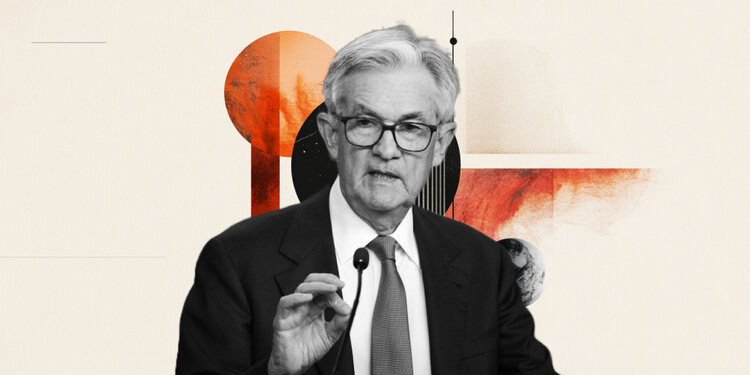

Federal Reserve (Fed) Chair Jerome Powell added additional feedback throughout his testimony earlier than the congressional finances committee on Tuesday, constructing out his case for holding off on fee cuts, probably till someday within the fourth quarter.

Key highlights

When the time is true, count on fee cuts to proceed.

Information suggests a minimum of a few of tariff will hit client.

I feel we’ll begin to see extra tariff inflation beginning in June.

We might be studying as we undergo the summer time.

I am completely open to the concept tariff-inflation cross by might be lower than we expect.

We do not should be in any rush.

If it seems inflation pressures are contained, we are going to get to a spot the place we reduce charges.

I will not level to a specific month.

The Fed simply making an attempt to watch out and cautious with inflation.

It is uncertainty in regards to the measurement and potential persistence of inflation from tariffs.

The financial system is slowing this 12 months. Immigration is one purpose.

Shock absorber from US oil trade is in query now.

The Fed would have a look at the general scenario if oil costs surge.

The greenback goes to be the reserve foreign money for a very long time.

I do not assume MBS runoff has a big influence on housing price.

As soon as we get there, we will react extra strongly to downturns within the financial system.

I feel the Fed is on proper observe in shrinking stability sheet.

The Fed has some shrinking left to do on stability sheet.

Credit score circumstances for small enterprise just a little bit tight.

We’d count on to see significant tariff inflation results in June, July or August.

If we do not see that, that might result in reducing earlier.

Proper now, we’re in watch and wait mode.

General, the inflation image is definitely fairly constructive.