Unlock the White Home Watch e-newsletter at no cost

Your information to what the 2024 US election means for Washington and the world

World equities rose on Monday on indicators that client electronics imported into the US from China may escape the steepest of Donald Trump’s tariffs, as inventory markets regained their footing after the turmoil created final week by the worldwide commerce conflict.

Futures monitoring the S&P 500 and the tech-heavy Nasdaq 100 had been up 1.4 per cent and 1.7 per cent respectively, after the White Home late on Friday excluded smartphones and different client electronics from steep tariffs it launched earlier this month, together with the 125 per cent levied on China.

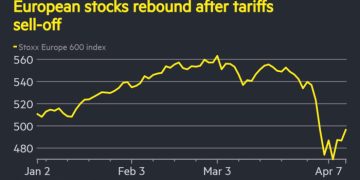

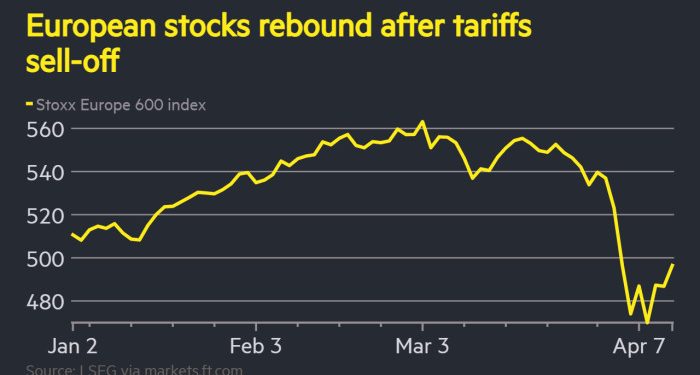

European shares rose, with the benchmark Stoxx Europe 600 up 2.2 per cent in afternoon buying and selling, whereas the UK’s blue-chip FTSE 100 climbed 1.8 per cent.

Trump and Howard Lutnick, US commerce secretary, on Sunday indicated that client electronics would as a substitute be topic to a separate obligation the White Home was making ready for semiconductors.

It was unclear what stage the chips tariffs can be set at, however different duties the Trump administration has imposed on particular person sectors akin to metal and aluminium recommend they might be considerably decrease than the levies presently imposed on China.

“Markets are taking no matter signal of reduction they’ll,” mentioned Mitul Kotecha, head of rising markets macro technique at Barclays.

In feedback to journalists on Air Drive One on Sunday, Trump mentioned his administration would present “flexibility” for some merchandise and signalled that it could be chatting with key corporations to debate the tariffs.

Requested what the semiconductor tariff price can be, he advised reporters he would “be saying it over the subsequent week”.

Trump’s sweeping tariffs, introduced at a “liberation day” occasion this month, unleashed turmoil throughout monetary markets and sparked fears of a worldwide recession. However shares rallied on the finish of the week, after Trump’s resolution to place a 90-day pause on large “reciprocal” tariffs for many international locations fed optimism that the worst-case commerce state of affairs might be prevented.

The prospect of decrease tariffs on common client electronics can be a lift for Apple and different tech teams that rely closely on Chinese language factories to make iPhones and different items.

Apple shares jumped 6.4 per cent in pre-market buying and selling.

“We is perhaps previous peak tariff concern,” mentioned Michael Metcalfe, head of macro technique at State Avenue World Markets, including that the brand new exemptions had been a “moderately important backing off” on the extent of tariffs anticipated on the finish of final week.

In Europe, expertise shares had been among the many winners, with Dutch chipmakers Besi and ASML up 3.8 per cent and a couple of.8 per cent respectively.

The greenback additionally prolonged its latest fall, shedding 0.4 per cent in opposition to a basket of main currencies together with the yen and the pound, as traders continued to be cautious about growing their publicity to US property.

Analysts mentioned markets had been being caught between indicators of capitulation on US tariffs and worries over the injury already achieved to the worldwide financial system.

“Trump is clearly backtracking,” mentioned Luca Paolini, chief strategist at Pictet Asset Administration. “Markets odor he’s determined to discover a method out of right here, however the injury can’t be utterly undone.”

Regardless of the market rebound, many traders stay cautious.

“Who is aware of what the subsequent announcement will likely be,” mentioned Max Kettner, chief multi-asset strategist at HSBC. “We’re not likely shopping for at the moment’s large rip — I’d a lot relatively promote rips like at the moment to promote a bit extra on the equities facet.”

The ten-year US Treasury yield, which soared final week as traders took fright over Trump’s escalating tariffs on China, fell 0.07 proportion factors to 4.42 per cent as the worth of the debt recovered.

Haven property had been regular. Gold touched a recent file excessive of simply over $3,245 per troy ounce on Monday, earlier than giving up its features.

Markets in Asia rebounded, led by Hong Kong’s Hold Seng index up 2.4 per cent, Japan’s Nikkei 225 rising 1.2 per cent and the broad Topix up by 0.9 per cent.

China’s mainland CSI 300 rose 0.2 per cent as official knowledge confirmed exports from the world’s second-largest financial system leapt final month amid a rush to dispatch shipments earlier than tariffs took impact.

Exports rose 12.4 per cent in US greenback phrases in March on a 12 months earlier, figures from China’s customs administration confirmed on Monday, nicely above expectations and the most important rise since October.

Imports fell 4.3 per cent, a much less steep contraction than the 8.4 per cent fall within the January-February interval.