Wall Avenue’s urge for food for firms holding Bitcoin on their stability sheets is cooling, and traders are beginning to present it, in line with the New York Digital Funding Group.

Associated Studying

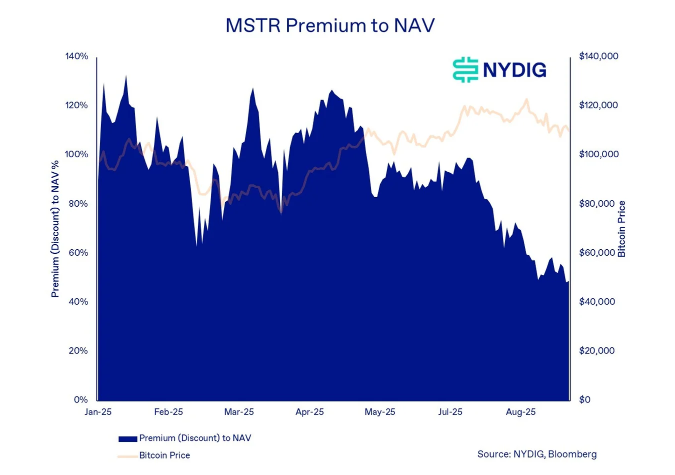

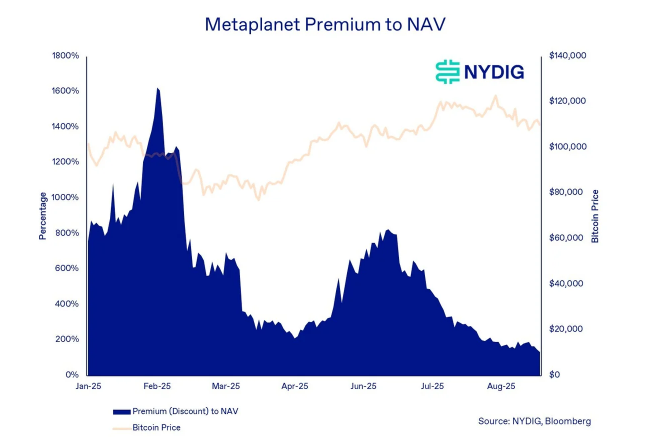

Greg Cipolaro, the agency’s world head of analysis, mentioned the disparity between share costs and internet asset worth (NAV) for main consumers is narrowing at the same time as Bitcoin reached highs earlier this 12 months.

He pointed to several forces pushing these premiums down, from looming provide unlocks to elevated share issuance.

Premiums On The Slide

Investor fear over future token unlocks is weighing on costs. Cipolaro listed different drivers: shifting company goals amongst digital-asset treasuries, recent share gross sales, investor profit-taking, and an absence of clear variations between firms that merely maintain Bitcoin.

Corporations usually used as proxies for Bitcoin good points — names like Metaplanet and Strategy — have seen that hole compress. In plain phrases, shares that after traded at a wholesome premium to the cash they personal are actually a lot nearer to their NAVs.

Shopping for Exercise Slows Sharply

Experiences have disclosed that the mixed holdings of publicly disclosed Bitcoin-buying firms peaked at 840,000 BTC this 12 months.

Technique accounts for a 3rd of that whole, or about 637,000 BTC, whereas the remaining is unfold throughout 30 different entities.

Information exhibits a transparent slowdown in buy measurement. Technique’s common purchase in August fell to 1,200 BTC from a 2025 peak of 14,000 BTC. Different firms purchased 86% lower than their March 2025 excessive of two,400 BTC per transaction.

Month-to-month progress has cooled too: Technique’s month-to-month enhance slid to five% final month from 40% on the finish of 2024, and different companies went from 160% in March to 7% in August.

Share Costs And Fundraising Values Are Coming Below Stress

Various treasury firms are buying and selling at or beneath the costs of latest fundraises. That hole creates danger. If newly issued shares start buying and selling freely and homeowners determine to money out, a wave of promoting may comply with.

Cipolaro warned a tough patch could also be forward and suggested firms to contemplate measures that assist their share value.

Associated Studying

Shares Might Face A Bumpy Trip

One simple transfer steered was inventory buybacks. In line with Cipolaro, crypto targeted firms ought to put aside some capital raised to purchase again shares if wanted. That method can elevate costs by shrinking the variety of excellent shares.

In the meantime, Bitcoin itself has not been proof against swings. Based mostly on CoinMarketCap quotes, BTC was buying and selling round $111,550, down about 7% from a mid-August peak above $124,000.

The value transfer tightens the margin for error for treasury companies: their fortunes are linked to the coin, however their inventory costs can transfer independently and generally extra harshly.

Featured picture from Unsplash, chart from TradingView