Bitcoin is evolving past its standing as “digital gold”, with the emergence of Layer-2 networks offering the muse for a brand new era of decentralized finance purposes.

Till lately, builders struggled to construct on Bitcoin attributable to its restricted programmability and an absence of correct tooling, however the emergence of recent Layer-2 networks has altered that dynamic. Lately, Bitcoin is quickly increasing and turning into extra subtle and versatile, rising the prospects for a brand new monetary financial system that lives in parallel to the present one primarily based on fiat.

That is exactly the purpose of Maestro, a blockchain infrastructure startup initially centered on Cardano. It has since pivoted to Bitcoin, the place it’s taking part in a pivotal position within the development of recent Bitcoin-based DeFi purposes corresponding to DEX platforms, lending protocols, NFTs, and extra.

“Our platform lowers the barrier to entry so builders can come to those Bitcoin L2s and really rapidly cut back the time to market to half of what it was with out an infrastructure supplier,” Maestor co-founder and Chief Government Marvin Bertin stated in a current podcast. “We’re constructing all of those instruments (for Bitcoin L2 improvement) to assist builders turn into the catalyst for Bitcoin ecosystem development.”

The Renaissance of Bitcoin

Bertin was talking to The Fringe of Present on the current Inscribing Vegas occasion, on the sidelines of the Bitcoin 2025 Convention in Las Vegas earlier this month. There, he mentioned among the newest improvements in areas corresponding to Ordinals and Runes and the way these developments are driving rampant development within the Bitcoin ecosystem.

“Bitcoin goes via a renaissance, the place its ecosystem has grown extra prior to now two years than it has within the final 5 or 10 years,” Bertin stated

In response to Bertin, Maestro was compelled to attend Inscribing Vegas as a result of it’s part of the largest Bitcoin occasion of the 12 months, and he feels that this 12 months’s occasion goes to be much more particular than earlier editions had been, because of the unimaginable tempo of innovation inside its ecosystem.

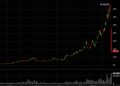

Bitcoin has lengthy been seen because the cornerstone of the crypto trade attributable to its immense worth, with its $2.35 trillion market capitalization outweighing all different cryptocurrencies mixed. Heralded as a “digital gold”, it’s by far the trade’s most sought-after asset, primarily as a result of it’s seen as a retailer of worth and a hedge in opposition to inflation.

However that view is altering as Bitcoin has advanced with the rise of recent ideas corresponding to L2s, Ordinals, and Runes, which reveal its potential to be greater than only a retailer of worth and a fee mechanism. Ordinals is a protocol that permits distinctive digital artefacts to be inscribed onto particular person satoshis and saved on the Bitcoin blockchain, whereas L2s enrich Bitcoin with sensible contract capabilities.

“We’re getting into a brand new chapter for Bitcoin, and there’s actually an entire new power about it,” Bertin stated. “The introduction of Ordinals and Runes modified folks’s minds about what we will do with Bitcoin, and what it means to make use of Bitcoin.”

Amongst those that are contemplating new utility for Bitcoin are among the world’s largest monetary gamers. Bertin cited the growing adoption of crypto amongst monetary establishments, corresponding to hedge funds and banks, in addition to massive companies and even nation states corresponding to El Salvador, which has legalized Bitcoin.

On the identical time, the U.S. authorities is embracing digital belongings in a very large approach, with new pro-crypto legal guidelines and rules being launched beneath the Donald Trump administration. With so many organizations holding Bitcoin on their steadiness sheets and of their treasuries, there’s a variety of curiosity in placing these funds to work, in a lot the identical approach as fiat-based belongings are invested.

“These folks need new instruments and providers,” Bertin defined, declaring that they hardly ever simply sit on their conventional monetary belongings. “They’re asking, how can I earn yield on my Bitcoin, how can I exploit it to lift funds, or take out a mortgage?”

