Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

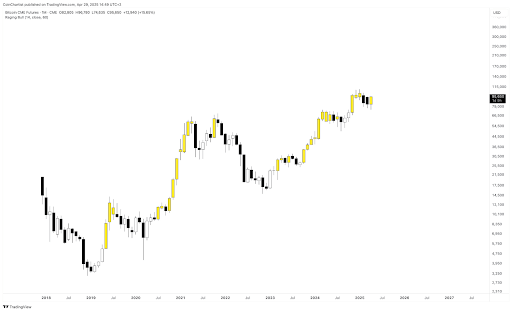

Bitcoin continues to show signs of resilience on the $95,000 area, pushing larger from latest lows and making an attempt to reclaim its bullish construction after a risky April. The month-to-month candlestick for April on the CME Futures chart presently presents a robust bullish engulfing formation, which, if sustained into the weekly shut, may present the market with bullish momentum to shut Could with one other bullish candle.

The potential of this bullish shut is sufficient to sway the sentiment among bearish proponents, in accordance with crypto analyst Tony “The Bull” Severino.

Raging Bull Instrument Flashes Sign On CME Futures

Bitcoin’s value motion over the past two weeks has been constructive and has seen an in any other case waning bullish sentiment slowly creeping again amongst crypto merchants. Curiously, this value motion has even seen Bitcoin’s internet taker quantity turn positive for the primary time shortly. Though the pattern remains to be in its early phases, the renewed energy is already starting to melt among the extra bearish outlooks, particularly as key indicators begin to flip.

Associated Studying

Tony “The Bull” Severino, a well-followed crypto analyst, recently revealed on social media platform X that his proprietary “Raging Bull” indicator has turned again on. Nonetheless, this indicator has turned again on solely on the Bitcoin CME Futures chart, not the spot BTC/USD chart.

The divergence between CME Futures and the spot chart, with solely the previous flashing this bullish sign, has added complexity to Bitcoin’s present outlook. The Raging Bull software, which makes use of weekly value information, is designed to determine early phases of highly effective upward actions. In line with Severino, the looks of this sign, regardless of his bearish stance, suggests a significant shift in market construction could also be creating. Nonetheless, he was fast so as to add {that a} confirmed weekly shut remains to be vital earlier than any agency conclusions may be drawn.

Breaking Above This Stage Is Key

Inspecting the month-to-month chart shared by the analyst, the bullish engulfing candlestick is clearly seen following a pointy rebound from April’s lows beneath $83,000. Bitcoin started the month of April at round $83,000, however a swift downturn in the first few days pushed the worth downward till it bottomed out at round $75,000. Nonetheless, the present April candle not solely erases March’s losses but in addition signifies elevated curiosity in Bitcoin from institutional merchants on the CME platform.

Associated Studying

Nonetheless, regardless of the encouraging candlestick formation, Bitcoin should decisively break above the $96,000 to $100,000 area, the place earlier uptrends have stalled. This degree is performing as a ceiling that would decide whether or not the latest bullish momentum continues or stalls. A failure to shut above this vary, both on the weekly or month-to-month timeframe, may invalidate the Raging Bull sign.

Moreover, the Raging Bull indicator wants to show again on the spot BTCUSD chart to substantiate a robust bullish outlook. This can only be done if Bitcoin manages to interrupt considerably above $96,000.

On the time of writing, Bitcoin is buying and selling at $94,934.

Featured picture from Pixabay, chart from Tradingview.com