Hey, Reader.

I as soon as requested my dad why his father migrated from the Illinois farm nation to Montana cattle nation within the early 1900s.

“Henry Ford destroyed all of the farm jobs,” he instructed me. “My dad couldn’t get work on the farms anymore, so he moved as much as Boseman to work as a cowboy.”

Now, Henry Ford didn’t destroy farm jobs personally, in fact… however his progressive tractor did. His “Fordson Mannequin F” tractor went into manufacturing in 1917 and have become an immediate hit with farmers within the Midwest.

As the primary mass-produced, cheap tractor, the Fordsons captured an amazing 70% share of the market by 1922, and their reputation grew quickly. By 1928, 700,000 of them had been rolling off the manufacturing line annually.

Synthetic intelligence will not be not like Henry Ford’s novel tractor.

It’s a new expertise that may produce widespread effectivity beneficial properties, whereas additionally decreasing or eliminating total classes of employment.

Modifications of that magnitude are tough to think about and, due to this fact, tough to embrace seamlessly and profitably. That’s the reason we should “future-proof” our lives to the furthest extent attainable.

It’s additionally why we should stay targeted on the once-in-a-generation funding alternatives AI is producing.

In impact, synthetic intelligence is slashing the world of commerce into two distinct teams: the AI appliers and the AI victims.

The businesses that hope to outlive and thrive should undertake and combine AI applied sciences as shortly as attainable. Those who fail to take action will perish… and time is of the essence, particularly as we get nearer and nearer to reaching synthetic common intelligence (AGI).

I first sounded the alarm concerning the method of AGI final August. At the moment, I shared a number of corporations that I believed to be each AI winners and losers to my subscribers at my elite buying and selling service, The Speculator.

And it seems, my calls had been proper on the cash, actually.

So as we speak, let’s take a deep dive on one AI success story to look at the traits that powered its market-beating outcomes… and one an organization within the crosshairs of AI that everybody ought to keep away from.

Let’s have a look…

A Toast to This AI Winner

Since I profiled this AI winner final August, its inventory has soared 80%.

This Boston-based agency gives AI-enabled options for just about each side of the restaurant biz – from on-line ordering achievement to reservations administration to supply-chain management.

I’m speaking about Toast Inc. (TOST).

Since 2011, Toast has been perfecting a platform that may are available and deal with all of the tech that eating places want, integrating on-line ordering, contactless funds, supply providers… and even bookkeeping.

The result’s a software program platform that the majority of us – or not less than practically everybody who orders takeout or supply on-line (myself included) – have used in some unspecified time in the future.

This expertise has helped Toast obtain a outstanding 119% internet income retention fee since 2015. This software-as-a-service (SaaS) metric calculates the share of income retained from an current buyer over a selected time frame.

In essence, Toast has develop into a database software program firm. The agency has one of many largest and most beneficial datasets in your entire restaurant business, enabling it to develop and ideal modern AI instruments for the business.

Toast’s database software program can assist eating places calculate their prices in real-time and perceive when to supply particular meals objects and at what value. These real-time insights can imply the distinction between success or failure within the cutthroat restaurant enterprise.

The extra knowledge Toast gathers from its rising roster of shoppers, the higher its AI turns into.