Constructing A New Monetary World

It’s exactly this demand that’s accountable for the wave of Bitcoin-based dApps and providers that reside on Layer-2 networks. They embrace DEX platforms, lending protocols, and so forth, which allow buyers to leverage BTC natively, with out utilizing custodians and blockchain bridges.

“You will have this explosion of creativity, with entrepreneurs who’re pondering that they’ve bought one thing new that they will construct with all of those new primitives,” Bertin stated. “We’re getting into a brand new market shift, and we’re going to see a variety of new merchandise that may hopefully onboard individuals who haven’t touched blockchain earlier than, however now discover that the consumer expertise of the advantages means it’s a very good time to get into this trade.”

🚨Our newest episode is reside!

What does creativity appear like on-chain?

We sat down with @POSTWOOK, @MarvinDefi, @uniqueNFT, @Ape1926, and @SteveMiller_PHX to discover how Bitcoin is powering the following wave of artwork, tradition, and innovation 🎙️

Stream now 👇 pic.twitter.com/IumhXlKDmL

— The Fringe of Present 🎙 (@TheEdgeofShow) July 23, 2025

Whereas Maestro’s infrastructure is primarily geared in the direction of dApp builders, the corporate finds itself in an advantageous place, as that skillset means it’s completely located to cater to institutional shoppers and their wants, too. Given the fast evolution of Bitcoin’s ecosystem, there are only a few others who’re positioned to provide them that sort of help. It’s this thrilling new world that Maestro needs to assist with its intensive infrastructure platform, and it has already made a variety of progress in a really quick house of time, increasing simply as quickly because the Bitcoin ecosystem is doing. In response to Bertin, he’s seeing a variety of curiosity from asset managers and establishments that need assistance to create custom-made monetary options and merchandise that may be optimized for his or her particular threat components and operational necessities.

“We’ve got the experience and we predict we will construct some very highly effective new Bitcoin monetary rails, or the spine for a brand new set of merchandise the place real-world TradFi cash can leverage Bitcoin to create a parallel monetary system,” Bertin stated.

Bitcoin is evolving past its standing as “digital gold”, with the emergence of Layer-2 networks offering the muse for a brand new era of decentralized finance purposes.

Till lately, builders struggled to construct on Bitcoin attributable to its restricted programmability and an absence of correct tooling, however the emergence of recent Layer-2 networks has altered that dynamic. Lately, Bitcoin is quickly increasing and turning into extra subtle and versatile, rising the prospects for a brand new monetary financial system that lives in parallel to the present one primarily based on fiat.

That is exactly the purpose of Maestro, a blockchain infrastructure startup initially centered on Cardano. It has since pivoted to Bitcoin, the place it’s taking part in a pivotal position within the development of recent Bitcoin-based DeFi purposes corresponding to DEX platforms, lending protocols, NFTs, and extra.

“Our platform lowers the barrier to entry so builders can come to those Bitcoin L2s and really rapidly cut back the time to market to half of what it was with out an infrastructure supplier,” Maestor co-founder and Chief Government Marvin Bertin stated in a current podcast. “We’re constructing all of those instruments (for Bitcoin L2 improvement) to assist builders turn into the catalyst for Bitcoin ecosystem development.”

The Renaissance of Bitcoin

Bertin was talking to The Fringe of Present on the current Inscribing Vegas occasion, on the sidelines of the Bitcoin 2025 Convention in Las Vegas earlier this month. There, he mentioned among the newest improvements in areas corresponding to Ordinals and Runes and the way these developments are driving rampant development within the Bitcoin ecosystem.

“Bitcoin goes via a renaissance, the place its ecosystem has grown extra prior to now two years than it has within the final 5 or 10 years,” Bertin stated

In response to Bertin, Maestro was compelled to attend Inscribing Vegas as a result of it’s part of the largest Bitcoin occasion of the 12 months, and he feels that this 12 months’s occasion goes to be much more particular than earlier editions had been, because of the unimaginable tempo of innovation inside its ecosystem.

