Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

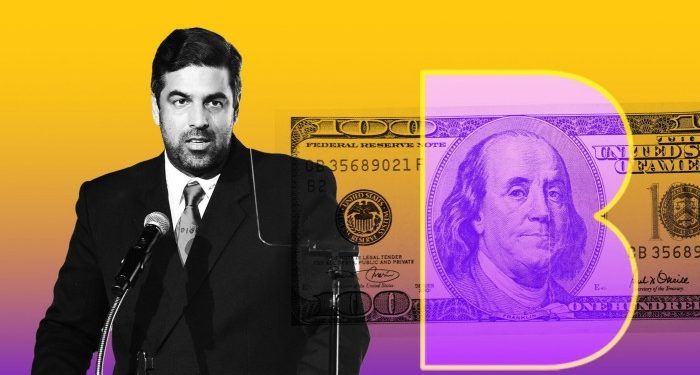

Sachin Dev Duggal, the founder and former chief government of the collapsed Microsoft-backed tech start-up Builder.ai, made no less than $20mn by means of promoting shares within the enterprise.

The self-described “chief wizard” of the software program firm, which raked in additional than $500mn from buyers on its promise to make use of synthetic intelligence to revolutionise app improvement, additionally borrowed towards his stake in Builder.ai, in keeping with a number of individuals acquainted with the matter.

Duggal’s funding agency, SD Squared Ventures, made in extra of $20mn from promoting shares within the enterprise, these acquainted with the matter mentioned, in transactions that started simply earlier than Builder.ai first obtained enterprise capital funding almost seven years in the past.

A lot of the share gross sales had been concluded earlier than 2023, when the corporate raised $250mn in a blockbuster funding spherical led by the Qatar Funding Authority, which secured Builder.ai a valuation of greater than $1bn and made it right into a uncommon UK tech “unicorn”.

The London-based start-up had additionally attracted backing of main buyers together with New York-based Perception Companions and SoftBank’s AI-focused DeepCore unit.

Builder.ai filed for US chapter safety earlier this month after an inner investigation discovered proof of potentially bogus sales and the corporate revised down revenues to only a quarter of prior estimates.

US chapter filings additionally present that SD Squared Ventures was nonetheless the corporate’s largest shareholder on the time of its collapse, with a greater than 15 per cent stake.

Hong Kong-based funding agency Ion Pacific additionally supplied Duggal with funds secured towards his shares by means of a so-called “structured transaction”, which has related traits to debt, in keeping with the individuals.

Ion Pacific had additionally purchased $6mn in shares in Builder.ai from different buyers in late 2022, in keeping with PitchBook.

Ion Pacific describes itself as a “special-situation” investor in enterprise capital. The agency’s web site states that it provides “private liquidity options backed by an fairness stake within the firm” to tech founders.

Michael Joseph, co-chief government of Ion Pacific, mentioned his agency’s funds “by no means had greater than $10mn in publicity” to Builder.ai and had lowered this “considerably” earlier than the corporate collapsed.

The Monetary Instances reported final month that Duggal had sounded out investors on a possible deal to purchase again the corporate he based out of insolvency, in a deal that will require lower than $10mn in preliminary funding.

There isn’t any suggestion that Duggal broke any guidelines by promoting his shares or borrowing towards them. Duggal declined to remark.

Earlier this month the FT reported the a number of methods through which the corporate, beneath Duggal’s tenure as chief government, was suspected of inflating revenues. Alleged practices which have come beneath scrutiny embody improperly booked reductions and seemingly round transactions with key clients.

Duggal’s attorneys mentioned there have been “critical inaccuracies” within the allegations round income inflation the FT had requested touch upon.

Within the weeks earlier than the corporate unravelled, the US Lawyer’s Workplace for the Southern District of New York additionally requested that Builder.ai hand over paperwork regarding its monetary reporting, accounting practices and buyer relationships.