Trump lashes out at Powell … who’s behind bond market chaos … the eye-opening statistics on authorities debt … what’s the actual worry?

Editor’s Notice: Our InvestorPlace places of work are closed tomorrow for Good Friday.

When you want help from our Buyer Service workforce, they’ll be blissful to help you after we re-open Monday.

Have an exquisite Easter Weekend!

Jerome Powell, useless man strolling?

Earlier at this time, President Trump took to Truth Social, posting:

The ECB is predicted to chop rates of interest for the seventh time, and but, ‘Too Late’ Jerome Powell of the Fed, who’s at all times TOO LATE AND WRONG, yesterday issued a report which was one other, and typical, full ‘mess!’

Oil costs are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS.

Too Late ought to have lowered Curiosity Charges, just like the ECB, way back, however he ought to definitely decrease them now.

Powell’s termination can’t come quick sufficient!

As we’ve detailed right here within the Digest, Trump actually desires decrease rates of interest.

Maybe it’s because of the trillions of {dollars}’ value of presidency debt which might be rolling over within the subsequent 18 months… perhaps he desires to supply a tailwind to the financial system… maybe he desires to present the wobbly inventory market a lift…

The issue is that even when Powell provides Trump the decrease charges he desires, that doesn’t imply Trump’s desired outcomes will come to go.

You see, the Federal Reserve solely controls the federal funds charge – a short-term lending charge. The “Large Canine” that impacts mortgage charges, the financial system, the inventory market, and so forth, is the 10-year Treasury yield. However for that, the market is the grasp puppeteer.

And in line with legendary investor Louis Navellier, there’s one group throughout the market that’s in management at this time…

Meet the Bond Vigilantes

To ensure we’re all on the identical web page, Louis’ favourite economist Ed Yardeni popularized the time period “Bond Vigilantes” within the Eighties.

It refers to bond traders who unload Treasurys in response to what they understand as irresponsible fiscal or financial insurance policies, like extreme authorities spending or inflationary insurance policies. By dumping bonds, they drive up yields, successfully punishing governments with larger borrowing prices.

These traders act like “vigilantes” available in the market, implementing monetary self-discipline when policymakers stray.

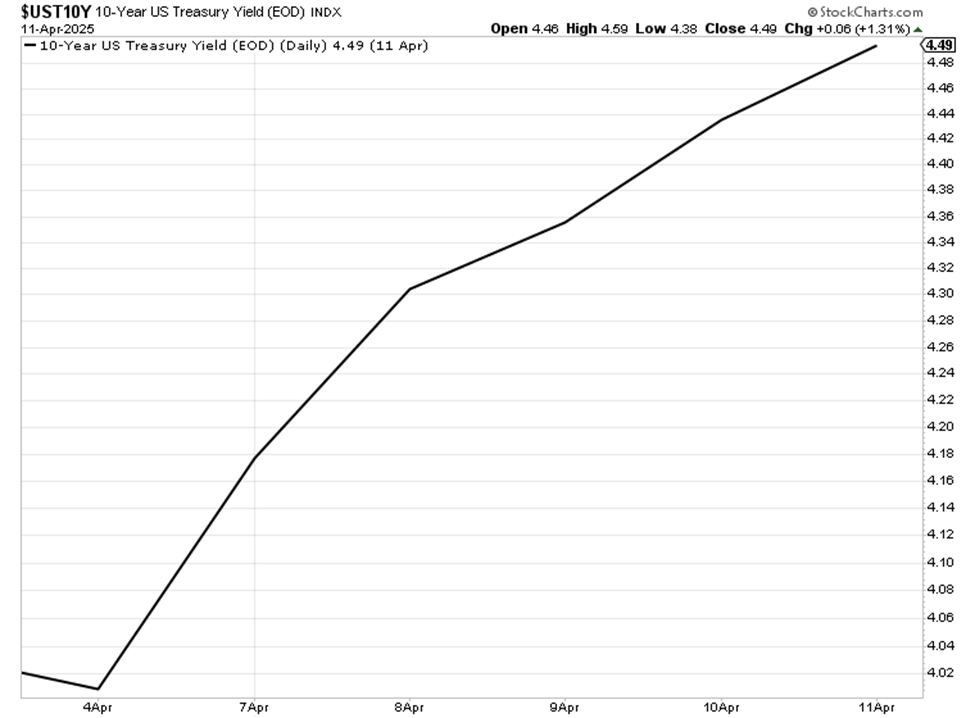

Now, April has introduced an historic transfer within the 10-year Treasury yield from these Bond Vigilantes.