Bitcoin has lengthy been seen because the cornerstone of the crypto trade attributable to its immense worth, with its $2.35 trillion market capitalization outweighing all different cryptocurrencies mixed. Heralded as a “digital gold”, it’s by far the trade’s most sought-after asset, primarily as a result of it’s seen as a retailer of worth and a hedge in opposition to inflation.

However that view is altering as Bitcoin has advanced with the rise of recent ideas corresponding to L2s, Ordinals, and Runes, which reveal its potential to be greater than only a retailer of worth and a fee mechanism. Ordinals is a protocol that permits distinctive digital artefacts to be inscribed onto particular person satoshis and saved on the Bitcoin blockchain, whereas L2s enrich Bitcoin with sensible contract capabilities.

“We’re getting into a brand new chapter for Bitcoin, and there’s actually an entire new power about it,” Bertin stated. “The introduction of Ordinals and Runes modified folks’s minds about what we will do with Bitcoin, and what it means to make use of Bitcoin.”

Amongst those that are contemplating new utility for Bitcoin are among the world’s largest monetary gamers. Bertin cited the growing adoption of crypto amongst monetary establishments, corresponding to hedge funds and banks, in addition to massive companies and even nation states corresponding to El Salvador, which has legalized Bitcoin.

On the identical time, the U.S. authorities is embracing digital belongings in a very large approach, with new pro-crypto legal guidelines and rules being launched beneath the Donald Trump administration. With so many organizations holding Bitcoin on their steadiness sheets and of their treasuries, there’s a variety of curiosity in placing these funds to work, in a lot the identical approach as fiat-based belongings are invested.

“These folks need new instruments and providers,” Bertin defined, declaring that they hardly ever simply sit on their conventional monetary belongings. “They’re asking, how can I earn yield on my Bitcoin, how can I exploit it to lift funds, or take out a mortgage?”

Constructing A New Monetary World

It’s exactly this demand that’s accountable for the wave of Bitcoin-based dApps and providers that reside on Layer-2 networks. They embrace DEX platforms, lending protocols, and so forth, which allow buyers to leverage BTC natively, with out utilizing custodians and blockchain bridges.

“You will have this explosion of creativity, with entrepreneurs who’re pondering that they’ve bought one thing new that they will construct with all of those new primitives,” Bertin stated. “We’re getting into a brand new market shift, and we’re going to see a variety of new merchandise that may hopefully onboard individuals who haven’t touched blockchain earlier than, however now discover that the consumer expertise of the advantages means it’s a very good time to get into this trade.”

🚨Our newest episode is reside!

What does creativity appear like on-chain?

We sat down with @POSTWOOK, @MarvinDefi, @uniqueNFT, @Ape1926, and @SteveMiller_PHX to discover how Bitcoin is powering the following wave of artwork, tradition, and innovation 🎙️

Stream now 👇 pic.twitter.com/IumhXlKDmL

— The Fringe of Present 🎙 (@TheEdgeofShow) July 23, 2025

Whereas Maestro’s infrastructure is primarily geared in the direction of dApp builders, the corporate finds itself in an advantageous place, as that skillset means it’s completely located to cater to institutional shoppers and their wants, too. Given the fast evolution of Bitcoin’s ecosystem, there are only a few others who’re positioned to provide them that sort of help. It’s this thrilling new world that Maestro needs to assist with its intensive infrastructure platform, and it has already made a variety of progress in a really quick house of time, increasing simply as quickly because the Bitcoin ecosystem is doing. In response to Bertin, he’s seeing a variety of curiosity from asset managers and establishments that need assistance to create custom-made monetary options and merchandise that may be optimized for his or her particular threat components and operational necessities.

“We’ve got the experience and we predict we will construct some very highly effective new Bitcoin monetary rails, or the spine for a brand new set of merchandise the place real-world TradFi cash can leverage Bitcoin to create a parallel monetary system,” Bertin stated.