What’s Leverage and Margin? (MT5 Step-by-Step + Tiny Instance)

Abstract

Leverage allows you to management a big place with a small deposit.

Margin is that deposit — the cash your dealer units apart to maintain your commerce open.

In MT5, realizing your leverage and margin helps you handle threat and keep away from margin calls.

Key Takeaways

Greater leverage = larger trades, but additionally larger threat.

Margin is the cash locked by your dealer once you open a commerce.

In case your losses get too large, a margin name can shut your trades.

MT5 exhibits your margin and free margin reside within the Terminal window.

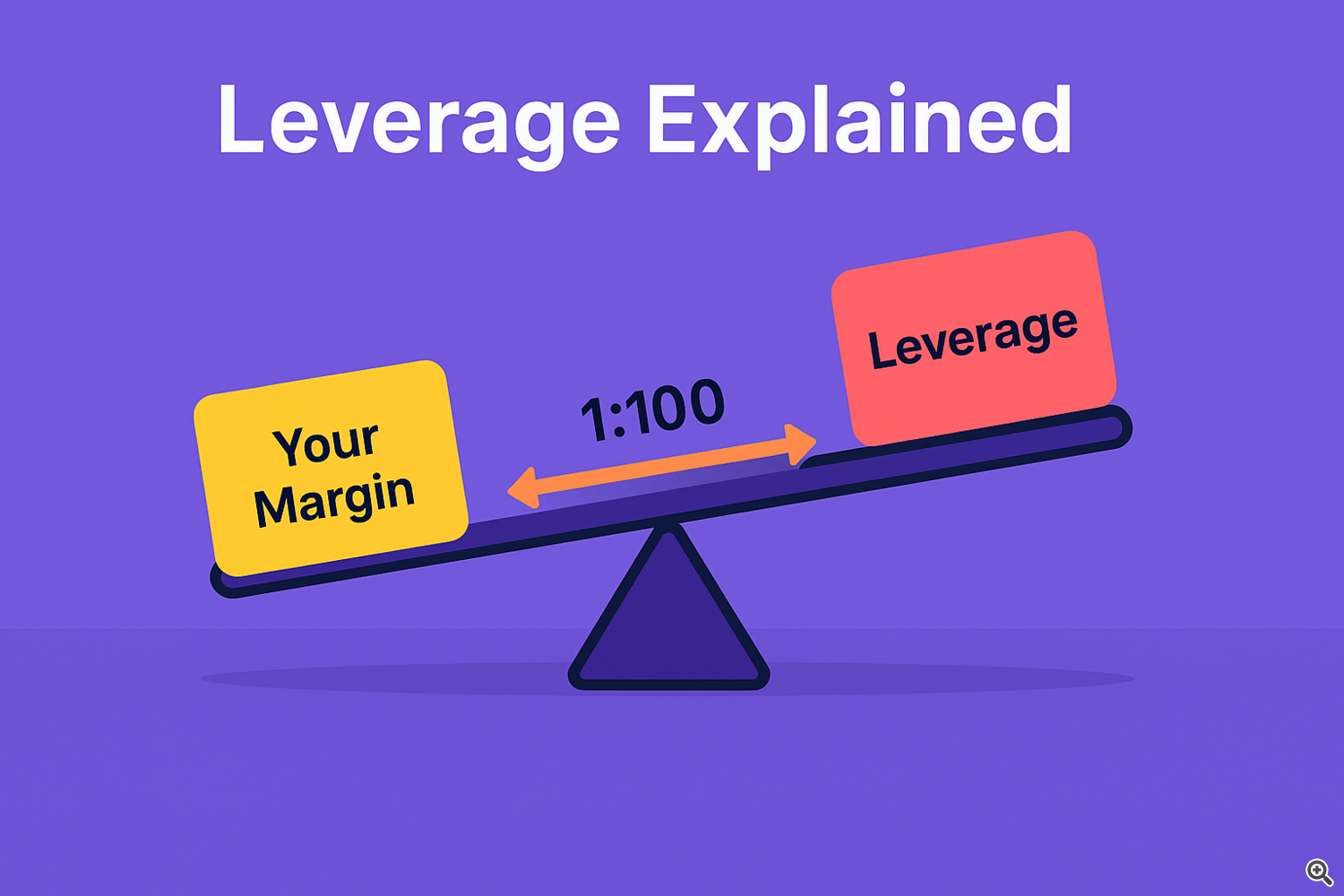

A – The Thought in Easy Phrases

Leverage is sort of a mortgage out of your dealer that permits you to commerce greater than you will have.

If in case you have $100 and leverage 1:100, you’ll be able to management $10,000 out there.

Margin is the a part of your cash that’s locked as a assure for that commerce.

The remainder of your steadiness is known as free margin — cash you’ll be able to nonetheless use for brand new trades or to soak up losses.

An excessive amount of leverage can wipe out your account shortly if the market strikes in opposition to you.

B – MT5 Steps to Test Leverage and Margin

-

Open MT5 and log in to your account.

-

Go to the Terminal window (Ctrl+T).

-

Click on the Commerce tab.

-

Search for:

-

Stability (whole funds)

-

Fairness (Stability ± open commerce earnings/losses)

-

Margin (cash locked for open trades)

-

Free Margin (Fairness – Margin)

-

Margin Degree (% = Fairness ÷ Margin × 100)

-

Your account leverage is ready by your dealer — you’ll be able to verify it in your account particulars.

