If you happen to’re fascinated by investing in venture capital or any non-public fund, it is advisable to perceive these 5 key phrases: MOIC, TVPI, DPI, Loss Ratio, and IRR. With out them, it’s like strolling right into a poker sport with out understanding the principles. And on this sport, the stakes—and potential payouts—are huge.

I’ve been investing in enterprise capital since 2003, sometimes allocating about 10% of my investable capital to the house in the hunt for multi-bagger winners. Since I don’t have a lot of an edge or the time as an angel investor, I’m completely happy to outsource the work to normal companions (GPs) who supposedly do have the sting, for a charge.

My hope is that I’ll choose the correct GPs who will spend their careers attempting to find winners on behalf of me and different restricted companions. In the event that they succeed, everyone wins.

Up to now, I’ve had respectable success. A number of funds have returned over 20% yearly for 10 years, whereas others have solely produced excessive single-digit returns. Fortunately, I haven’t invested in a single fund that’s misplaced me cash but. The identical couldn’t be stated if I have been investing straight in particular person offers, so watch out.

Deciding Whether or not To Make investments In A New Enterprise Capital Classic

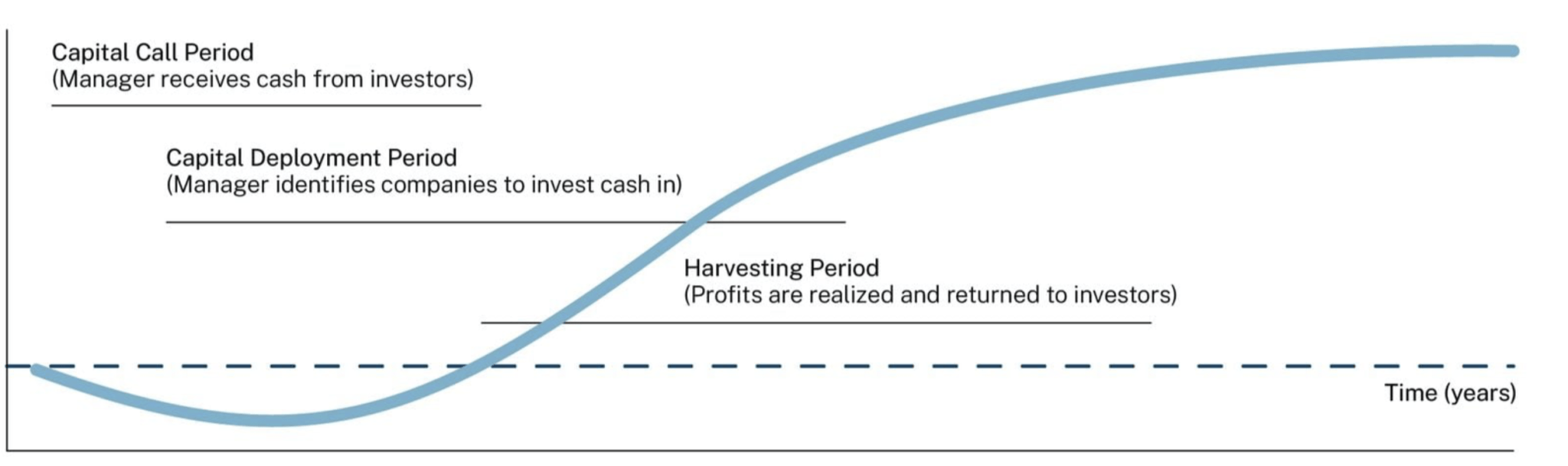

Proper now, I’m debating whether or not to commit $200,000 to a brand new closed-end VC fund that focuses on seed and Collection A corporations. I already dedicated $200,000 to its prior classic a number of years in the past, however to this point the outcomes have been restricted. There’s virtually all the time a loss for the primary few years till the potential earnings come. That is referred to as the “J-curve.“

At this early stage, investing is so much like betting on a promising highschool participant finally making it to the NBA. Roughly 80% of those corporations will go bust. About 10% will change into “zombie corporations” or solely mildly worthwhile—like gamers who find yourself enjoying abroad. That leaves the ultimate 10% to ship outsized returns—ideally 30×—to drive the classic towards a 25% IRR over 5 years.

Let’s break down the 5 key metrics utilizing my hypothetical $200,000 funding so you’ll be able to see precisely how they work.