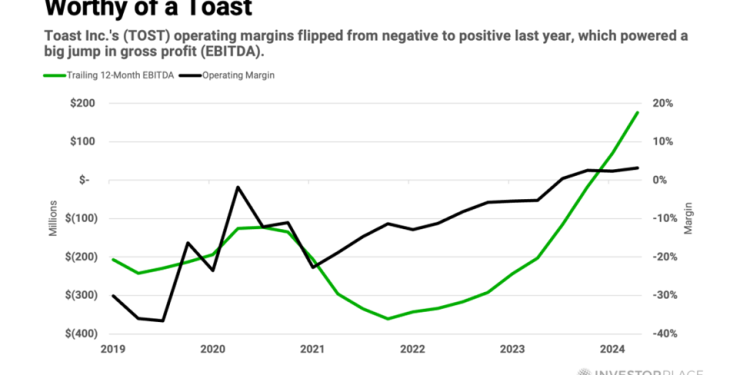

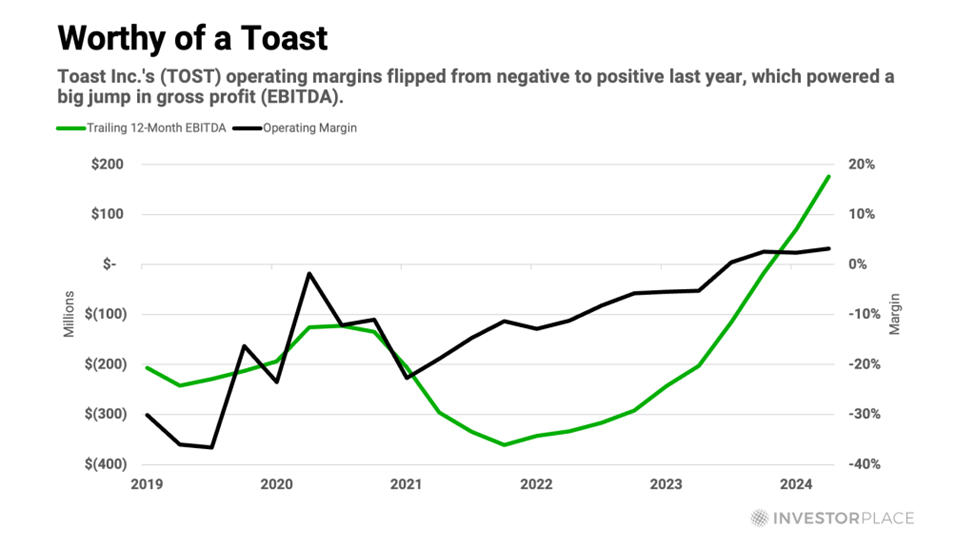

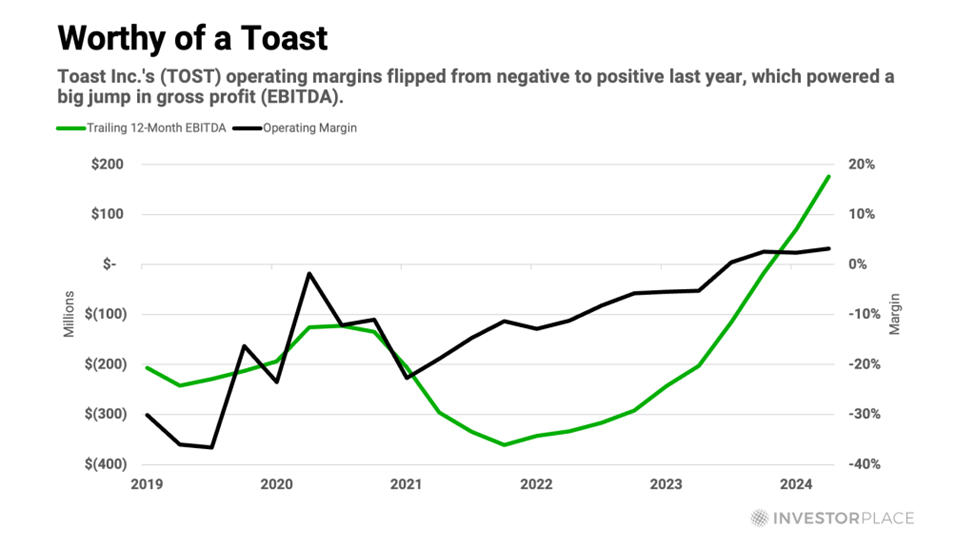

Toast’s working margins have achieved a pivotal inflexion level, from damaging to constructive. After operating double-digit damaging margins for a number of years, that metric inched into constructive territory 9 months in the past and has continued shifting larger. Consequently, Toast’s gross revenue (EBITDA) can be constructive and shifting larger.

Final week, the corporate reported file income and EBITDA for the primary quarter, each of which topped analyst estimates by a large margin. The inventory celebrated the excellent news by leaping 10% on the day of the earnings launch.

Toast is integrating AI expertise into its market-leading platform as quickly and comprehensively as attainable, which is one massive cause why I count on the corporate to thrive.

It’s the type of firm you could need to examine additional, because it ought to produce rising revenues and earnings over the approaching years.

As AI applied sciences stretch the tentacles into each side of our existence, the roster of profitable “AI appliers” will develop by the day. However the roster of “AI victims” will develop even bigger.

Right here is one such inventory to keep away from…

There Can’t Be Winners With out Losers

The businesses that fail to undertake AI applied sciences both lack the experience to take action or have enterprise fashions which might be basically incompatible with AI.

Both means, we don’t need to be holding shares that AI is threatening.

That’s why I proceed to focus on at-risk corporations every now and then, like I did final August once I recognized Shutterstock Inc. (SSTK) as an organization “sitting within the crosshairs of AI.”

As I defined on the time…

As soon as upon a time, Shutterstock was a cutting-edge graphics firm with a large, and useful, library of proprietary pictures. Right this moment, that library appears to be like extra like an anvil than a pair of wings.

Because of GenAI applied sciences like OpenArt, “proprietary graphics” are practically a factor of the previous…

Due to these aggressive threats, subscriber “churn” is rising at Shutterstock. Consequently, gross margins and internet earnings are each collapsing… These declining fortunes replicate declining demand for the corporate’s core content material library.

Since issuing that warning, Shutterstock’s monetary outcomes have continued to deteriorate. The corporate posted EPS of simply $1.01 final yr, not the $1.90 analysts anticipated, whereas the consensus earnings estimate for this yr has tumbled from $3 to $2.10. Not surprisingly, the inventory is down greater than 40% since my skeptical evaluation.

Shutterstock will not be an outlier. Subsequently, we should look at each potential funding via the lens of AI and be alert to each the alternatives and the hazards it can create.

That’s why I’ve simply put the ending touches on 4 new analysis stories targeted on investing in AI earlier than synthetic common intelligence takes maintain. Three of the stories spotlight a inventory to purchase, whereas the fourth one warns about three shares to promote.

You can learn how to access those reports by clicking here.

Like final August, I’m as soon as once more internet hosting an occasion on AGI’s risks – and alternatives.

The time to prepare earlier than AGI seems is operating out, which is why I’m now issuing my “Final Warning.”

Throughout that occasion, which you can watch right now here, I put ahead a three-part blueprint, that includes…

- My ideas on why treasured metals, vitality, actual property, and biotech sectors are the place everybody ought to be wanting proper now…

- My No. 1 AGI-related inventory choose that’s already confirmed a 46% acquire whereas the S&P 500 index dropped 5%…

- And particulars on vital shares to keep away from or promote instantly earlier than they collapse.

Click here to watch my urgent “Final Warning” presentation.

Regards,

Eric Fry