Final week, they stampeded out of the 10-year Treasury, inflicting its yield to soar from lower than 4.00% to about 4.50% – the most important weekly achieve in over a decade. You’ll be able to see the bounce within the chart under.

Supply: StockCharts.com

Here’s Louis from yesterday’s Special Market Podcast in Growth Investor:

Final week’s occasions have been gorgeous.

The primary takeaway is the Bond Vigilantes are in cost – these large institutional Treasury traders.

The U.S. greenback is now down virtually 10% for the yr, and Treasury yields rose as a result of apparently the Bond Vigilantes determined to promote a few of our Treasuries…

Which means President Trump isn’t in cost; the Bond Vigilantes are…

When the Bond Vigilantes began to keep away from our Treasuries, President Trump had no alternative however to reply and put a 90-day suspension on reciprocal tariffs.

So, what are the Bond Vigilantes nervous about?

The higher query is “what aren’t they nervous about?”

There’s the U.S. funds deficit that grew to $1.83 trillion final yr. That’s equal to six.4% of U.S. financial output, marking the very best studying aside from the COVID-19 pandemic.

To date in fiscal yr 2025 (masking the primary half of the fiscal yr), the deficit has climbed to greater than $1.3 trillion. That is the second-highest six-month deficit on file (second solely to Covid).

Then there’s the general nationwide debt, which is ballooning – and accelerating. It’s now almost $37 trillion, rising at greater than $1 trillion about each 100 days.

The present debt-to-GDP ratio clocks in at 123%. Long run, that is unsustainable. It’ll lead to both an financial or forex collapse.

Subsequent up is the scale of our authorities’s curiosity funds which might be primarily based on the scale of our debt and at this time’s elevated rates of interest.

Right here’s the non-partisan thinktank Peter G. Peterson Basis:

The Congressional Funds Workplace (CBO) tasks that curiosity funds will complete $952 billion in fiscal yr 2025 and rise quickly all through the subsequent decade…

Relative to the scale of the financial system, curiosity prices in 2026 would exceed the post-World Conflict II excessive of three.2 %…

The federal authorities already spends extra on curiosity than on funds areas corresponding to:

- Protection

- Medicaid

- Federal spending on kids

- Earnings safety packages, which embrace packages focused to lower-income People such because the Supplemental Diet Help Program; earned earnings, little one, and different tax credit

- Veterans’ advantages

The truth is, curiosity funds will exceed the quantity that the federal authorities spends on Medicare (web of offsetting receipts) this yr, leaving Social Safety the one program bigger than web curiosity.

Then we have now President Trump’s tax plan.

To set the stage for why Bond Vigilantes have an issue with this, do not forget that governments solely have two essential technique of funding their spending: taxes and debt (by way of issuing Treasurys).

If President Trump’s tax plans make it by Congress, tax revenues will fall.

The Committee for a Accountable Federal Funds estimates that the tax cuts would add $7.75 trillion to the U.S. nationwide debt over the subsequent decade.

This is able to imply the federal government must rely extra on debt issuance to satisfy all its spending obligations.

And this leaves debt (Treasurys) within the highlight…which brings us full circle to the bond vigilantes who’re punishing perceived financial unhealthy habits by driving Treasury yields larger.

The case for international bond vigilantes including to the promoting stress

To be clear, month-to-month Treasury knowledge comes with a lag. So, we don’t know precisely who bought bonds final week. However there are suspicions – and culprits aren’t restricted to U.S. sellers.

The 2 greatest international holders of U.S. debt are China and Japan.

China clearly has a motivation for dumping our debt, and a few analysts consider they’re holding the smoking gun.

Right here’s CNBC:

“I believe China is definitely weaponizing the Treasury holding already,” stated Chen Zhao, chief international strategist at Alpine Macro.

“They promote U.S. Treasurys and convert the proceeds into Euros or German bunds. That’s truly very per what occurred during the last couple of weeks,” he added.

Germany’s bunds had bucked a wider sell-off in long-dated Treasurys final week, with its 10-year yields sliding.

Now, there’s pushback towards this principle.

In any case, if China sells U.S. bonds, it means capital flows again to China within the yuan, therein strengthening the yuan. This isn’t what China desires – Beijing is attempting to offset the influence of Trump’s tariffs.

As for Japan, final week, Japanese Finance Minister Katsunobu Kato stated Japan received’t use its accumulation of Treasurys as a bargaining chip towards Trump:

We handle our U.S. Treasury holdings from the standpoint of making ready for in case we have to conduct exchange-rate intervention sooner or later.

However apparently, Japanese insurer Nippon Life owns an amazing quantity of Treasurys, they usually could possibly be behind the latest promoting.

