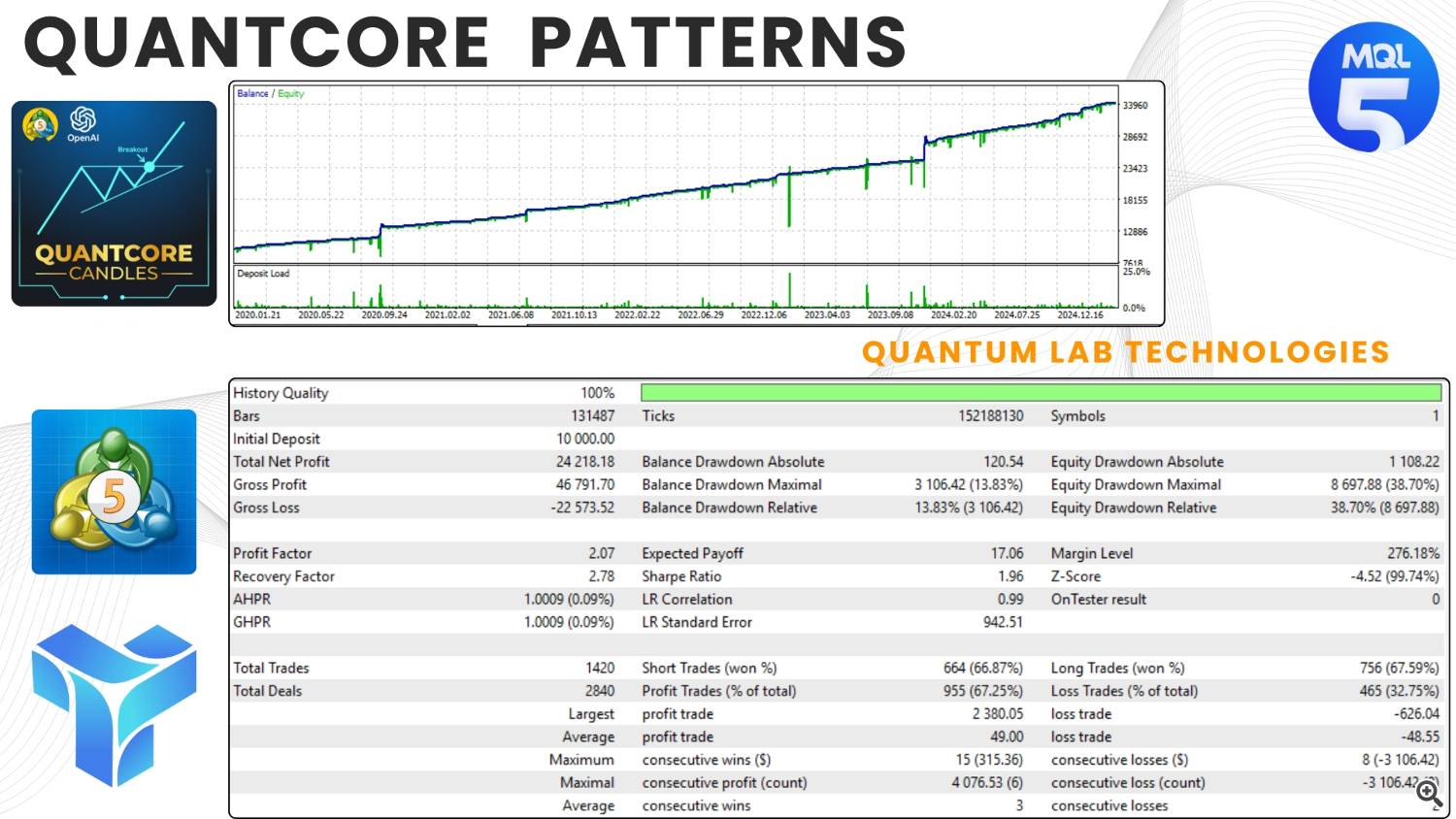

QuantCore Patterns — an clever buying and selling advisor based mostly on patterns. Automate your evaluation. Handle your income.

