of tariffs of 25 p.c on imported automobiles and a few automotive elements set to be put in place this week, barring any last-minute reprieve. That’s along with beforehand delayed tariffs on Mexico and Canada, in addition to the potential for additional retaliatory tariffs on different nations.

Including to buyers’ angst is the scheduled launch on Friday of the month-to-month report on the well being of the U.S. jobs market. It may present one other studying of how the Trump administration’s coverage pursuits are weighing on the financial system.

“I hear it from practically each shopper, practically each chief — practically each particular person — I discuss to: They’re extra anxious in regards to the financial system than any time in latest reminiscence,” Laurence D. Fink, the chief govt of the asset administration large BlackRock, wrote on Monday in his annual letter to investors. “I perceive why. However we have now lived by means of moments like this earlier than. And one way or the other, in the long term, we determine issues out.”

Keith Bradsher and Jason Karaian contributed reporting.