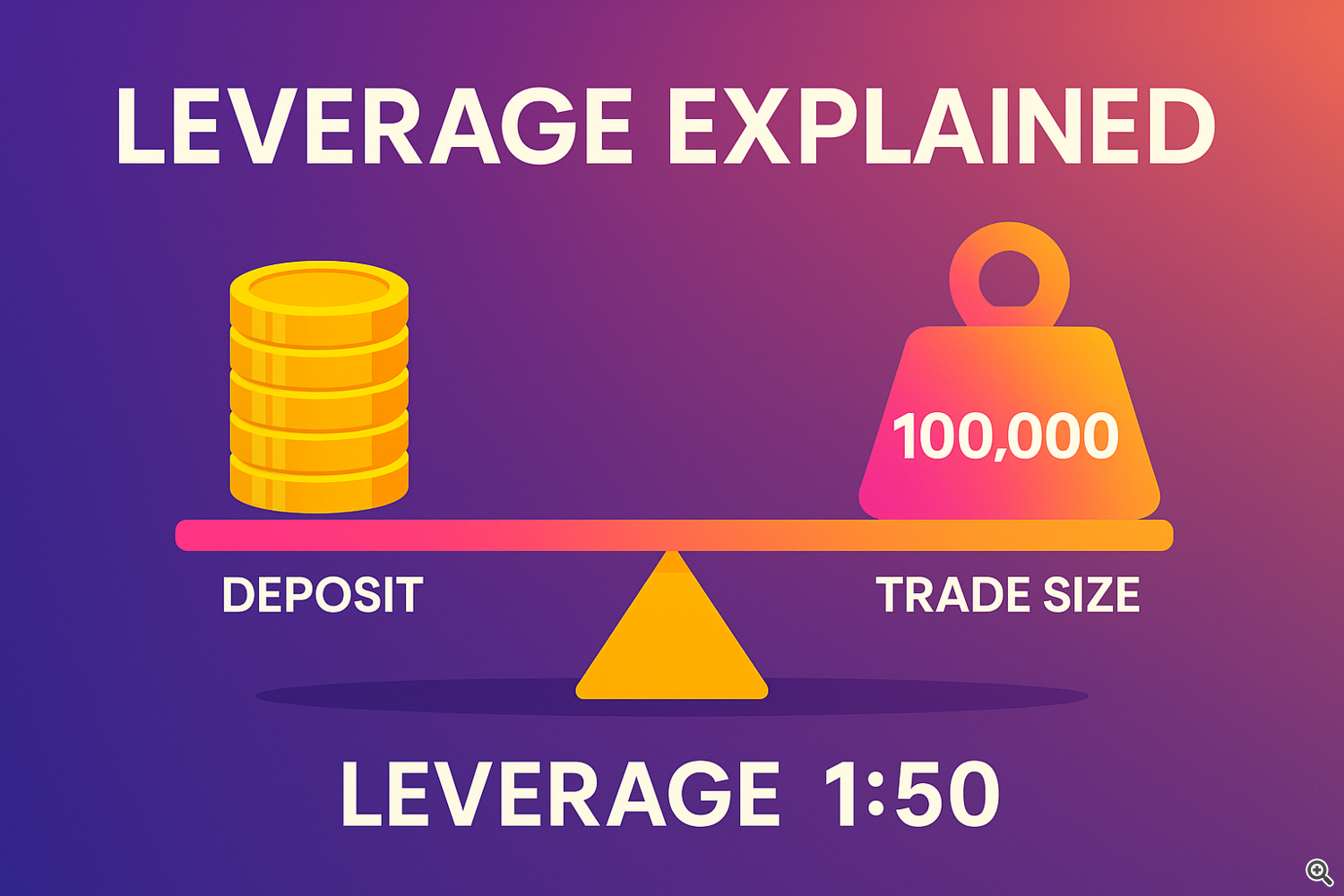

C – Fast Instance with Numbers

You may have:

Required Margin = 100,000 ÷ 100 = 1,000 EUR (~$1,000 USD)

|

Time period |

Worth |

|

Stability |

$1,000 |

|

Place Dimension |

$100,000 |

|

Leverage |

1:100 |

|

Margin |

$1,000 |

Right here, your total steadiness is used as margin — no free margin left for extra trades.

D – Frequent Errors & Fixes

-

Utilizing an excessive amount of leverage → Use smaller lot sizes to scale back threat.

-

Not checking free margin → At all times preserve some free margin to deal with losses.

-

Complicated margin with charges → Margin shouldn’t be a value; it’s a locked deposit.

-

Ignoring margin stage % → If it drops too low, you threat a margin name.

-

Buying and selling a number of pairs with out monitoring margin → Can shortly over-leverage you.

E – If You Use My Instruments (Elective)

A few of my MT5 indicators show margin stage, free margin, and threat per commerce straight in your chart.

Mini-Glossary

-

Leverage: A ratio exhibiting how a lot bigger your trades are in comparison with your capital.

-

Margin: Cash put aside by your dealer once you open a commerce.

-

Free Margin: Fairness minus margin — cash nonetheless obtainable for buying and selling.

-

Margin Degree: Fairness ÷ Margin × 100.

-

Fairness: Your steadiness plus or minus open commerce outcomes.

-

Stability: Complete cash in your account (no open trades).

-

Margin Name: Dealer motion when your margin stage is simply too low.

Guidelines

-

Know your account leverage.

-

Test margin earlier than opening trades.

-

Maintain free margin obtainable.

-

Watch margin stage % to keep away from margin calls.

-

Use smaller positions if threat feels too excessive.

Comply with the trades & updates on MQL5 → https://www.mql5.com/en/channels/issam_kassas