- Gold trades flat close to $3,369, on observe for a weekly lack of almost 1.90%.

- Trump backs off fast Iran motion, boosting threat sentiment and denting safe-haven demand.

- Fed officers break up on fee outlook; Waller eyes July minimize, Barkin stays cautious.

Gold value trades flat on Friday and is poised to finish the week with an almost 1.90% loss, after US President Donald Trump delayed taking army motion towards Iran, opting as an alternative for a diplomatic resolution. On the time of writing, XAU/USD trades at $3,369, down 0.11%.

Sentiment turned bitter outdoors of geopolitical occasions, associated to “US could revoke waivers for allies with semiconductor crops in China,” as Bloomberg reported. Trump’s resolution on Iran boosted threat urge for food, a headwind for Gold costs.

In the meantime, Israel and Iran continued to trade blows. Reuters reported that an Iranian senior official acknowledged they’re prepared to debate limitations on uranium enrichment. Nonetheless, they mentioned “zero enrichment will undoubtedly be rejected by Tehran, particularly now, beneath Israel’s strikes.”

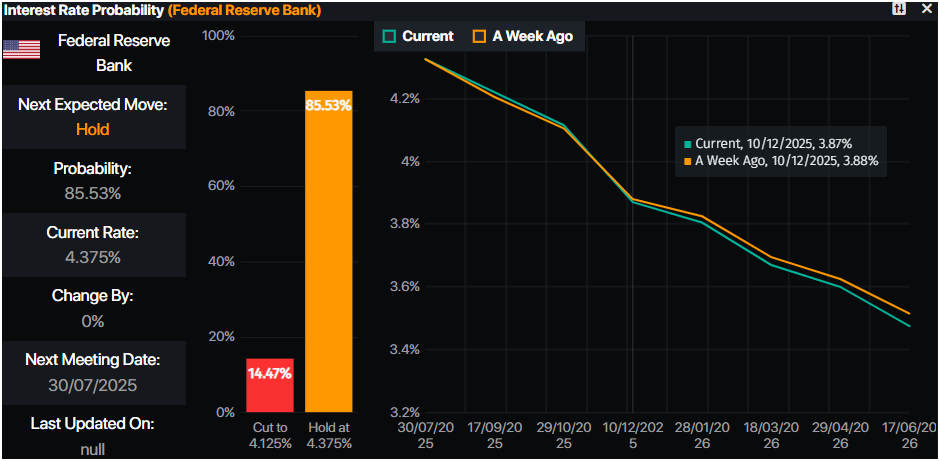

Within the meantime, Federal Reserve (Fed) officers started to cross the wires after the central financial institution determined to carry charges unchanged, adopting a barely hawkish stance. Fed Governor Christopher Waller turned uber dovish, eyeing the primary fee minimize on the July assembly.

In opposition to him, the Fed revealed its Financial Coverage Report, wherein it talked about that coverage “is effectively positioned for what lies forward,” amid geopolitical and tariff uncertainty. Alongside this, Richmond Fed President Thomas Barkin mentioned he’s in no rush to chop charges.

Though Gold has dipped this week, it’s sometimes sought in periods of geopolitical tensions and decrease rates of interest Nonetheless,the Fed’s restrictive tilt could immediate traders to show towards different currencies alongside the US Greenback.

Subsequent week, the US financial docket will characteristic Fed speeches, S&P World Flash PMIs, housing and inflation knowledge, alongside Gross Home Product (GDP) figures.

Every day digest market movers: Gold stays agency, hoovering close to $3,370 on risk-off temper

- The US 10-year Treasury notice yield is flat at 4.391%. US actual yields, that are inversely correlated with Gold costs, are additionally unchanged at 2.081%.

- The US Greenback Index (DXY), which tracks the US Greenback’s worth towards six currencies, is poised to finish the week with a 0.50% acquire, at 98.65.

- Knowledge in the US (US) revealed that the financial system is slowing down, as indicated by the most recent Philadelphia Fed Manufacturing Index in June, which dropped to -4, unchanged from Could however worse than the estimated -1 contraction.

- The Fed’s Financial Coverage Report just lately revealed that there are early indicators that tariffs are contributing to greater inflation. Nonetheless, their full influence has but to be mirrored within the knowledge. The report added that the present coverage is well-positioned and that monetary stability is resilient amid excessive uncertainty.

- Fed Chair Powell commented that the consequences of tariffs will depend upon the extent, including that “Will increase this yr will probably weigh on financial exercise and push up inflation.” Powell mentioned that “So long as we’ve got the form of labor market we’ve got and inflation coming down, the appropriate factor to do is maintain charges.”

- Cash markets recommend that merchants are pricing in 46 foundation factors of easing towards the tip of the yr, in keeping with Prime Market Terminal knowledge.

Supply: Prime Market Terminal

XAU/USD technical outlook: Gold value to stay pressured under $3,400

Gold value uptrend stays intact, however as of writing, it has dipped under $3,375. On its manner down, XAU/USD hit a five-day low of $3,340 earlier than bouncing off these lows as consumers lifted the spot value.

The Relative Energy Index (RSI) is bullish, regardless of turning flat. That mentioned, additional sideways motion is probably going within the close to time period.

For a bullish resumption, XAU/USD should clear $3,400. As soon as hurdled, the next key resistance ranges, such because the $3,450 mark and the file excessive of $3,500, lie forward. In any other case, if Bullion drops under $3,370, the pullback may prolong towards the $3,350 mark and to the 50-day Easy Shifting Common (SMA) at $3,308. Additional losses are seen as soon as cleared, on the April 3 high-turned-support at $3,167.

Threat sentiment FAQs

On the planet of monetary jargon the 2 extensively used phrases “risk-on” and “threat off” consult with the extent of threat that traders are prepared to abdomen in the course of the interval referenced. In a “risk-on” market, traders are optimistic in regards to the future and extra prepared to purchase dangerous property. In a “risk-off” market traders begin to ‘play it secure’ as a result of they’re nervous in regards to the future, and due to this fact purchase much less dangerous property which can be extra sure of bringing a return, even whether it is comparatively modest.

Usually, in periods of “risk-on”, inventory markets will rise, most commodities – besides Gold – may even acquire in worth, since they profit from a optimistic development outlook. The currencies of countries which can be heavy commodity exporters strengthen due to elevated demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – particularly main authorities Bonds – Gold shines, and safe-haven currencies such because the Japanese Yen, Swiss Franc and US Greenback all profit.

The Australian Greenback (AUD), the Canadian Greenback (CAD), the New Zealand Greenback (NZD) and minor FX just like the Ruble (RUB) and the South African Rand (ZAR), all are likely to rise in markets which can be “risk-on”. It’s because the economies of those currencies are closely reliant on commodity exports for development, and commodities are likely to rise in value throughout risk-on durations. It’s because traders foresee better demand for uncooked supplies sooner or later as a result of heightened financial exercise.

The key currencies that are likely to rise in periods of “risk-off” are the US Greenback (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Greenback, as a result of it’s the world’s reserve foreign money, and since in instances of disaster traders purchase US authorities debt, which is seen as secure as a result of the most important financial system on the earth is unlikely to default. The Yen, from elevated demand for Japanese authorities bonds, as a result of a excessive proportion are held by home traders who’re unlikely to dump them – even in a disaster. The Swiss Franc, as a result of strict Swiss banking legal guidelines provide traders enhanced capital safety.