Within the period of knowledge overload and market volatility, skilled merchants and traders are searching for correct, confirmed options that may guarantee stability and capital progress. That is precisely the answer – QuantCore Patterns – a high-tech buying and selling algorithm that may acknowledge and use the ability of market patterns for automated buying and selling.

- Really helpful pairs: EURUSD, GBPUSD, USDCAD, NZDUSD, AUDUSD

- Timeframe: M15 — lets you mix accuracy and frequency of transactions

- Minimal deposit: $1000 per foreign money pair (you should utilize cent accounts)

- Danger administration: 0.01 lot for each $1000 of deposit

- Circumstances: minimal unfold, ideally ECN accounts

To make use of the Skilled Advisor you want a VPS: ➡️ https://myforexvps.com/billing/aff.php?aff=1426

We advocate you to make use of cashback to return the unfold ➡️ https://fxcash.ru/?id=X79614

Greatest EA Buying and selling Account ➡️ https://telegra.ph/Open-a-RoboForex-Account-04-16

Chart patterns are a well-liked methodology utilized in technical evaluation to analyse and predict value actions within the monetary markets. Merchants and traders use chart patterns to determine potential entry and exit factors available in the market, which will help them make extra knowledgeable buying and selling selections. These patterns are fashioned by the worth actions of a monetary instrument, reminiscent of a inventory, foreign money pair, commodity, or index, over a selected time frame. Right here, we’ll discover some frequent chart patterns and their traits.

What are the most typical chart patterns?

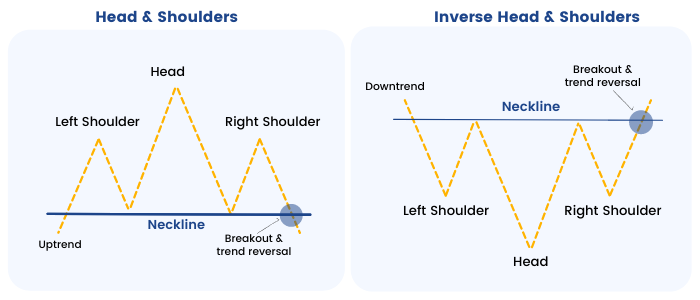

1. Head and Shoulders Sample:

- This sample consists of three peaks with the center peak (head) being larger than the opposite two (shoulders).

- The left shoulder types as the worth rises to a peak, adopted by a decline.

- The pinnacle types as the worth rises once more however reaches a better peak than the left shoulder, adopted by one other decline.

- The appropriate shoulder types as the worth rises as soon as extra however fails to exceed the pinnacle’s peak, adopted by a decline.

- It’s thought-about a reversal sample, indicating a possible pattern change from bullish to bearish.

2. Inverse Head and Shoulders Sample:

- That is the other of the pinnacle and shoulders sample and signifies a possible pattern change from bearish to bullish.

- It consists of three valleys with the center valley (head) being decrease than the opposite two (shoulders).

- The sample’s traits mirror these of the common head and shoulders sample however in an inverted method.

3. Double High and Double Backside:

- A double prime is fashioned when the worth reaches a peak (resistance), then declines, and later rises once more to kind a second peak at an identical degree as the primary one.

- A double backside is the other, fashioned by two value troughs (help) at roughly the identical degree.

- These patterns point out potential pattern reversals.

4. Triple High and Triple Backside:

- Just like double tops and double bottoms, however these patterns have three peaks or troughs as a substitute of two.

- The third peak or trough additional confirms the potential pattern reversal.

