Unlock the Editor’s Digest without spending a dime

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

China’s newest export controls on uncommon earth minerals may trigger shutdowns in automotive manufacturing, with stockpiles of important magnets set to expire inside months if Beijing totally chokes off exports.

Beijing expanded its export restrictions to seven rare earth parts and magnets very important for electrical automobiles, wind generators and fighter jets in early April in retaliation for US President Donald Trump’s steep tariffs of 145 per cent on China.

Authorities officers, merchants and auto executives mentioned that, with inventories estimated to final between three and 6 months, corporations can be racing to stockpile extra materials and discover different provides to keep away from main disruption.

Jan Giese, a metals dealer at Frankfurt-based Tradium, warned that prospects had been caught off guard and most automotive teams and their suppliers seem like holding solely two to 3 months’ price of magnets.

“If we don’t see magnet deliveries to the EU or Japan in that point or at the very least near that, then I feel we’ll see real issues within the automotive provide chain,” mentioned Giese.

China’s newest controls centered on “heavy” and “medium” uncommon earths that allow high-performance magnets that may stand up to larger temperatures, akin to dysprosium, terbium and samarium. These are very important for navy purposes akin to jets, missiles and drones, in addition to rotors, motors and transmissions that characteristic closely in electrical and hybrid automobiles.

A senior automotive government mentioned the essential mineral restrictions can be “consequential” for Tesla and all different automotive producers, describing the export controls as a “7 or 8” on a scale of 1 to 10 when it comes to severity.

“It’s a type of retaliation the place the Chinese language authorities can say ‘OK, we’re not going to go tit-for-tat any extra on the tariff price however we’ll harm you USA and we’ll incentivise corporations to plead with your personal residence governments to alter tariff coverage’,” he mentioned.

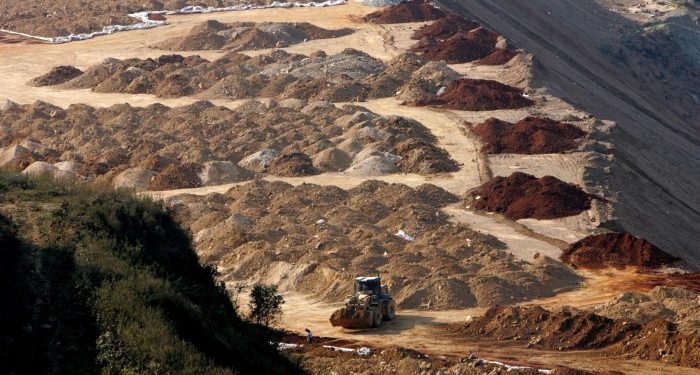

Uncommon earth metals are generally discovered within the earth’s crust however are troublesome to extract at low value and in an environmentally pleasant method, with China commanding a close to monopoly on heavy uncommon earths processing.

The “mild” uncommon earths, akin to neodymium and praseodymium, utilized in bigger portions in magnets haven’t been focused, giving Beijing a “large risk vector” to broaden controls if the commerce conflict intensifies, mentioned Cory Combs of Beijing-based Trivium, a consultancy.

Beijing’s controls require exporters to achieve licences for every cargo of fabric abroad and have expanded their scope to ban re-exports to the US. Nonetheless, utility of the curbs — which have coated a regularly increasing group of essential minerals since 2023 in response to US blocks on Chinese language entry to chip know-how — has been removed from common.

Chinese language exporters have already declared pressure majeure on cargoes of uncommon earths and magnets heading abroad and have withdrawn materials on the market from the market, additional obscuring the worth of already opaque commodities.

Japan and different nations are pinning hopes on loosening China’s grip over the heavy uncommon earths by way of Australia’s Lynas, which is ready to broaden its Malaysian processing website to supply dysprosium and terbium by mid-2025.

“Heavy uncommon earth stockpile parts don’t suffice to keep away from potential turbulence of automotive provide chains,” mentioned a Japanese authorities official, who added that nationwide stockpiles ought to present additional reduction past the 2 to 3 months of provide held by automakers.

“The problem is whether or not we will construct the brand new, different provide chain in time for our stockpile to outlive this,” he added.

It’s not but clear from Chinese language authorities bulletins since April 2 how Beijing plans to implement the most recent export controls.

The export controls come as China faces declining feedstock for the heavy uncommon earths due to the civil conflict in Myanmar, analysts mentioned, which means a block on exports would shore up home provides.

Consultants have famous that over latest years, China has been reluctant to dam shipments that might harm its personal financial pursuits, akin to gallium, however shipments have been closely snarled up of different metals akin to antimony, which is used to make bullets.

“The essential query is how lengthy they are going to take to course of the export licences,” mentioned Giese.