MOIC — A number of on Invested Capital

MOIC is all the things your funding is value (each the money you’ve gotten again and the businesses you’re nonetheless holding) divided by what you place in.

Instance: I make investments $200,000. Over time, I get $50,000 in money distributions and my remaining holdings are valued at $250,000. That’s $300,000 complete ÷ $200,000 invested = 1.5× MOIC. Not unhealthy, however not life-changing cash.

MOIC says nothing about how lengthy it took to attain it. That is why LPs additionally have a look at IRR (inside price of return). A 3X in 10 years is a 11.6% IRR, however a 3X in 5 years is a 25% IRR. An enormous distinction.

IRR — Inner Fee of Return

IRR is the annualized return you’ve earned in your funding, bearing in mind each the timing and the dimensions of money flows out and in. It’s not nearly how a lot you made, however when you made it.

- A 2× MOIC achieved in three years may imply a 26% IRR.

- That very same 2× MOIC over ten years is barely a couple of 7% IRR.

For funds, IRR is commonly the quantity they brag about as a result of it captures each magnitude and pace of returns — however watch out. IRR may be gamed early on by fast partial returns that make the quantity look flashy, even when the fund’s later exits are mediocre.

TVPI — Complete Worth to Paid-In

For many functions, that is mainly the identical as MOIC. It’s simply the VC method of sounding fancier. Method: (Residual Worth + Distributions) ÷ Paid-In Capital. So identical math, identical outcome — 1.5× in our instance.

DPI — Distributions to Paid-In

DPI is the “cash-on-cash” quantity. How a lot have you ever truly gotten again in actual, spendable cash? In our case: $50,000 ÷ $200,000 = 0.25× DPI. Paper features don’t pay the payments, and DPI is your actuality examine.

Loss Ratio

This one’s a intestine punch: the proportion of your invested capital that’s gone to zero. If $40,000 of my $200,000 is in failed startups, that’s a 20% loss ratio.

Pulling All The Enterprise Capital Funding Definitions Collectively

Seven years in, our $200,000 may seem like this:

- Distributions: $50,000

- Unrealized worth: $250,000

- Losses: $40,000

- MOIC/TVPI = 1.5× ($300,000 / $200,000)

- DPI = 0.25× ($50,000 / $200,000)

- Loss Ratio = 20% ($40,000 / $200,000)

Greatest-Case State of affairs (5× MOIC)

High tier enterprise capital companies return a 5X MOIC over a 10-year interval. Let’s check out what that would seem like.

- $500,000 in distributions + $500,000 in unrealized worth for a complete of $1,000,000

- DPI = 2.5× ($500,000 / $200,000)

- Loss Ratio = 10% ($10,000 / $200,000)

- IRR = 26.23% over 10 years

A 26.23% inside price of return (IRR)—the annualized price at which an funding grows over time—over 10 years is phenomenal, about 16% larger than the S&P 500’s common annual return. Simply nearly as good is that the enterprise capital restricted accomplice stayed invested for the complete decade, partly as a result of they needed to. With public equities, it’s far simpler to panic promote or lock in earnings early, which might derail long-term compounding.

Real looking Worst-Case State of affairs (0.7× MOIC)

Backside tier enterprise capital companies return a 1X MOIC or much less. Here is what a 0.7X MOIC may seem like on a $200,000 funding.

- $50,000 in distributions + $90,000 in unrealized worth ($140,000 / $200,000)

- DPI = 0.25× ($50,000 / $200,000)

- Loss Ratio = 40% ($80,000 / $200,000)

- IRR = –4.24% over 10 years

So regardless that the unhealthy fund “solely” loses ~30% of its worth on paper, the time issue drags the annualized return deep into adverse territory. If the S&P 500 returned 10% a 12 months over the identical 10-year interval, you’d have $519,000 versus simply $140,000. That’s a massive gap, which is why selecting the best enterprise capital funds is crucial.

Betting on a brand-new VC is dangerous because of the lack of a observe document. To offset this, the overall accomplice must both decrease their charges and carry, or seed the portfolio with some early winners to cut back the J-curve interval of losses and enhance the percentages of reaching a powerful MOIC and IRR.