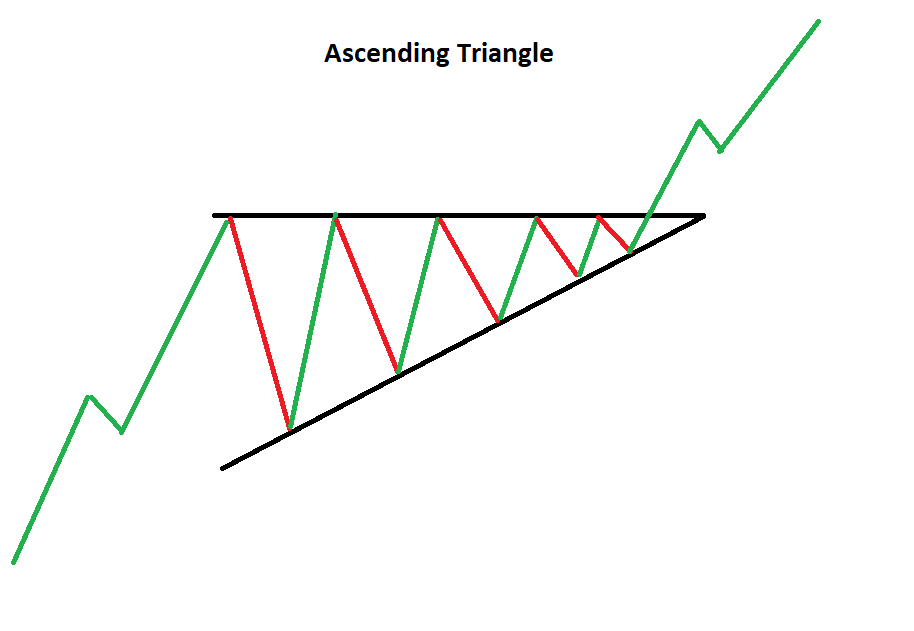

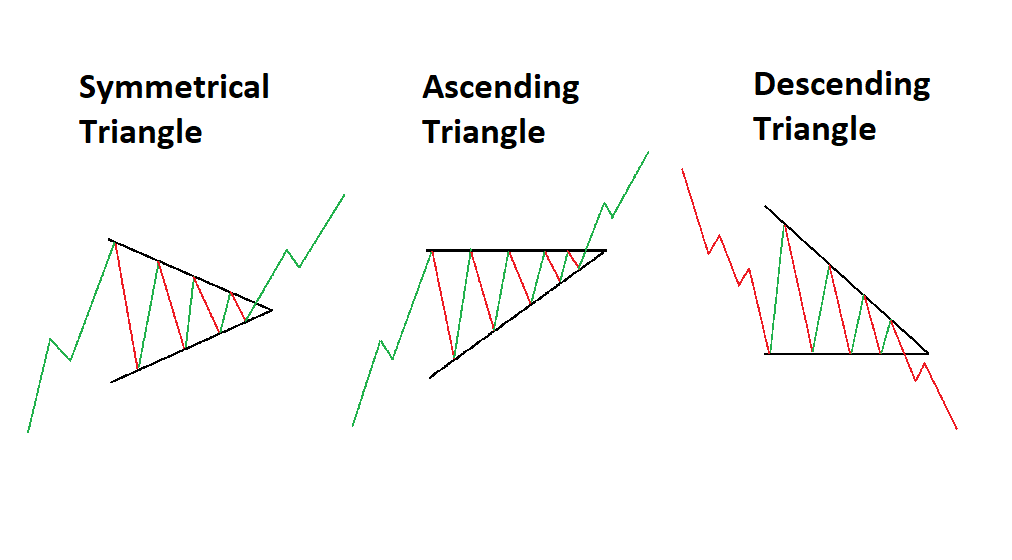

5. Ascending Triangle:

- Shaped by a horizontal resistance degree and an upward-sloping help line.

- Every time the worth touches the resistance, it retreats, and every time it touches the help, it bounces again.

- This sample means that the worth might get away upwards, indicating a possible bullish pattern continuation.

