5 ways for constructing actual wealth within the age of AI…

Hiya, Reader.

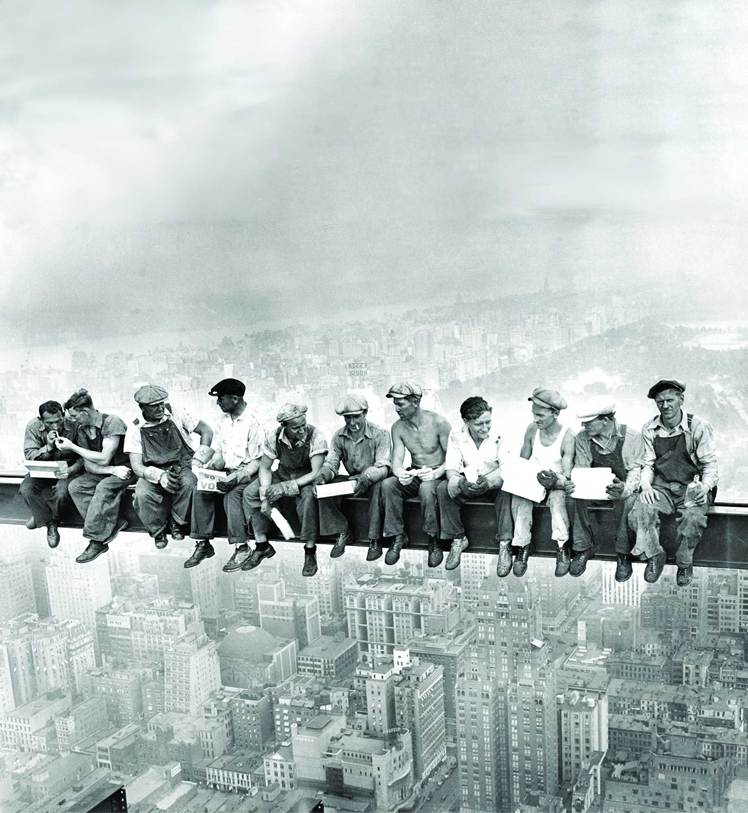

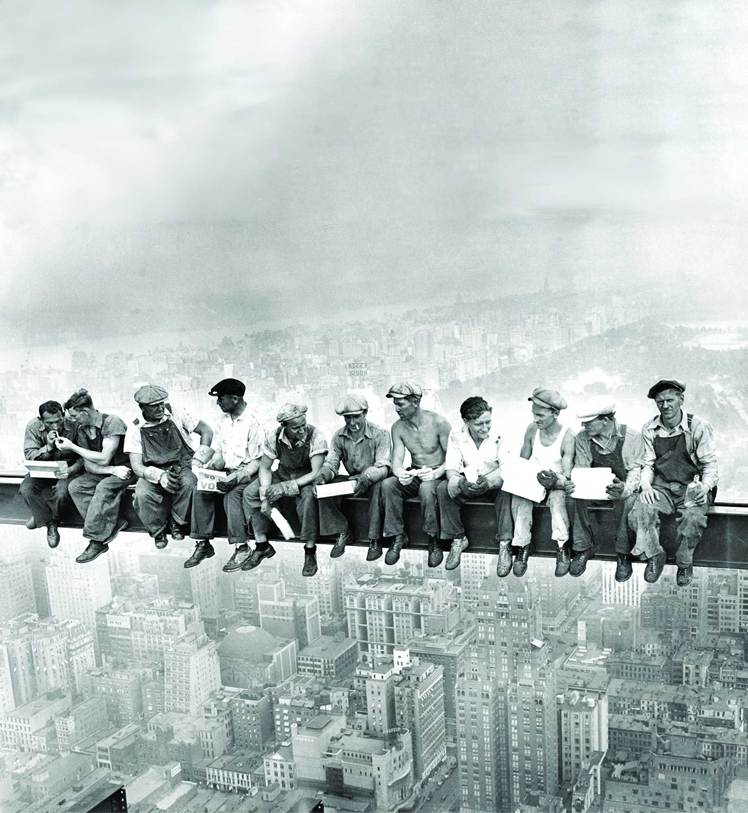

“Lunch Atop a Skyscraper” is among the many most iconic pictures of the 20th century. On September 20, 1932 – precisely 93 years in the past – 11 ironworkers ate their lunch 850 toes within the air, scuffed sneakers dangling, gloved palms opening lunch containers.

This makeshift lunchtime view is now the Prime of the Rock Remark Deck, the first attraction at Rockefeller Middle. It options 360-degree views of the New York skyline.

The enduring {photograph} exhibits only a small personnel who helped assemble the skyscraper, which was commissioned by the eldest son and inheritor of John D. Rockefeller, founding father of the Normal Oil Co. and one of many wealthiest tycoons of the Gilded Age.

Rockefeller’s fortune was estimated at $1.4 billion on the time of his dying in 1937. That giant fortune accounted for 1.5% of all the nation’s wealth, and a whopping 16% of the wealth of “Manhattan Island,” based on the Census Bureau.

In contrast, common family financial savings in 1937 had been lower than $200! Meaning Rockefeller’s fortune was seven million instances better than the everyday financial savings of parents just like the ironworkers who constructed the skyscraper bearing his household’s identify.

