Now and again, two impartial variables converge in such a profound and terrifying method that it doesn’t simply rewrite the principles; it burns the entire playbook.

That’s the place we’ve arrived with AI.

On one facet is synthetic intelligence itself: a quickly advancing know-how, tearing via duties as soon as thought too complicated, too human, even too sacred to be automated.

On the opposite is the economic system: a fragile machine powered by client earnings and employment – and one that may solely survive a lot disruption earlier than it fractures.

However as AI threatens to upend companies and industries around the globe, disruption is the title of this sport. This tech is already designing advert campaigns, diagnosing sufferers, drafting authorized briefs…

In some instances, it’s doing all of it quicker, cheaper, and higher than the people that got here earlier than it.

And after months of analysis and modeling, I imagine that AI is more likely to eradicate 20- to 30 million American jobs by 2035 – a degree of collapse for the U.S. economic system.

That is shaping as much as be crucial financial story of our time – and it’s unfolding quicker than anybody anticipated…

AI Job Loss Is Accelerating: 30 Million at Threat by 2035

Let’s begin with the brute details.

Information from the Bureau of Labor Statistics reveals that present complete U.S. payroll employment measures ~160 million jobs.

Yearly, automation will get higher, cheaper, and extra broadly deployed. And synthetic intelligence – particularly the most recent wave of agentic, multi-modal, voice-native fashions – is now able to changing each repetitive labor and a rising portion of cognitive white-collar work.

In response to analysis from OpenAI, McKinsey, Goldman Sachs, and others, the roles most uncovered fall into three classes.

Excessive-Threat (50–100% automatable in 10 years):

- Administrative assist: 8 million jobs → ~6M in danger

- Customer support & name facilities: 4M → ~3.5M in danger

- Quick meals & self-checkout: 5M → ~3M in danger

- Transportation (drivers, dispatch): 4M → ~2M in danger

That’s already ~15 million jobs gone…

Medium-Threat (20–50% automatable):

- Retail, finance, authorized providers, manufacturing, training

→ one other 8- to 12 million plausibly displaced

Low-Threat (onerous to exchange):

- Healthcare, expert trades, building

→ minimal short-term influence and marginal job loss

Complete seemingly jobs displaced by 2035: 20- to 30 million

This isn’t a scare tactic. It’s a rational projection based mostly on financial evaluation, historic precedent, and present know-how trajectories. In reality, it’s already taking place within the type of AI name facilities, self-serve retail, and autonomous automobile pilots. Many firms are actively restructuring or decreasing employees in sure areas because of AI’s capabilities.

And what we’re seeing immediately is only the start…

What Occurs When the U.S. Economic system Loses 20% of Its Jobs?

Now, right here’s the much more chilling half: we ran the numbers to determine what number of job losses the U.S. economic system might endure with out systemic failure. We weren’t making an attempt to match the AI estimates – we have been simply modeling the place the wheels fall off.

And the reply we arrived at?

Roughly 20- to 25% structural unemployment, or 20- to 30 million individuals.

Any greater than that, and we expect the system enters a demise spiral – not instantly however over the course of months and years as mass client demand collapses, tax revenues shrink, debt balloons, and political instability rises.

In spite of everything, in a capitalist economic system, jobs create earnings. Revenue fuels spending. Spending drives enterprise income. And income helps extra jobs.

Pull 25 million individuals out of that loop, and the flywheel slows. Income fall. Firms contract. Unemployment begets extra unemployment.

Sure, the wealthy will maintain spending. Sure, AI will create new wealth. However right here’s the factor: capital can’t devour like labor can. A billionaire may purchase 5 Teslas. However hundreds of thousands of middle-class People purchase hundreds of thousands of used Toyotas.

In some unspecified time in the future, even the wealthy begin to really feel the chilliness.

Why the Wealthy Win as AI Destroys Center-Class Jobs

And but, because of AI…

Even because the economic system hollows out for most individuals, the highest 10% – and particularly the highest 1% – will most likely expertise a decade of unprecedented wealth acceleration.

Right here’s the breakdown.

Who owns the AI?

- The prime 10% of households personal ~89% of all U.S. shares.

- In addition they personal the startups, information facilities, infrastructure, land – and, more and more, the robots.