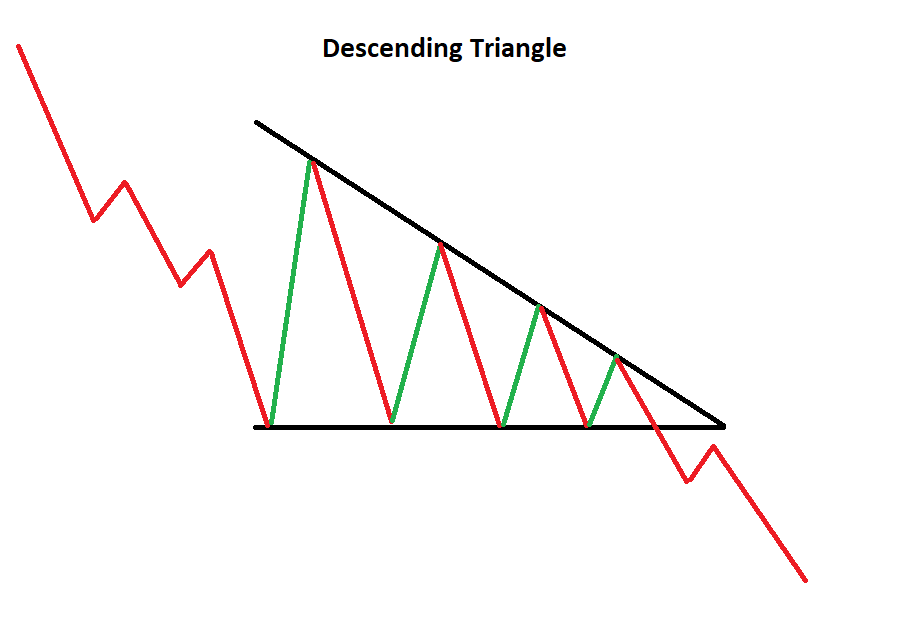

6. Descending Triangle:

- Inverse of the ascending triangle, this sample has a horizontal help degree and a downward-sloping resistance line.

- The value approaches the help and will get pushed again, whereas it approaches the resistance and will get rejected.

- This sample means that the worth might get away downwards, indicating a possible bearish pattern continuation.

7. Symmetrical Triangle:

- Shaped by converging trendlines, with each the help and resistance getting nearer collectively over time.

- The value oscillates between these strains, forming larger lows and decrease highs.

- This sample would not point out a selected directional bias and might get away both upwards or downwards.

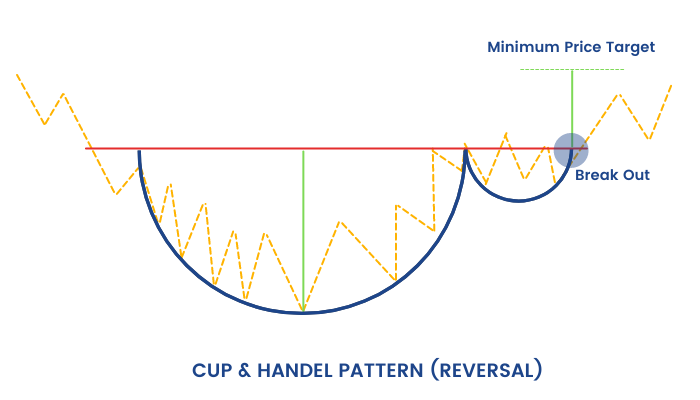

8. Cup and Deal with:

- A bullish continuation sample that resembles a cup with a deal with.

- The cup is fashioned as the worth step by step declines after which rises again to roughly the identical degree.

- The deal with is a small dip in value that follows the cup’s rise.

- A breakout above the deal with’s resistance degree signifies a possible uptrend continuation.

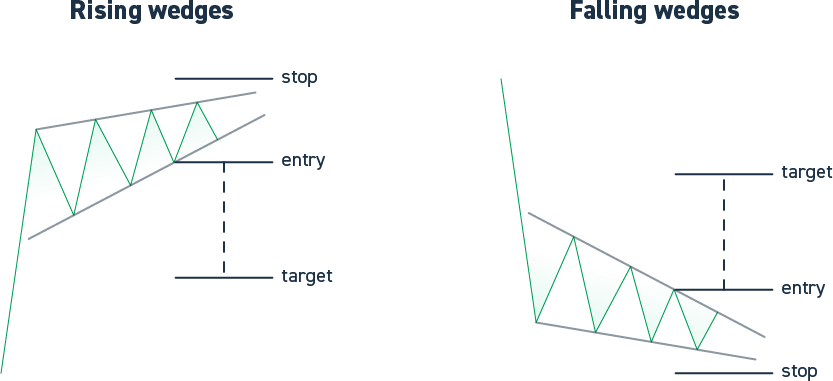

9. Wedge Patterns:

- Rising Wedge: Shaped by converging pattern strains with a better resistance line and a better help line. It normally signifies a bearish pattern.