The immense wealth divide within the U.S. is as outdated the American oil business itself (and as outdated as metal, railroads, and delivery, for that matter).

However the factor is… it’s rising wider.

Now, because of AI, the monetary chasm between of us is increasing by the day and making a rising roster of recent market aristocrats, together with excessive social and financial imbalances.

So, in immediately’s Good Cash, let’s check out the rise of a brand new “market aristocrat.”

Then, I’ll share 5 particular ways you need to use to hitch them.

Let’s dive in…

The Gilded Age, 2.0

The American financial system of 2025 is each dazzling and disturbing.

In 2025, billionaires have by no means been extra quite a few. There are greater than 3,000 of those world elite.

Take Oracle Corp. (ORCL) founder Larry Ellison.

He first grew to become one in all fewer than 200 billionaires in 1993. He’s now a multi-billionaire, many instances over, as Oracle has change into a dynamic AI play. Ellison even briefly eclipsed Elon Musk because the richest particular person on the earth final week, after the tech firm introduced stellar quarterly earnings.

Just like the “robber barons” of the 20th century, Ellison’s fortune dwarfs that of the typical American.

The chart beneath exhibits Larry Ellison’s inventory wealth, expressed not in {dollars} however as multiples of the median U.S. family’s internet price.

In 2005, Ellison’s fortune was already staggering, amounting to a number of hundred thousand instances that of the everyday American household. However since 2020, the trajectory has turned vertical. At the moment, Ellison is 2 million instances wealthier than the median family.

This comparability doesn’t merely inform the story of 1 multibillionaire. It demonstrates how the “capital class” is flourishing within the age of AI, relative to the “labor class.”

The house owners of mental property, inventory choices, and fairness stakes in know-how corporations are watching their wealth skyrocket, whereas median family internet price is rising modestly, if in any respect, eroded by inflation, housing prices, and debt burdens.

In different phrases, for each Ellison, there are hundreds of thousands of households who discover themselves priced out of housing, squeezed by medical payments, or caught with stagnant wages.

However regardless of this rising wealth division, we particular person traders should not powerless within the face of those forces.

On the contrary, the best response to immediately’s socioeconomic challenges could also be as outdated as America itself… even surpassing the monolithic monopolies of the Rockefeller period.

And that’s…

The 5 Techniques to Changing into a “New Market Aristocrat”

Self-determination.

A self-determined investor is one who actually evaluates each danger and reward, after which units a long-term course towards wealth creation. That is additionally the type of investor who might finally change into a billionaire, becoming a member of the ranks of the “new market aristocrats.”

Whereas not all will change into billionaires, after all, most billionaires began as self-determined traders who refused to simply accept the established order. Admittedly, AI complicates this journey as a result of it introduces new and scary dangers.

However a sophisticated journey shouldn’t be an unattainable one. If we maintain our eyes on the prize, we will hitch our monetary future to the engines of progress, relatively than being run over by them.

In sensible phrases, self-determination embraces and applies 5 ways…

1. Personal Companies, Not “Tickers” – Self-determined traders insist on shopping for companies with formidable aggressive moats, not “story shares” which might be attempting to dig a moat with a backyard trowel.

2. Respect Each Promise and Peril – The prudent investor should acknowledge each side of AI’s break up persona – like driving innovation… after which hollowing out sure jobs – after which craft their funding technique accordingly. The clever course is neither blind enthusiasm, nor blanket rejection.

3. Suppose in Years, Not Days – The self-determined investor appears previous the noise and insists on an extended timeframe. Wealth shouldn’t be in-built days or perhaps weeks. It’s in-built years, even many years.

4. Diversify With out Diluting – In an AI-driven age, diversification may imply balancing high-growth innovators with stalwarts in vitality, infrastructure, or healthcare.

5. Refuse the Seduction of Fads – The vary of compelling funding alternatives extends far past the present fad of the know-how sector. Self-determined traders can, and may, hunt for alternative in the four AI categories that I’ve identified: Builders, Enablers, Appliers, Survivors.

The contradiction between abundance and anxiousness shouldn’t be a brand new characteristic of the American financial system.

Clearly, we traders can not block the trail of progress, however we will put together for it… a minimum of to some extent. That preparation begins by making use of self-determination.

And it continues by understanding precisely which shares to purchase, which to promote, and when.

That’s the reason, in my free “Sell This, Buy That” broadcast, I share the names of 4 firms to promote earlier than they crater, together with some that may shock you.

These aren’t fly-by-night operations. These are firms which were market darlings for years – and are nonetheless obese in lots of traders’ accounts.

Extra importantly, I additionally share the names of four companies that could multiply your money in the coming months.

As an illustration, whereas everybody is targeted on Nvidia Corp. (NVDA), I’ve recognized a inventory that’s now change into a key provider to AI knowledge facilities in all places.

And whereas traders maintain piling into Amazon.com Inc. (AMZN), I reveal a just about unknown on-line retailer that might be like shopping for Amazon in 2005 — however with a good larger aggressive benefit.

I’m sharing all of this with you immediately, freed from cost. All you need to do is click here to access my special broadcast… and produce alongside your spirit of self-determination.

Good investing!

Regards,

Eric Fry

Editor, Good Cash