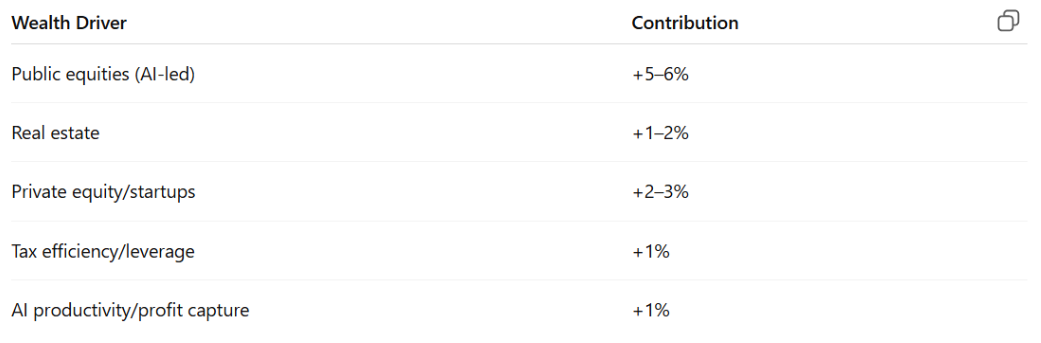

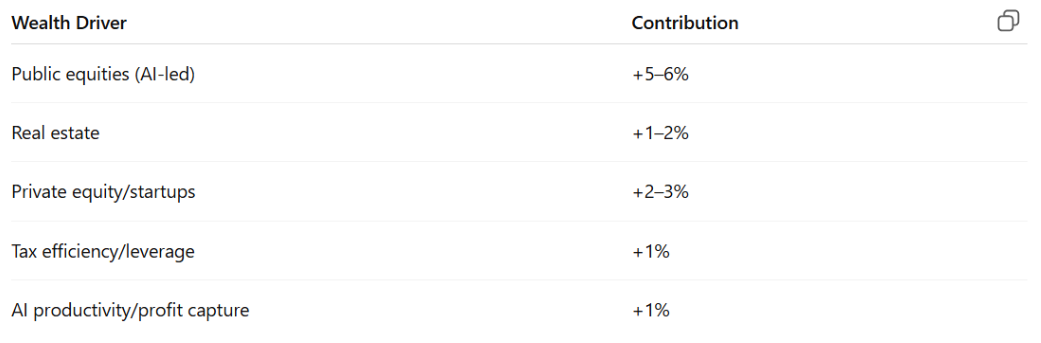

How briskly will their wealth develop?

We modeled a 10% compound annual progress price (CAGR) for the highest 10%, based mostly on:

At present, that cohort contains about $112 trillion in wealth. If their wealth compounds at 10% per 12 months, they’ll be price $292 trillion by 2035.

That’s $180 trillion-plus in new wealth.

In the meantime, the underside 90%? Flat… or worse.

Given pervasive job loss, stagnant working class salaries, misplaced employee leverage because of AI, lack of AI asset possession, and extra, we imagine the underside 90% might even see their wealth shrink by 1% per 12 months over the following 10 years.

That portion of the inhabitants at the moment has a web price of about $48 trillion. If that shrinks by 1% per 12 months, it’ll measure $43 trillion in wealth by 2035.

That’s a lack of $5 trillion… whereas the higher 10% make $180 trillion.

If we thought the wealth hole was unhealthy now, it solely stands to worsen within the Age of AI.

The Wealth Singularity: When Capital Replaces Labor

We’re heading towards what we name a “Wealth Singularity” – a degree the place the wealthy not solely personal a lot of the economic system however the economic system’s future.

Think about:

- Robots, owned by enterprise capital, cooking your meals

- AI, coded by hedge fund-backed groups, doing all of your taxes

- Autonomous vehicles delivering items from warehouses owned by actual property funding trusts (REITs)

- All earnings flowing to traders whereas human labor is more and more eradicated

The previous labor-capital dynamic breaks. Should you don’t personal the capital, you don’t take part. The labor class loses. The capital class wins.

It’ll be the largest switch of wealth ever from the labor class to the capital class.

Now, can the wealthy maintain the economic system operating?

Within the brief time period, sure.

The highest 10% (these making $250,000-plus yearly) account for practically half of all client spending within the U.S., in keeping with Moody’s Analytics.

We count on their AI-fueled wealth growth will assist luxurious demand, asset costs, and a few service industries as they purchase robotic butlers, AI tutors, customized drugs, and digital mansions.

However in the long run…

An economic system with no center class is sort of a rocket with out gasoline. It would maintain rising for a bit on momentum – however ultimately, it stalls, ideas, and crashes.

That’s why ~20- to 25% unemployment is the utmost sustainable threshold. Past that, we’d face:

- Social unrest

- Political instability

- Mass protests

- Riots

- Asset seizures

- And ultimately… main structural reform or collapse

Revenue from the AI Economic system Even Whereas Jobs Disappear

So, what does this imply for you?

It means there’s just one rational response to this brewing macroeconomic superstorm:

You have to spend money on the AI economic system.

And never simply any shares – not “tech” broadly or the previous software program firms pretending to be AI.

You should personal the platforms, infrastructure, and picks and shovels behind the AI revolution.

These are the businesses that can seize the productiveness good points, personal the mental property, hire out the fashions, present the chips, lease the robots, and maintain compounding – no matter whether or not 30 million jobs vanish or not.

We’re speaking:

- Foundational AI firms: suppose Nvidia (NVDA), AMD (AMD), Broadcom (AVGO), and Marvell (MRVL)

- Utilized AI and robotics corporations: Tesla (TSLA), Palantir (PLTR), UiPath (PATH), and Symbotic (SYM)

- AI infrastructure performs: Arista Networks (ANET), MP Supplies (MP), Constellation (CEG), Cisco (CSCO), Oracle (ORCL), and extra

These firms are more likely to be the one ones compounding actual earnings whereas the remainder of the market flails.

Right here’s Tips on how to Make investments as AI Reshapes Capitalism

Proper now, we’re staring into the mouth of a metamorphosis in contrast to something capitalism has seen.

We are able to’t cease the approaching storm. However we are able to construct portfolios that survive it.

Over at TradeSmith, CEO Keith Kaplan simply unveiled what he believes is the corporate’s largest monetary breakthrough in 20 years…

A brand new option to doubtlessly double your cash, by foreseeing the largest jumps on 5,000 shares, to the day, with 83% accuracy.

In rigorous backtesting, it turned each $10,000 into $85,700, crushing the S&P 500 by a median of 108%, even through the longest bull market ever… and through the largest selloffs.

Keith calls this “Green Day” investing. And since this technique first went reside in January, you might have doubled your cash six completely different instances with its suggestions.

With AI steering the U.S. economic system towards a Wealth Singularity, this “Inexperienced Day” investing technique might provide help to rewrite your monetary future.

Learn more now – as a result of Keith’s system suggests a rapid-fire money-making alternative might start as quickly as tomorrow, July 30.