This text is an on-site model of our Ethical Cash publication. Premium subscribers can enroll here to get the publication delivered 3 times every week. Commonplace subscribers can improve to Premium here, or explore all FT newsletters.

Go to our Moral Money hub for all the most recent ESG information, opinion and evaluation from across the FT

Yearly, worldwide local weather negotiators collect to debate the best way to galvanise capital flows into low-income nations to fund inexperienced improvement and local weather resilience.

However amid increased international rates of interest previously few years, these capital flows have been shrinking, and have in lots of circumstances turned destructive. In 2023 — in response to the most recent World Financial institution information — low- and lower-middle-income nations paid out extra to their lenders than they obtained in new credit score (even together with concessional loans from worldwide monetary establishments).

This has left many of those nations struggling to fund primary providers, not to mention inexperienced funding. Under, we spotlight a brand new plan to deal with this sticky scenario.

Additionally at the moment: are economies of scale the reply to Africa’s largest killer?

Sovereign debt

The seek for inexperienced alternative in a debt disaster

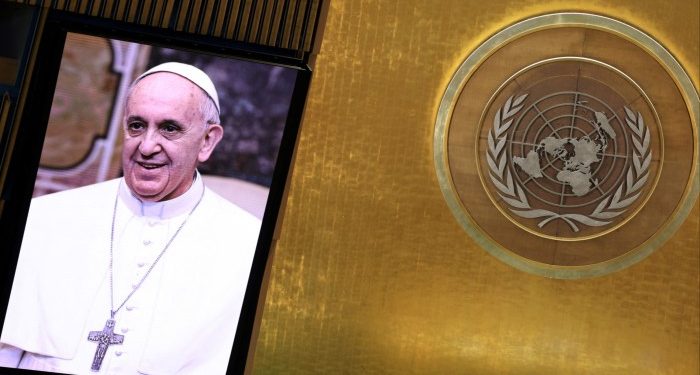

In his ultimate new 12 months’s tackle earlier than his demise this month, Pope Francis urged wealthy nations, “in recognition of their ecological debt”, to write down down the loans of poorer nations “which are in no situation to repay the quantity they owe”.

He was removed from alone in voicing alarm on the debt struggles of lower-income countries, the place surging curiosity payments are squeezing budgets for essential services and infrastructure.

Ultimately week’s IMF and World Financial institution spring conferences in Washington, figures from IMF head Kristalina Georgieva to US Treasury secretary Scott Bessent spoke of the necessity for talks on restructuring of sovereign money owed which have in some circumstances turn into unsustainable.

Whereas it might not quantity to the sweeping debt “jubilee” that the late pope envisaged, momentum appears to be rising behind a wiser strategy to sovereign debt reduction. And this presents a chance for a wider rethink on finance for lower-income economies, with a higher emphasis on local weather and nature resilience.

That’s the argument of a brand new report from a global professional group, commissioned by the governments of France, Kenya, Colombia and Germany to discover how creating nations’ sovereign debt “can turn into extra sustainable, each fiscally and environmentally”.

“We actually can not have the debt dialog with out together with local weather and nature,” Vera Songwe, a former World Financial institution economist who co-chaired the group, informed me.

The idea of “ecological debt”, as espoused by Pope Francis, has been central to discussions at latest UN local weather and nature conferences. Local weather-vulnerable low-income nations have argued that wealthy nations — which, on a per capita foundation, have contributed a disproportionate share of worldwide carbon emissions and environmental injury — are morally obliged to assist them adapt to local weather change, and assist finance their low-carbon improvement.

Songwe and her co-authors recommend that conditional debt reduction may very well be a robust means of offering this help. They make the case for “greening debt restructuring”, with collectors taking haircuts in alternate for commitments from debtor nations to particular local weather or nature investments.

The identical precept may very well be utilized to the refinancing of debt owed by nations that aren’t but technically in misery, however face problematically excessive debt service funds. Previously few years, a handful of countries together with Ecuador and Gabon have undertaken debt-for-nature swaps, by which they dedicated funds to conservation tasks as a part of a refinancing deal.

Scaled-up efforts on this entrance can be within the curiosity of creditor nations, the authors argue, provided that local weather and nature funding in low-income nations might be important if the world is to avert ecological catastrophe. And at a time when rich-world governments have been slashing abroad assist spending, they “would possibly discover it politically simpler” to help low-income nations on this means moderately than by way of new grants and loans, the report suggests.

There are some grounds for warning in regards to the concepts proposed within the paper. For one factor, including a posh new dimension to sovereign debt restructuring dangers additional extending a course of that’s typically painfully protracted as it’s. And the authors’ suggestion of obligatory haircuts for all collectors, as a part of the proposed restructuring offers, may injury the long-term urge for food of private-sector debtors for lending to low-income nations.

However patrons of high-yield authorities bonds are nicely conscious of the dangers that they’re taking, Songwe argued. She added that the IMF and World Financial institution may assist to create a framework for these processes by overhauling their strategy to calculating debt sustainability, to account correctly for environmental dangers and the financial advantages of investing in resilience.

“We have to take a look at this as a one full dialog,” Songwe mentioned.

Philanthropy

New child well being fund raises $450mn amid international assist cuts

Every year, greater than one million infants in Africa die of their first month of life, making neonatal mortality the continent’s largest killer. A richly funded new philanthropic initiative is aiming to alter that.

Launched yesterday, the Beginnings Fund has raised $450mn from a large group of foundations to help mom and toddler care in Africa, with a concentrate on coaching and system enhancements, in partnership with nationwide governments.

The launch comes at a grim time for state-funded abroad assist, after Donald Trump gutted the US Company for Worldwide Growth and several other European nations slashed their assist budgets. Whereas it has been within the works since nicely earlier than Trump’s return, the Beginnings Fund is a reminder of the firepower available from philanthropic foundations to melt that blow.

The brand new initiative has a broad crowd of funders, starting from the muse of United Arab Emirates chief Mohammed bin Zayed to the Gates Basis and the Kids’s Funding Fund Basis. Thus far, philanthropic approaches to this downside have been fragmented and infrequently sub-scale, with an excessive amount of duplication of efforts, mentioned Tsitsi Masiyiwa, chair of Delta Philanthropies, one other of the backers.

“New child mortality is inflicting extra deaths than HIV or tuberculosis or malaria, and but it hasn’t had this type of joined-up initiative that these different areas in international well being have needed to date,” mentioned Robyn Calder, president of ELMA Philanthropies, one other backer. The brand new fund may benefit from economies of scale, she added, within the procurement of medicines and tools.

“It’s not nearly cash, but additionally learnings and expertise, and modelling what does and doesn’t work,” added Masiyiwa. “And if we pull all that collectively, then we usually tend to scale back these obtrusive numbers.”

Sensible reads

Knowledge at risk On local weather science, “the US is exhibiting indicators of becoming a rogue state,” warns Anjana Ahuja.

Weighing choices Norway’s Equinor is considering suing the Trump administration after it was compelled to halt development of a wind farm off the New York coast.

Battery battle Chinese language and South Korean firms are fighting for dominance available in the market for large-scale batteries to help electrical energy grids.