Unlock the White Home Watch publication free of charge

Your information to what the 2024 US election means for Washington and the world

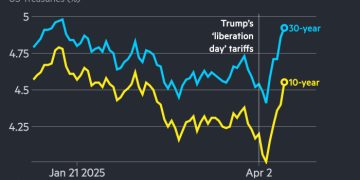

Treasuries dropped on Friday in risky buying and selling, as market contributors warned of rising strains within the $29tn marketplace for US authorities debt.

The ten-year Treasury yield climbed as a lot as 0.19 proportion factors to 4.58 per cent on Friday, amid a deepening droop for an asset historically thought-about the worldwide monetary system’s premier haven.

The yield later reversed a few of these good points to commerce at 4.48 per cent after Boston Fed President Susan Collins told the Monetary Occasions the US central financial institution “would completely be ready” to deploy its firepower to stabilise monetary markets ought to circumstances turn into disorderly.

President Donald Trump’s erratic tariff policies have shaken traders’ religion in US policymaking and the financial system, sparking an exodus from American belongings. The ten-year yield rose virtually 0.5 proportion factors this week, the most important rise since 2001, in line with Bloomberg knowledge.

Whereas Trump backed down from his so-called reciprocal tariffs on non-retaliating international locations earlier this week — agreeing to a 90-day hiatus for many main US buying and selling companions — he positioned steeper levies on Chinese language imports.

“There may be actual strain throughout the globe to promote Treasuries and company bonds if you’re a international holder,” mentioned Peter Tchir, head of US macro technique at Academy Securities. “There’s a actual international concern that they don’t know the place Trump goes.”

“We’re involved as a result of the actions you see level to one thing else aside from a traditional sell-off,” mentioned a European financial institution government in prime companies, a division that facilitates leveraged buying and selling for corporations together with proprietary merchants and hedge funds. “They level to an entire lack of religion within the strongest bond market on the planet.”

Merchants mentioned poor liquidity — the benefit with which traders can purchase and promote Treasuries with out transferring costs — was exacerbating market strikes.

Analysts at JPMorgan mentioned market depth, a measure of the market’s capability to soak up giant trades with out vital shifts in value, had considerably worsened this week, that means even small trades had been transferring yields considerably.

As he travelled to his Mar-a-Lago resort on Friday, Trump mentioned: “The bond market’s going good. It had slightly second, however I solved that downside in a short time.”

When requested to what extent the bond market factored into his 90-day pause of reciprocal tariffs to non-retaliating international locations, the president recommended it didn’t, regardless of saying so earlier within the week. “I wish to put the nation in an unbelievable financial place. Which is the place we needs to be,” he mentioned.

The pinnacle of Treasury buying and selling at a serious US bond supervisor mentioned liquidity was “not nice at the moment” and defined that “market depth was operating 80 per cent beneath regular averages” on Friday.

“If a stiff breeze blew by the Treasury market at the moment, charges would transfer 1 / 4 level,” added Man LeBas, chief fixed-income strategist at Janney Montgomery Scott.

Friday’s Treasury volatility was accompanied by a drop within the greenback.

A gauge of the forex’s power in opposition to main friends fell as a lot as 1.8 per cent on Friday. Sterling, the Japanese yen and the Swiss franc all made vital good points.

Trump mentioned of the greenback: “We’re the forex of alternative. We’re at all times going to be . . . I believe the greenback is great.”