Again in late 1994, tech firm Netscape launched its net browser to the world. And nobody knew it on the time, however that second sparked what would change into probably the most explosive funding growth in trendy historical past…

Over the next 4 years, from late ‘94 to ‘99, the Dot-Com Increase gave early buyers the prospect to change into millionaires… even billionaires. Simply look to Stripes founder Ken Fox. Alongside Walter Buckley and Pete Musser, Fox turned a ‘paper billionaire’ by investing in B2B e-commerce corporations throughout this worthwhile period.

Although, huge paydays weren’t simply reserved for early buyers. It seems that it didn’t matter if you happen to had been available in the market on Day One.

In reality, the largest good points truly got here through the Dot-Com Increase’s second half.

How In the present day’s AI Increase Mirrors the Dot-Com Period – And What It Means for Traders

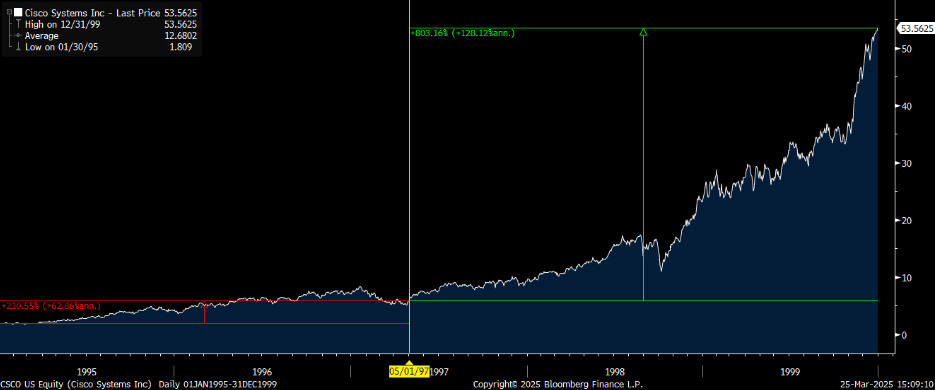

See: Cisco (CSCO), the poster little one of this growth.

Because the world rushed to construct out our trendy web infrastructure, the networking options supplier noticed demand for its tools soar. The inventory turned an enormous winner.

From early 1995 to summer time 1997 – early within the Dot-Com Increase – CSCO rallied about 200%

However do you know that almost all of the corporate’s good points got here within the ‘second half’ of that growth?

Between summer time 1997 and late ‘99, CSCO went parabolic, hovering an absurd 800%.

In different phrases, within the first two years of the dot-com period, Cisco inventory tripled. Then, in its previous couple of years, CSCO rose about 9X.

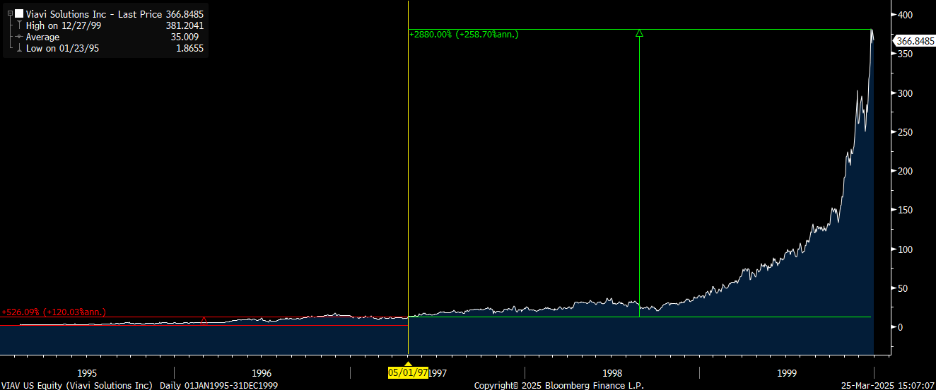

It’s the identical story with Viavi Options (VIAV), one other networking options supplier for the web buildout.

Within the Dot-Com Increase’s first half, from early 1995 to summer time ‘97, that inventory rallied an astounding ~500%.

However from mid-97 to late ‘99, it completely skyrocketed – almost 3,000%.

