Trump firing the pinnacle of the BLS after a poor jobs report was a serious warning signal for the standard of upcoming financial information, however that is not the one downside with non-farm payrolls proper now.

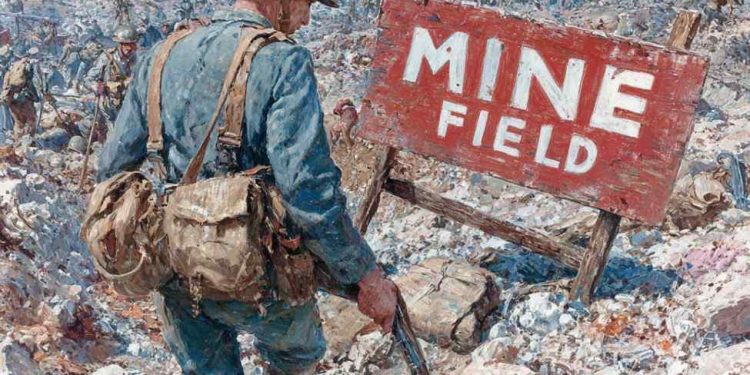

A recent report is arising this upcoming Friday and it is a minefield. The primary downside for merchants is accounting for immigration. There’s a compelling argument that the sharp drop in US immigration together with self-deportation and enforced deportation is having materials impacts on the labor market. It is extraordinarily arduous to mannequin however the Fed’s Barkin this week mentioned he envisions 0-50K month-to-month jobs as a baseline for a secure market. That is in distinction to 100-150K within the post-pandemic period.

There shall be all types of downstream impacts from this however for merchants, I believe the danger is in over-reacting to jobs numbers near zero. On the floor which will look ‘weak’ however unemployment might keep flat. That is why I believe the quantity to doubly concentrate on is unemployment whereas ignoring swings within the non-farm payrolls headline.

As well as, I concern that the Fed might over-react to low headline numbers and reduce charges too low. That is one thing that can plant the seeds of a future inflation shock or asset bubble.