Unlock the White Home Watch publication free of charge

Your information to what Trump’s second time period means for Washington, enterprise and the world

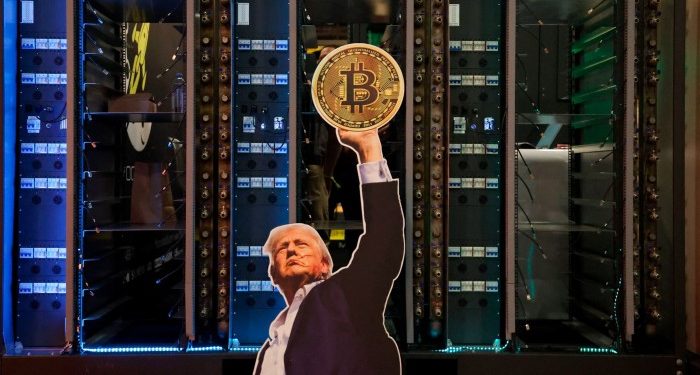

Donald Trump has been on fairly a journey for the reason that days when he stated bitcoin “looks as if a rip-off”. This week, the Trump household media firm stated it was elevating $2.5bn from buyers to purchase up the cryptocurrency. His sons Eric and Donald Jr promised hundreds of orange-clad bitcoin buyers in Las Vegas a bonanza, partially as a result of, as his vice-president JD Vance instructed the identical convention, “crypto lastly has a champion and an ally within the White Home”. Bitcoin has hit a latest file excessive on optimism that US lawmakers will quickly agree their first crypto rules — for stablecoins, or digital tokens pegged to the greenback or one other forex.

But the Trump household’s enthusiasm for crypto ventures mixed together with his administration’s pro-crypto stance creates a obtrusive battle of curiosity. The drive to legitimise typically unstable crypto belongings additionally threatens to inject new dangers into the monetary system.

Few presidents and their households have related themselves so intently, in workplace, with one industry. The US chief has promoted his $TRUMP memecoin, and hosted a gala dinner for its greatest holders. World Liberty Financial, which lists Trump as its “chief crypto advocate”, has launched a dollar-pegged stablecoin, USD1, which now has a $2.15bn market worth.

Inside days of returning to workplace, a Trump executive order revoked Biden-era measures geared toward limiting crypto dangers, promising to advertise US “management in digital belongings and monetary expertise”. One other order got down to create a strategic bitcoin reserve. The president has appointed crypto advocates to key roles, together with Paul Atkins as Securities and Trade Fee chair.

The incoming administration has shifted from “regulation by enforcement” to efforts to create a regulatory framework for crypto and foster development. The Division of Justice has, together with the SEC, dropped several cases towards crypto companies. Crypto fans have lengthy instructed offering regulatory readability by way of congress reasonably than the courts may bolster innovation and bonafide crypto companies. However a extra permissive surroundings dangers amplifying risks corresponding to fraud and market manipulation.

Till lately, it appeared the Trump household’s personal crypto pursuits may turn out to be a block on legislative efforts. A bunch of Democratic senators refused to again the so-called Genius Act to control stablecoins except it included steps to ban elected officers and their households — together with the president — from proudly owning or taking part in stablecoin ventures. However they joined Republicans this month in permitting the invoice to advance, arguing that the necessity for clear guidelines took precedence.

The invoice does set worthwhile guidelines together with requiring US stablecoin issuers to take care of reserves equal to 100 per cent of excellent cash in {dollars}, US Treasuries or equivalents, and set out clear redemption procedures. However some senior Democrats have warned it has inadequate client protections and would nonetheless allow US exchanges to commerce offshore-issued stablecoins corresponding to Tether, which they are saying has a file of getting used to facilitate prison exercise (Tether itself has denied any wrongdoing). Stablecoins exist in a gray world by which they act like banks, fee methods and securities, but might be regulated as none of these. The Genius Act provides a really light-touch framework.

Digital asset proponents argue they might pace up funds and enhance monetary inclusivity. However these advantages could possibly be extra safely harnessed by means of central financial institution digital currencies. Trump vigorously opposes a US CBDC, insisting as a substitute that personal stablecoins will “broaden the dominance of the US greenback”. Until they’re extraordinarily rigorously policed, they could solely do the other.