- Falling Wedge: Shaped by converging pattern strains with a decrease resistance line and a decrease help line. It normally signifies a bullish pattern.

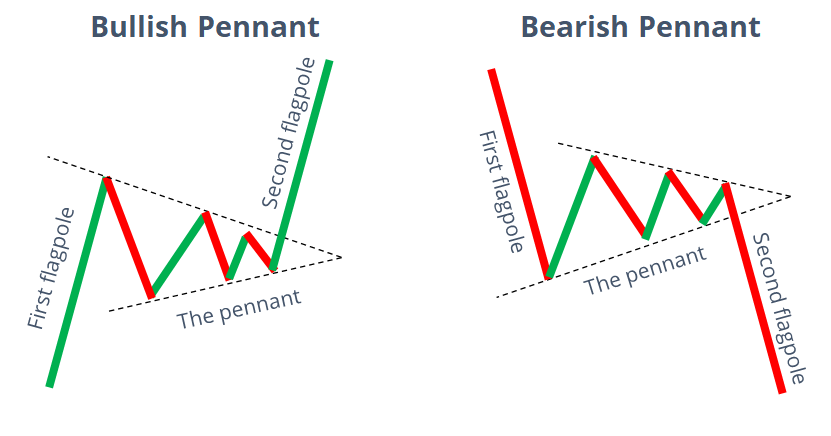

10. Pennant:

- A brief-term continuation sample that resembles a small symmetrical triangle.

- It’s fashioned after a major value motion, representing a interval of consolidation earlier than the worth continues within the earlier course.

11. Flag:

- One other continuation sample, fashioned by two parallel trendlines, representing a quick pause in a robust value pattern.

- It’s characterised by its rectangular form, resembling a flagpole (the preliminary robust value transfer) and the flag itself (a interval of consolidation).

What’s the significance of quantity in chart patterns?

Quantity can present extra affirmation to a chart sample. As an example, larger quantity through the formation of a sample can point out stronger conviction amongst market individuals, growing the probability of its validity.

In chart patterns, quantity can be utilized to:

- Verify value actions. When quantity will increase as the worth of a safety strikes up or down, it signifies that there’s extra shopping for or promoting exercise, which may give the motion extra significance. For instance, if a inventory breaks out of a buying and selling vary on excessive quantity, it’s extra prone to be a sustainable transfer than if it breaks out on low quantity.

- Determine developments. Rising quantity on uptrends and falling quantity on downtrends will help to substantiate {that a} pattern is in place. For instance, if a inventory is in an uptrend and the quantity begins to extend, it may very well be an indication that the pattern is accelerating.

- Determine reversals. A lower in quantity after a pointy value transfer is usually a signal {that a} reversal is underway. For instance, if a inventory has been rising on excessive quantity after which the quantity begins to lower, it may very well be an indication that the uptrend is coming to an finish.

Total, quantity is a invaluable software for technical evaluation that may assist to substantiate value actions, determine developments, and spot reversals. Nonetheless, you will need to keep in mind that quantity will not be an ideal indicator and needs to be used along side different technical indicators to make buying and selling selections.

Buyers ought to search for divergences between value and quantity. A divergence happens when value and quantity transfer in reverse instructions. This is usually a signal {that a} pattern is about to reverse. Contemplating the quantity of the general market in a selected inventory may be affected by the quantity of the general market. For instance, if the general market is experiencing low quantity, then it’s extra doubtless {that a} inventory will even expertise low quantity.Use quantity filters. Quantity filters can be utilized to determine shares which might be buying and selling on excessive or low quantity. This may be useful for locating shares which might be prone to be trending or which might be about to reverse.

When ought to I enter or exit a commerce based mostly on a chart sample?

The entry and exit factors for a commerce based mostly on a chart sample can fluctuate relying on the particular sample and the dealer’s technique. Typically, merchants enter a commerce when the sample is confirmed by a breakout or breakdown of a major value degree. They could exit the commerce when the sample’s goal is reached or when there are clear indicators of a pattern reversal.