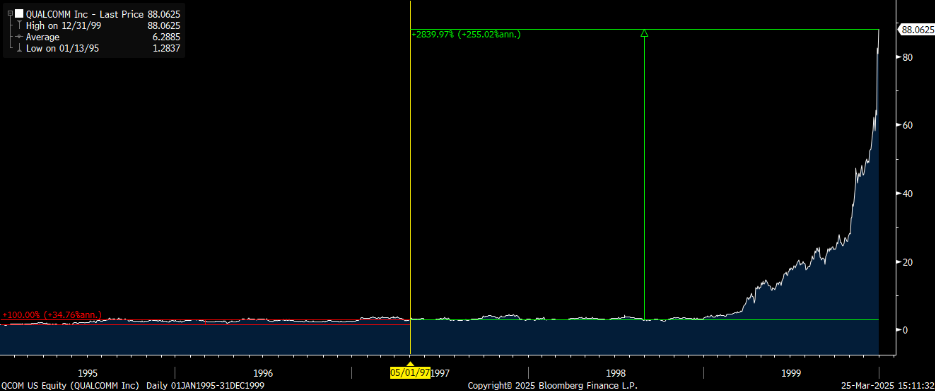

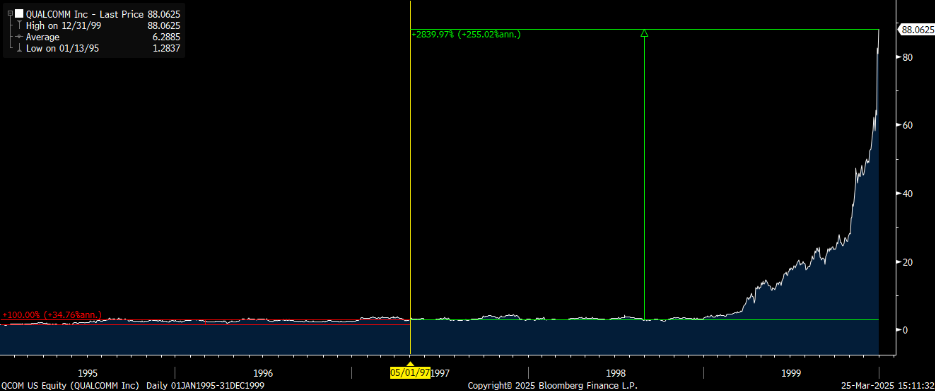

Qualcomm (QCOM) adopted the same sample.

That inventory doubled within the first half of this growth, between early 1995 to summer time ‘97. Then, it soared greater than 2,800% from summer time 1997 to late ‘99.

Lather, rinse, repeat for different huge web inventory winners of the Nineties like Semtech (SMTC), Utilized Supplies (AMAT), Oracle (ORCL), Paychex (PAYX), Sanmina (SANM), and so forth.

All had been enormous winners within the Dot-Com Increase. And all produced their greatest returns in a while within the sport.

Why?

Not due to Netscape’s browser debut, however due to what got here after…

Why the Largest AI Funding Alternatives Are Nonetheless Forward

As with most rising know-how, it took just a few years for net browsers like Netscape to achieve widespread adoption.

However as soon as they did, the stage was set for the web’s “acceleration part” – a interval when groundbreaking purposes like Amazon emerged, constructed on prime of these browsers, and went on to remodel the world.