Right here’s CNBC:

“It’s all very properly for the Japanese authorities to say, we’re not going to promote U.S. Treasurys, however it’s not the Japanese authorities that owns them. It’s Nippon Life,” [BCA Research’s Garry Evans] added.

If these insurers are nervous about U.S. coverage flip-flopping and need to cut back publicity, there’s “not so much the federal government can do.”

Clearly, “bond vigilantes” don’t exist solely within the U.S.

Now, no matter who’s behind the selloff, the underside line stays: large gamers have been bailing on the 10-year.

What’s the worst case that these Bond Vigilantes worry?

Think about your brother-in-law involves you, lamenting that issues are slightly tight; he must borrow some money.

You give him a mortgage, solely to look at him go spend extravagantly, far past his earnings. It’s not lengthy earlier than he’s again at your door, requesting more cash. You agree…he spends recklessly as soon as once more.

Now, say this sample repeats one other half a dozen instances.

Finally, what are you going to do?

Both 1) ask for a better return in your loans, or 2) simply cease lending.

Whereas the Bond Vigilantes have been engaged in one thing just like the “larger return” technique, billionaire hedge fund founder Ray Dalio is nervous concerning the second chance – folks not eager to lend our authorities cash anymore.

From Fortune:

[Speaking at CONVERGE LIVE in Singapore, Dalio said that] in some unspecified time in the future, the U.S. must “promote a amount of debt that the world isn’t going to need to purchase.”

That is an “imminent” situation of “paramount significance,” Dalio stated.

Fortune went on to cite Wharton Enterprise College finance professor Joao Gomes:

An important factor about debt for folks to remember is you want someone to purchase it.

We used to have the ability to rely on China, Japanese traders, the Fed to [buy the debt]. All these gamers are slowly going away and are literally now promoting.

If at some second these people which have thus far been blissful to purchase authorities debt from main economies determine, “You realize what, I’m not too positive if it is a good funding anymore. I’m going to ask for a better rate of interest to be persuaded to carry this,” then we might have an actual accident on our arms.

Dalio went on to foretell that when the world runs low on patrons for U.S. Treasurys, we’ll see “stunning developments by way of how [debt] goes to be handled.”

What would that imply?

Dalio factors towards restructurings of debt, stress from Washington on nations to purchase the debt, and even monetization of debt.

Although Dalio didn’t explicitly say this, a research of worldwide financial historical past reveals that monetization of debt dangers hyperinflation.

So, what do you do?

First, regardless of Dalio’s reference to an “imminent” disaster, it’s unlikely that some type of financial A-bomb is true across the nook.

Whereas we respect Dalio’s evaluation, he’s been preaching related doom-and-gloom for years at this level. Finally, he’ll be proper, but when there’s one factor our authorities excels at, it’s sticking fingers in dikes and kicking cans down roads.

Second, concentrate on what you possibly can management fairly than fearing what’s past your management.

Whereas understanding and recognizing these big-picture macro actions may help inform your market selections, they shouldn’t paralyze them.

Circling again to Louis, you’re higher served specializing in what he calls the “iron regulation” of the inventory market:

Inventory worth traits can diverge from earnings traits for some time, however over the long run, if an organization grows and grows the amount of money it takes in, its share worth is certain to go larger.

This is the reason Louis stays bullish throughout this earnings season that simply started. If you restrict your shopping for to essentially superior shares which have earnings energy, earnings season normally brings welcomed features.

For the most recent essentially superior shares that Louis likes, click here to learn about joining him at Growth Investor.

In the meantime, don’t overlook the facility of AI that can assist you navigate at this time’s difficult market

Final night time, Keith Kaplan, the CEO of our company companion TradeSmith, went reside at this AI Predictive Power Event.

It was a unbelievable night with hundreds of attendees studying about TradeSmith’s AI-powered algorithm “An-E” (brief for Analytical Engine).

This AI-fueled expertise forecasts the share worth of hundreds of shares, funds, and ETFs one month into the long run together with the conviction degree of that prediction. It’s equally highly effective in each bull and bear markets.

To look at a free replay of the occasion, together with examples of back-tests, just click here. Keith even provides away 5 of An-E’s most bearish forecasts. These are shares that the AI platform tasks will drop laborious within the coming weeks.

Coming full circle…

Final September, the Fed started reducing charges (as Trump desires).

Did it end result within the 10-year Treasury yield falling?

Nope. As you possibly can see under, the 2 yields diverged, and the 10-year surged…

Supply: StockCharts.com

Bottom line: Trump can focus on Powell all he wants, but Louis is right…

The Bond Vigilantes are running the show.

Have a good evening,

Jeff Remsburg