September is often a foul month, however perhaps not this yr… a reside commerce alternative with Jonathan Rose… the newest enormous declare from Elon Musk… look ahead to $7 trillion in money to maneuver again into the market

Going by the information, yesterday’s market selloff is a preview of what to anticipate for the remainder of September…

Or is it?

Based on market historical past, we’ve simply begun the worst month of the yr for inventory efficiency. Right here’s MarketWatch with the gory particulars:

Historical past reveals that the Dow Jones Industrial Common has generated a median month-to-month decline of 1.1% in September and completed larger solely 42.2% of the time courting again to 1897.

September has additionally been the worst month of the yr for the S&P 500 and the tech-heavy Nasdaq Composite, which have averaged month-to-month declines of 1.1% and 0.9%, respectively.

The S&P 500 has completed larger solely 44.9% of the time since 1928, whereas the Nasdaq has registered optimistic month-to-month returns 51.9% of the time courting again to 1971.

However bears shouldn’t pop the cork but…

Historical past additionally tells us that the severity of September weak point eases when shares have trended larger over the summer time and held up throughout August. And this yr, saying shares “held up” is an understatement.

The Dow climbed 3.2% final month – its finest August efficiency since 2020. In the meantime, the Nasdaq and S&P posted respective returns of 1.6% and 1.9%. And rate-sensitive small-caps did the most effective as merchants upped their bets on rate of interest cuts from the Federal Reserve. The Russell 2000 jumped 7%.

So, will September reside as much as its bearish status?

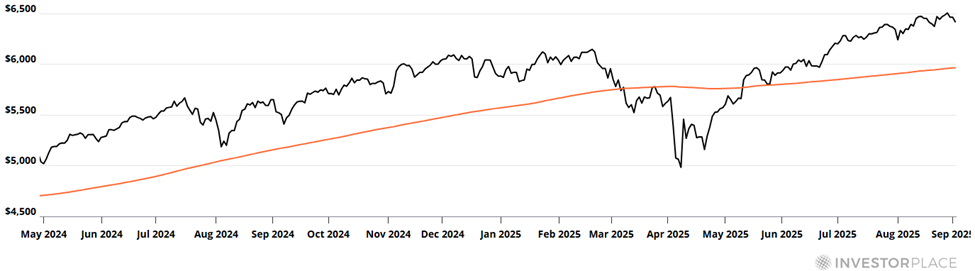

One indicator supplies clues – the S&P’s 200-day shifting common (MA).

Right here’s Adam Turnquist, chief technical strategist at LPL Monetary:

Since 1950, when the S&P 500 is above its 200-day shifting common going into September, the typical worth return for the month jumps to 1.3%, with 60% of occurrences producing optimistic outcomes.

This compares to a median September worth decline of 4.2% and positivity price of solely 15% when the index is under its 200-DMA going into the month.

As you possibly can see under, the S&P presently trades at a wholesome cushion above its 200-day MA.

So, perhaps September won’t be as disastrous as history suggests.

Now, even if it is, that doesn’t mean traders won’t be able to find pockets of strength. And veteran trader Jonathan Rose has a suggestion for you…

An under-the-radar accounting shift is resulting in fast profits

For newer Digest readers, Jonathan is the latest analyst to join our InvestorPlace family.

He earned his stripes at the Chicago Board Options Exchange, going toe-to-toe with some of the world’s most aggressive and successful moneymakers. He’s made more than $10 million over the course of his career, profiting from bull markets, bear markets, and everything in between.

On August 11, we highlighted Jonathan’s work on a little-noticed provision buried in President Trump’s “Big Beautiful Bill.”

While headlines focused on tax brackets and energy credits, the real market-moving detail was tucked in the fine print: a retroactive change to how U.S. companies expense their R&D.

From 2022 through 2024, businesses were forced to amortize their research spending over five years. This dulled the financial benefits of innovation and depressed reported earnings.

But starting in 2025, the rule flipped back – and with it came the ability to go back and expense those prior years immediately.

The accounting shift doesn’t alter revenue or operations, but it does transform how earnings and free cash flow appear on paper. And in markets, appearances can move prices (at least in the short term).

Jonathan flagged a handful of stocks that were in a great position to benefit. Here he is with details on one:

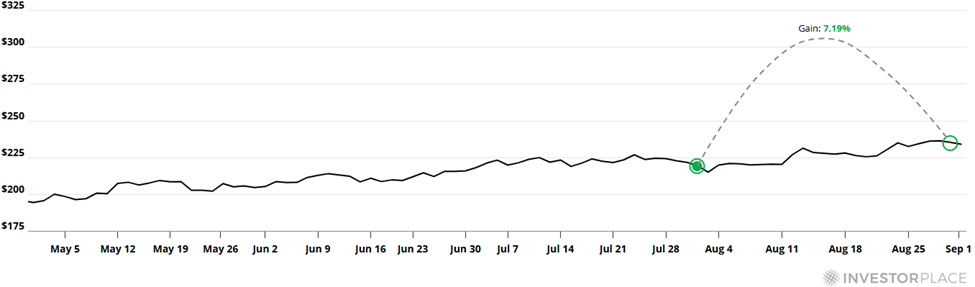

Thirty days before the Street woke up, I wrote an essay to our Masters in Trading community pointing the opportunity stemming from this accounting shift.

Lyft was my top name on the list. We bought in on July 30th when shares were around $13–$14.