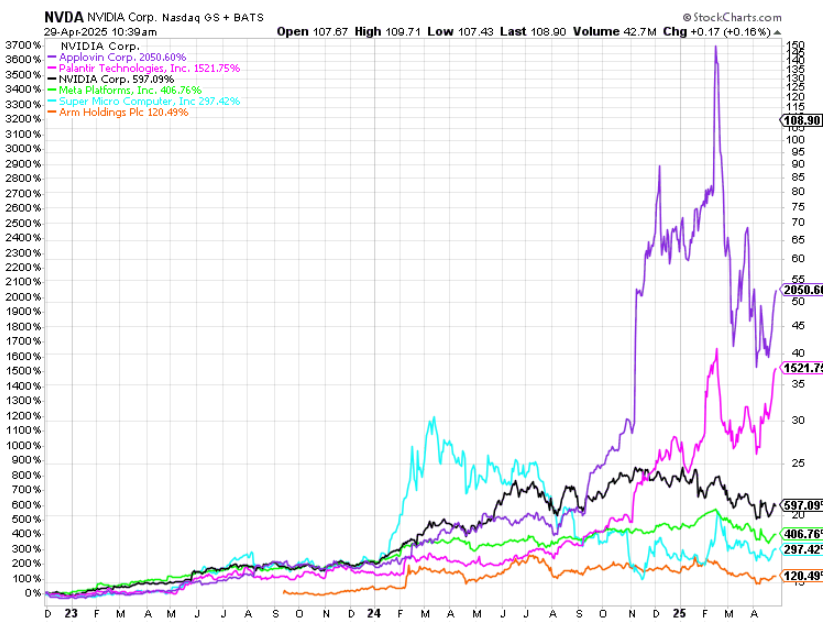

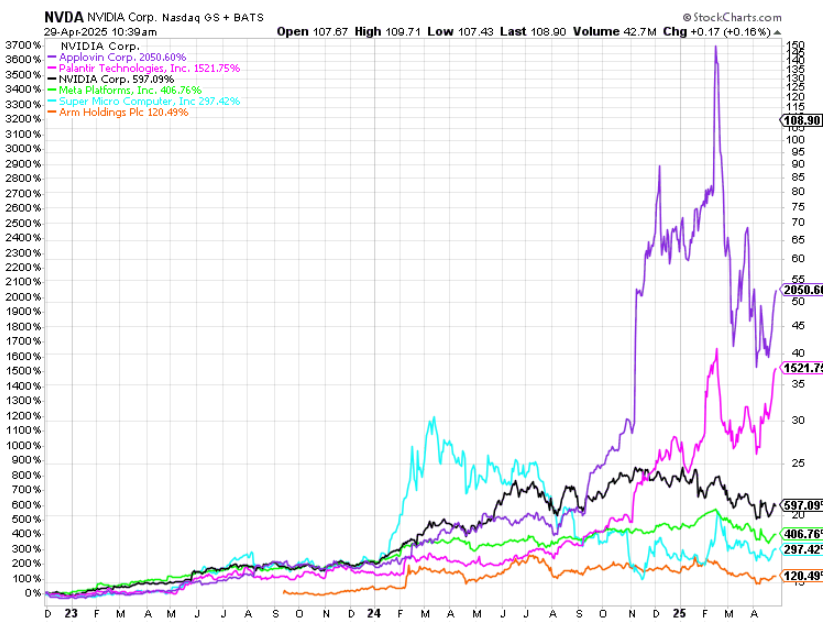

Proper now, the very same factor is going on as soon as once more. Besides this time, it’s all about AI.

The AI Increase started in late 2022 with ChatGPT’s launch – the “Netscape second” for this era. Since then, AI has dominated headlines, and AI stocks have soared.

However make no mistake…

We aren’t on the finish of this worthwhile period – merely the midpoint.

In reality, if historical past is any information, the subsequent 24 months might be even greater than the final 24 – simply as 1998 and ‘99 had been much more worthwhile for buyers than 1995 and ‘96.

However this time… one thing is totally different. Somebody is interfering – U.S. President Donald J. Trump.

That’s, over the previous a number of weeks, Trump has unleashed a cascade of tariffs, reigniting a worldwide commerce warfare and throwing the inventory market into absolute chaos.

We’ve seen historic up days, adopted by devastating crashes. A few of the greatest – and worst – one-, two, and three-day stretches in market historical past have occurred over the previous three months.

Very just lately, the volatility index (VIX) – Wall Road’s concern gauge – was flashing 52.33; a stage we noticed on the depths of the COVID Crash and 2008 monetary disaster.

It’s been one of many most risky three-month stretches in inventory market historical past.

And but… the biggest shock hasn’t even happened yet.

How a Could 7 Set off Might Launch the Subsequent Huge Rally

Suppose again once more to the Dot-Com Increase: The market has been right here earlier than.

In 1998, international currencies had been in turmoil, Russia defaulted, and Lengthy-Time period Capital Administration collapsed. Pundits had been satisfied that the Dot-Com Increase was completed.

It wasn’t.

Proper in the midst of that chaos, the largest tech rally in historical past took off.

I feel historical past is about to repeat.

That’s as a result of, on Could 7, I imagine President Donald Trump and a message popping out of Washington will assist set off a $7 trillion panic within the markets as buyers on the sidelines – and all of the money they’re holding – rush to leap again in as alternatives open up.

This significant financial occasion ties collectively every little thing occurring now — the inventory market chaos, the commerce warfare headlines, the AI Increase, and each single investor’s portfolio.

This feels the identical as 1997 — the panic, the concern, the headlines. Beneath all of it, nevertheless, an enormous alternative is quietly forming.

When the powers that be in Washington take the stage on Could 7, they might mild the spark.

This Thursday at 7 p.m. EST, I’m internet hosting a free urgent briefing to arrange you for what I’ve been calling The 2025 Summer time Panic.

I’ll stroll you thru the historic parallels, present you why the AI Increase is much from over, and reveal what might occur on Could 7 – and place your self.

For causes I’ll clarify Thursday evening, a vital financial occasion that President Trump is pushing exhausting for is about to ignite this rally in a small particular group of shares as quickly as subsequent week.

Throughout that free broadcast, I’ll be sure you have all the main points on the seven small corporations I’ve recognized as the largest potential winners of The 2025 Summer time Panic…

Once more: Thursday evening, 7 p.m. EST. Clear your calendar. What occurs subsequent might go down in historical past.

On the date of publication, Luke Lango didn’t have (both immediately or not directly) any positions within the securities talked about on this article.

Questions or feedback about this situation? Drop us a line at langofeedback@investorplace.com.