Key Notes

- Bitcoin trades at $113,227 on Saturday, August 2, down 5.78% amid a 5-day dropping streak.

- Eric Trump urges merchants to “₿uy the dips!” following an analogous February name throughout market volatility.

- The 20-day transferring common at $117,000 acts as key resistance for Bitcoin worth rebound makes an attempt to realize traction.

As market digests Eric Trump’s bullish “purchase the dip” sign, can BTC worth stage a rebound above the 20-day transferring common at $117,000? The dip comes at a time when political and monetary voices have re-entered the crypto discourse. Eric Trump, Govt Vice President of the Trump Group, posted a renewed bullish call on Saturday, urging merchants to “purchase the dips!!!”, a sentiment he beforehand echoed on February 25 amid related market anxiousness.

At the moment, Ethereum dropped to $1,400 following his publish however rebounded sharply to over $3,900, coinciding with bettering macro situations and renewed institutional demand. Bitcoin worth mirrored that trajectory, rallying to $122,838 in mid-July.

Notably, World Liberty Monetary, a Trump-affiliated DeFi venture, reportedly acquired 77,226 ETH at a median of $3,294, according to Lookonchain data from July 29.

Extra so, Eric Trump lately joined Bitcoin investor Metaplanet’s Board of Advisors in March 2025. The Japanese agency has now dedicated to a $3.7 billion Bitcoin funding by means of most well-liked shares, focusing on 210000 BTC holdings by 2027, according to crypto exchange, Bitget’s latest report.

As BTC worth struggles to defend the $113,000 help at press time, it stays to be seen if US President’s son, Eric Trump’s latest optimistic feedback present the well timed market sentiment increase wanted to avert additional losses as tariff tensions swirl.

BTC Worth Forecast: Will Bitcoin Reclaim $117K or Slide Towards $110K?

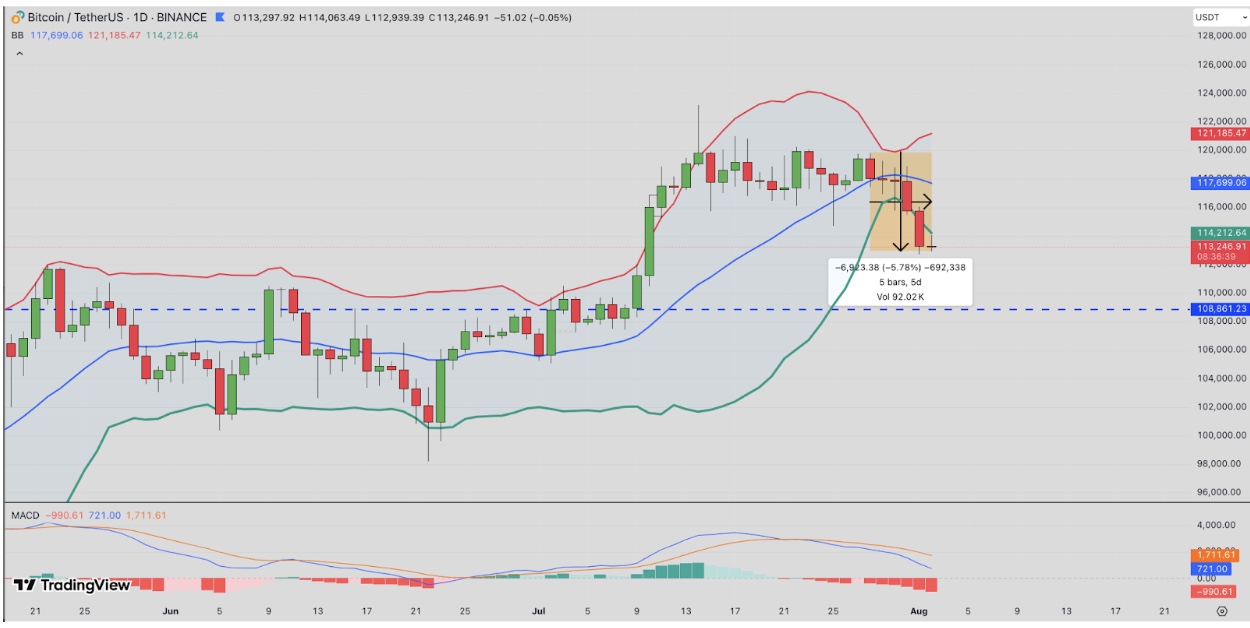

Technically, the outlook stays combined. The latest 5-day decline has introduced Bitcoin nearer to the decrease Bollinger Band close to $112,000, signaling potential oversold situations that might entice dip consumers. Quantity on the pullback stays reasonable, suggesting absence of excessive depth panic-driven sell-offs.

A key resistance degree to watch is the 20-day transferring common at $117,000, which additionally aligns with the Bollinger Band’s midline. Bitcoin worth held on firmly across the help degree for greater than per week after a parabolic rally in early final month halted on the $122,838 all time excessive on July 14.

A breakout above $117,700 may reignite bullish sentiment and make sure that BTC has shaped a short-term backside at $113,000.

Nonetheless, the MACD paints a extra cautionary image. With the MACD line at –991.82 and nonetheless under the sign line, momentum stays bearish. This implies bulls will want a transparent catalyst, probably a major restoration in market volumes to flip the short-term pattern.

Bitcoin Worth Forecast | Supply: TradingView

On the draw back, if the $113,000 BTC worth help breaks, the following draw back goal lies close to $108,861, a horizontal help degree from early July. A breach under this may probably invite panic promoting, probably forcing a drawdown towards the $105,000 vary.

Eric Trump’s bullish commentary may supply short-term psychological help, particularly if echoed by giant gamers or aligned with optimistic coverage information. However such a bullish projection should align with vital enhance in market volumes for a affirmation.

Within the close to time period, if BTC worth reclaiming of the $117,000 degree can be the clearest sign that bulls are again in management. Till then, Bitcoin worth stays at a crossroads, with $113,000 appearing because the final line of protection towards a deeper correction part.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at present finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.