By late August, the stock had rallied to $17 — right into its expected move range. That’s when we started locking in some profits.

Since we featured Jonathan’s research on August 11, LYFT has jumped 30%.

If you missed this move, you’re not too late

Jonathan just put on a new bullish LYFT trade last Thursday in his Advanced Notice buying and selling service.

And, yesterday, we realized that Lyft introduced a personal providing of $450 million of convertible senior notes. Jonathan despatched me this fast evaluation:

This transfer screams confidence and strategic place, not misery:

- Elevating low-cost capital in a nonetheless comparatively low-rate atmosphere

- Utilizing monetary instruments to restrict dilution

- Signaling undervaluation by buybacks

- Making ready for progress alternatives like robotaxis and worldwide growth

Put all of it collectively and right here’s Jonathan’s forecast:

The writing is on the wall. By the tip of the yr, I consider Lyft trades comfortably above $20.

Whereas a bounce to $20+ from LYFT’s $17.58 worth (as I write) would imply a buying and selling acquire approaching 15%, for veteran merchants like Jonathan, the actual fireworks come from taking part in such a possible transfer with an possibility.

Although many elements affect an possibility’s worth, a name possibility benefiting from a 15% bounce within the underlying inventory might explode upwards of 200% – 300% over the following months.

Jonathan’s observe report is a testomony to such triple-digit returns. A couple of such examples in Advanced Notice from the previous few months embody:

- ETHA name unfold: +275.33% (lower than a month within the commerce)

- U Name Unfold: +227.03% (a few month and a half within the commerce)

- MP Name Unfold +700.00% (about half a month within the commerce)

If “choices” makes you nervous…

That’s comprehensible. Nevertheless, your nervousness may very well be misinformed – and standing in the way in which of a large increase to your portfolio.

Right here’s Jonathan:

Choices aren’t some Wall Avenue thriller reserved for guys in $5,000 fits.

I get it. You begin studying about straddles, strangles, iron condors, and butterflies, and your eyes glaze over. It appears like studying a international language. So, you retreat again to what’s snug — shopping for and promoting shares.

However right here’s what you’re lacking…

Choices are simply one other solution to commerce your identical opinion on the identical shares you already know.

In the event you’re inquisitive about learn how to use choices properly, Jonathan is likely one of the finest academics on the market. He’s created a curriculum that walks traders by the educational course of – the Masters in Trading Options Challenge.

Right here’s how Jonathan describes it:

You’ve obtained nothing to show. You’ve simply obtained to be prepared to be taught.

And when you see how easy it may be, you’ll by no means have a look at choices the identical method once more.

In any case, contemplate your self tipped off on Lyft.

Is Tesla chucking up the sponge on being a automobile firm?

Yesterday, Elon Musk made considered one of his boldest predictions but…

About 80% of Tesla’s long-term worth will come from Optimus, the humanoid robotic venture he first unveiled 4 years in the past.

That’s a staggering declare for a corporation finest recognized for electrical automobiles. However it underscores a actuality that’s greater than Tesla itself…

Humanoid robots are now not science fiction – they’re already right here.

Listed here are three examples:

- Tesla’s Optimus is folding laundry, stocking cabinets, and even serving popcorn at a brand new Tesla diner in Los Angeles…

- Determine’s humanoids are working in warehouses…

- And Sanctuary’s AI-powered robots are dealing with logistics and instruments…

Now, Musk could also be exaggerating Tesla’s share of the pie. However on the bigger level, he’s proper…

The way forward for financial progress belongs to AI and robots.

For traders, the message is easy. You don’t need to guess the farm on Tesla, however you do want publicity to this megatrend. As a result of identical to electrical energy, the web, and smartphones, humanoids gained’t be non-compulsory – they’ll be all over the place.

For extra on learn how to place your portfolio, Luke lately put out a free research report that dives into Tesla’s Optimus humanoid and a backdoor way to invest (not shopping for Tesla). You possibly can try the full story right here.

Although robots are a long-term progress alternative, for doubtlessly a lot quicker income, legendary investor Louis Navellier says the highlight shifts to President Trump

It is because what Louis calls the “Trump Shock” might ignite a strong, near-term rally simply weeks from right this moment – September 30, to be actual.

As we’ve been profiling within the Digest, roughly $7 trillion in money is sitting on the sidelines, ready for a inexperienced gentle to maneuver again into shares.

Check out this mountain of money…

Supply: Federal Reserve information

As we coated in yesterday’s Digest, with Trump’s tariff agenda now beneath courtroom scrutiny, he has each incentive to push his pro-growth playbook tougher. Which means tax cuts, power growth, onshoring, and infrastructure spending on a scale not seen in a long time.

The parallel to Reagan’s Eighties increase is difficult to overlook…

Again then, daring fiscal coverage drove GDP progress above 7% and despatched the Dow hovering 250%. Louis believes Trump 2.0 might unleash a equally explosive transfer – however extra concentrated.

This gained’t be an index-wide transfer – as an alternative, huge institutional cash will pour right into a select handful of companies with the earnings energy to harness AI and different transformational applied sciences.

Louis has already pinpointed five “buy”-rated names that he expects to steer when Wall Avenue catches on. With September 30 quick approaching, the window to get positioned is closing.

For the complete story from Louis, click here.

We’ll preserve you up to date on all these tales right here within the Digest.

Have a very good night,

Jeff Remsburg