Unlock the Editor’s Digest without spending a dime

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

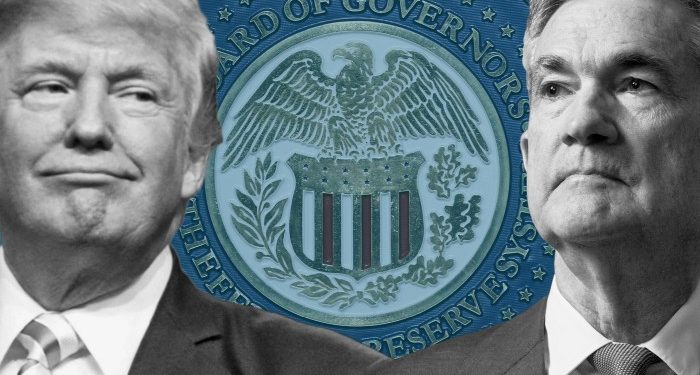

Donald Trump’s tariffs have opened a schism on the Federal Reserve as prime policymakers spar over whether or not to chop rates of interest as quickly as this summer season or maintain them regular for the rest of 2025.

Christopher Waller, a Fed governor seen as a candidate to switch Jay Powell as its subsequent chair, on Friday known as for a fee lower as quickly as subsequent month and performed down the dangers that US president’s levies would push up inflation.

“We’ve been on pause for six months considering that there was going to be a giant tariff shock to inflation. We haven’t seen it,” Waller, who turned a Fed governor in 2020 after Trump nominated him to the publish throughout his first time period, mentioned in a CNBC interview.

“We needs to be basing coverage . . . on the information.”

Waller’s feedback got here simply two days after the Fed kept rates on hold for its fourth assembly in a row in a unanimous resolution, following 1 share level of reductions in 2024.

Trump has sharply criticised the Fed for not slashing charges, with the president this week calling for as a lot as 2.5 share factors of cuts and deriding Powell as an “American shame”.

He additionally mused about whether or not he ought to “appoint myself” to the world’s most influential central financial institution.

A set of projections launched on Wednesday confirmed a widening divide among the many central financial institution’s prime policymakers on whether or not or not they might be capable of lower charges a number of instances this 12 months — or by no means.

Powell, whose time period as Fed chair ends in Could 2026, acknowledged on Wednesday that there was a “fairly wholesome variety of views on the committee”, however famous that there was “sturdy assist” for the choice to maintain rates of interest on maintain for now.

The Fed chair additionally anticipated that variations amongst committee members would “diminish” as soon as extra knowledge on the economy got here in over the approaching months. “With uncertainty as elevated as it’s, nobody holds these fee paths with a variety of conviction,” he mentioned.

There have been nonetheless 10 members anticipating two or extra quarter-point cuts this 12 months, based on Wednesday’s financial projections. However seven now forecast no fee cuts and two predict one lower.

“One notable factor is the variety of Fed officers who assume there needs to be no cuts has grown. There’s clearly a distinction in opinion among the many committee,” mentioned Rick Rieder, BlackRock’s chief funding officer for world mounted earnings, who oversees about $2.4tn in belongings.

The talk on the Fed centres on whether or not to maintain borrowing prices increased due to expectations that Trump’s tariffs will increase costs, or lower charges to offset any softening of financial progress.

Charges at 4.25-4.5 per cent are thought of to be above the so-called impartial degree, which neither accelerates nor slows the financial system.

The Fed’s projections this week confirmed that policymakers total count on a big slowdown in progress this 12 months and a rise in inflation.

However worth will increase from tariffs up to now have remained muted, with the Could studying for shopper worth index inflation final week coming in softer than anticipated, with costs rising 2.4 per cent from the earlier 12 months.

Mary Daly, president of the Federal Reserve Financial institution of San Francisco, mentioned on CNBC on Friday that she had develop into much less involved concerning the impression of tariffs on inflation. She added that whereas she didn’t envision a lower in July, there could be a larger chance within the autumn.

“I don’t assume the considerations [on inflation] are as giant as they have been when the tariffs have been first introduced,” Daly mentioned. “However we can’t wait so lengthy that we overlook that the basics of the financial system are shifting within the path the place an rate of interest adjustment is likely to be mandatory.”

Whereas some officers assume the US jobs market stays stable, others consider the labour market is weakening in some sectors.

Powell on Wednesday warned that the central financial institution’s “obligation is to maintain longer-term inflation expectations properly anchored”. Inflation stays above the Fed’s goal of two per cent.

“In the interim, we’re properly positioned to attend to be taught extra concerning the possible course of the financial system earlier than contemplating any changes to our coverage stance,” he mentioned.

Futures markets sign that traders count on two quarter-point cuts this 12 months, starting in October, based on Bloomberg knowledge.

“I believe Waller was reflecting truthfully on how the Fed is lots nearer to chopping than they’re letting on, they only want some kind of a extra definitive affirmation from the financial system that they should transfer,” mentioned Steven Blitz, chief US economist at TS Lombard.