Editor’s be aware: “Say Hi there to the $400 Billion AI Bazooka Aimed on the Market” was beforehand revealed in September 2025. It has since been up to date to incorporate probably the most related data accessible.

The skeptics are out in drive. They’ve bought charts, historic parallels, and breathless warnings about bubbles, overvaluation, and “an excessive amount of too quickly.” They’ve bought a laundry listing of explanation why AI stocks can’t maintain hovering.

I’ve bought one motive why they’re all flawed…

It’s shockingly easy: Most cash within the fashionable economic system goes to AI.

That motive behind this AI delegation is why AI shares have been hovering, and it’s why they’ll maintain hovering.

And once you observe the cash, the path doesn’t simply level to AI – it leads straight to the beating coronary heart of the worldwide economic system itself.

Large Tech Is the World Economic system

Let’s cease pretending in any other case: Large Tech doesn’t simply affect the worldwide financial order – they are the worldwide financial order.

Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Meta (META), Broadcom (AVGO), Taiwan Semiconductor (TSM), Tesla (TSLA) – the valuations alone inform the story.

All are trillion-dollar corporations. If Nvidia and Microsoft had been international locations, they’d rank because the fifth and sixth largest economies on the planet, larger than India, the U.Ok., France, Italy, Brazil, Canada, Russia, and Mexico.

And these are the behemoths which can be going all-in on AI spending.

Not dabbling or cautiously allocating. They’re loading up a monetary superweapon – what I name the AI Bazooka – and firing it nearly completely at increasing AI infrastructure.

The AI Capex Explosion

The numbers are staggering. Let’s begin with Meta.

In 2022, the corporate spent about $32 billion on servers and information facilities. This 12 months, analysts anticipate spending to method $40- to $45 billion, with AI infrastructure being the largest driver.

And it isn’t alone.

Microsoft’s annual capex has practically doubled for the reason that pandemic, topping $50 billion, and steerage suggests it might push increased as AI cloud demand accelerates.

Alphabet has boosted annual capex from roughly $25 billion in 2021 to greater than $50 billion in 2025, with a majority directed at AI compute and information facilities.

Amazon stays the heavyweight: consensus estimates peg AWS-related spending above $70 billion this 12 months.

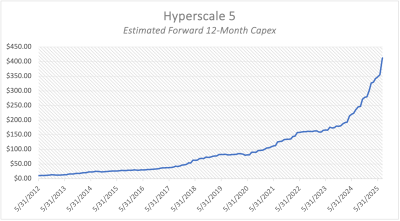

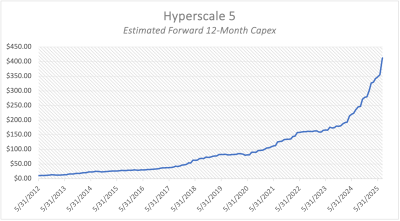

Collectively, the “Hyperscale 5” are projected to exceed $250- to $300 billion in annual AI-related capex – a dramatic leap from beneath $150 billion in 2022.

That signifies that in lower than three years, we’ve seen a 2.5x enhance – and it’s nonetheless accelerating. Simply take a look at that chart above. Like AI inventory costs, it’s going vertical.

What Makes This Totally different From Any Different Spending Cycle

Tech spending cycles are nothing new. However that is completely different in three essential methods:

- The Scale – These corporations aren’t simply huge. They’re the most important profit-generating entities in human historical past. Their capex will increase aren’t measured in percentages. They’re measured in complete GDPs of small international locations.

- The Focus – Practically each incremental greenback goes into AI infrastructure – information facilities, chips, networking, energy, cooling. One sector, full blast.

- The Flywheel – AI infrastructure permits higher AI fashions, which drive extra merchandise, which generate extra income, which funds extra infrastructure. That is compounding development in motion.

That’s why I name it the AI Bazooka. It’s the concentrated firepower of the world’s richest companies, aimed squarely at one goal: AI dominance.

The place the AI Bazooka Cash Lands

All that cash has to discover a residence, and Wall Road has been more than pleased to obtain it. The beneficiaries are unfold throughout your entire AI provide chain.

- Uncooked Supplies: Uncommon earths provider MP Supplies (MP) is up 315% previously 12 months.

- Chips & Foundries: Nvidia up greater than 600% in 5 years; Taiwan Semi has risen about 250% since ChatGPT’s launch in November 2022 and is hitting file revenues (~$30.1 billion).

- Reminiscence & Storage: Micron (MU), Western Digital (WDC), Seagate (STX) are all breaking 52-week highs.

- Semiconductor Gear: ASML (ASML), Lam Analysis (LRCX), Utilized Supplies (AMAT) are promoting the pickaxes on this gold rush.

- Networking & Optics: Astera Labs (ALAB) – up practically 165% since April – Arista (ANET), Marvell (MRVL), Rambus (RMBS) are vital for AI’s high-speed information pipes.

- Energy & Cooling: Vistra (VST), Quanta Providers (PWR), and Eaton (ETN) profit as information facilities pressure grids and cooling demand surges.

That is the blast radius of the AI Bazooka. These shares have been profitable, and as long as the bazooka retains firing, they’ll maintain rising.

Why This AI Spending Growth Gained’t Cease

The massive query: Is that this only a non permanent surge, or a sustained pattern?

Our view: It’s solely simply getting began.

Over $400 billion is anticipated to pour into AI infrastructure within the subsequent 12 months. By 2030, analysts anticipate annual AI-related capex to method $1 trillion. The extra compute energy deployed, the extra indispensable AI turns into. This cycle reinforces itself.

So, when pundits say AI shares can’t maintain going up, they’re ignoring the one greatest capital allocation pattern on the planet.

It’s not simply that Large Tech needs to dominate AI. They have to. The aggressive stakes are existential. The corporate with probably the most compute wins the AI race. That’s why they’re emptying their vaults into chips, information facilities, and energy grids.

Wall Road isn’t dumb. It follows the cash. And proper now, the cash – all the cash – is headed into AI.

The Backside Line on AI Shares

The AI Bazooka is locked, loaded, and firing a whole lot of billions of {dollars} into one of the highly effective technological buildouts in historical past. The winners are clear: AI infrastructure shares, from chipmakers to cooling suppliers, are driving the blast wave.

So long as Large Tech retains spending (and they’re going to), these shares will maintain ripping increased. The skeptics can cling to their valuation charts and bubble metaphors. The remainder of us will observe the cash.

As a result of on this market, the AI Bazooka all the time finds its goal.

But it surely isn’t simply geared toward chips and information facilities…

It’s about to fireplace into humanoid robotics, with Tesla’s Optimus main the cost. Morgan Stanley estimates this market may very well be price trillions. However the greatest windfall received’t come from Tesla; it’ll come from the small, little-known suppliers making the actuators, sensors, and semiconductors that deliver these machines to life.

If you wish to be in entrance of the blast wave – not behind it – now’s the time to see which names are within the crosshairs.

Click here to see my full briefing before the AI Bazooka fires again.