Enterprise Capital Is A Hit-Pushed Enterprise

The fact is most investments fail, a couple of go sideways, and one or two residence runs make the fund. A excessive MOIC with a low DPI means you’re taking a look at “paper riches.” A excessive loss ratio tells you the supervisor is swinging for the fences, however lacking typically. Be certain the ratios align with what you need.

Earlier than writing a examine, all the time:

- Test the observe document — throughout a number of funds and vintages (years), not simply the shiny final one.

- Ask concerning the loss ratio — you’ll shortly see in the event that they’re disciplined or gamblers.

- Discover out the time to liquidity — as a result of a 5× MOIC in 12 months 15 is so much much less thrilling than it sounds.

- Be sincere about your personal danger tolerance — may you watch 90% of your portfolio corporations fail with out dropping sleep?

Understanding MOIC, TVPI, DPI, Loss Ratio, and IRR gained’t magically make you choose the subsequent Sequoia Capital. However it’ll cease you from investing blind. And in enterprise capital, avoiding massive errors is necessary. You do not need to lock up your capital for 10-plus years solely to considerably underperform. The chance value could also be too nice to bear.

Different Selection: Open-Ended Enterprise Capital Funds

If you’d like publicity to enterprise capital with out among the drawbacks, open-ended VC funds are value a tough look. These autos don’t simply provide liquidity, in addition they allow you to see the portfolio earlier than you make investments. That’s type of like sitting down at a Texas Maintain’em desk already understanding your opponents’ playing cards and seeing the flop earlier than it’s revealed.

With that type of visibility, you’ll be able to determine whether or not the businesses are thriving or floundering and place your bets with a real edge. Positive, the flip and river can nonetheless convey surprises, however at the very least investing is not a complete leap of religion like the way in which you’re with conventional closed-end funds. Over time, that information benefit could add up.

Your Age Issues When You Make investments In Enterprise

The older I get, the extra danger there’s in locking up cash for a decade with much less visibility and liquidity. With closed-end VC funds, you often don’t know the way issues are going till 12 months three, on the earliest.

10 years is a very long time to attend for returns and capital again. At 48, I can’t assure I’ll even be alive at 58 to benefit from the features. If an emergency arises within the meantime, I additionally need the choice of tapping some liquidity, which conventional funds merely don’t permit. That’s why you must solely spend money on conventional closed-end funds with cash you’re 100% positive you gained’t want for a decade.

Then there’s the 20%–35% carry charge. I get it. Normal companions earn their hold by discovering high-return corporations. But when there’s an alternate method to spend money on non-public corporations with out coughing up that hefty slice of earnings, why wouldn’t I take it? That is the place platforms like Fundrise Venture shine. It fees a 0% carry charge and solely has a $10 minimal to speculate whereas providing liquidity.

Personally, I’m diversified throughout early-, mid-, and late-stage VC, however my candy spot is Collection A, B, and C. These corporations often have actual traction, recurring income, and product-market match. As a substitute of praying for a 100X moonshot from a seed-stage gamble, I’ll fortunately take “constant” 10–20X winners. At this stage in my life, I needn’t chase too many lottery tickets any extra, just a few for the fun of it.

Flexibility And Visibility Are Enticing Attributes To Investing

Open-ended VC funds offer you one thing uncommon in non-public investing: flexibility and readability. They cut back lock-up danger, eradicate hefty carry charges in some circumstances, and offer you visibility into what you’re truly shopping for. You may additionally be capable of skip the J-curve with an open-ended VC fund.

For youthful traders with many years to attend, conventional closed-end funds makes extra sense. The capital calls over a three-to-five-year interval are nice for constant investing. However for these of us who or older and worth optionality, open-ended funds really feel just like the extra pragmatic alternative.

So there you have got it. Now you understand the principle enterprise capital funding phrases and choices that will help you higher allocate your capital. Keep in mind to remain disciplined as you construct extra wealth for monetary freedom.

Readers, are you a enterprise capital investor? If that’s the case, what share of your investable capital do you allocate to the asset class? With development corporations staying non-public for longer, why don’t extra traders put extra capital into non-public markets to seize that upside?

Subscribe To Monetary Samurai

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and focus on among the most fascinating subjects on this website. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Financial Samurai newsletter. You can even get my posts in your e-mail inbox as quickly as they arrive out by signing up here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every thing is written based mostly on firsthand expertise and experience.