Bitcoin edged increased on Sunday as indicators of easing US-China commerce tensions lifted threat property, whereas Technique’s founder hinted the corporate stored including to its Bitcoin holdings.

Associated Studying

Technique Retains Shopping for

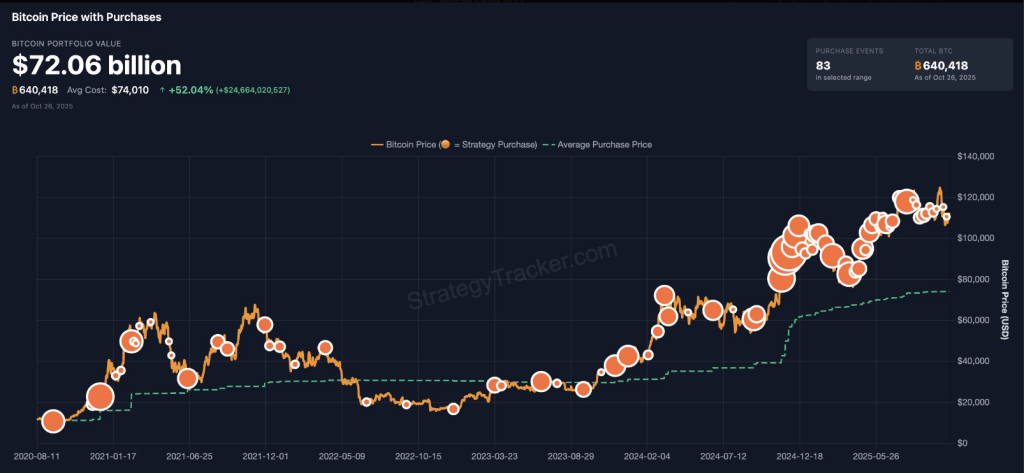

Michael Saylor posted a chart on October 26 that makes use of orange dots to mark current purchases. The visible cue has turn into his shorthand for brand new buys.

Primarily based on experiences, Technique added 387 BTC between October 13 and October 20, bringing its whole to 640,418 BTC. That quantity is putting by itself. It exhibits a gentle, deliberate strategy to purchasing even when costs are risky.

Technique’s disclosed common price for its Bitcoin stands at $74,010. The corporate’s strikes these days have been small in contrast with September, when it took in additional than 7,000 BTC throughout a number of massive transactions. The scale of any contemporary purchases this week has not been publicly revealed.

On the identical time, Bitcoin’s market strikes had been influenced by broader information. The value of Bitcoin rose about 1.6% on Sunday, whereas Ethereum gained roughly 2.8%. Quick-term swings seem pushed extra by headlines than by a single firm’s actions.

It’s Orange Dot Day. pic.twitter.com/5FSGmxwoNS

— Michael Saylor (@saylor) October 26, 2025

Holdings, Valuation And Monitor File

Primarily based on experiences, at costs a little bit over $115,000 per BTC, Technique’s Bitcoin stash is valued at round $72 billion. That valuation implies a paper acquire of greater than $25 billion over a complete price foundation of about $47.4 billion because the program started in 2020.

Experiences have logged 83 separate buy occasions in that point, a sample that has left traders with a transparent view of the agency’s playbook: purchase repeatedly and report afterward.

Among the shopping for was concentrated in September, when the agency added 1000’s of cash in a couple of massive strikes. Lately, nevertheless, allocations have appeared smaller and extra frequent. That shift suggests a desire for regular accumulation somewhat than single large bets.

Shopping for Habits And Market Response

Technique shares have been buying and selling above the corporate’s internet asset worth. That reality suggests traders are snug proudly owning MSTR as a approach to acquire Bitcoin publicity with out shopping for the token immediately. The corporate’s methodology — announce purchases after the very fact and let the market replicate the holdings — has been constant and predictable.

Associated Studying

Geopolitical Headlines Drive Volatility

In the meantime, officers from the US and China signaled progress in trade talks, and that helped calm some traders. In response to experiences, Scott Bessent advised CBS Information he anticipated the specter of 100% tariffs and a direct export management regime to have receded.

Earlier in October, China introduced tighter limits on uncommon earth exports utilized in chip manufacturing. On October 11, US President Donald Trump stated he would impose a further 100% tariff on Chinese language items and deliberate export controls on sure software program to take impact on November 1.

These days of sharp rhetoric brought on heavy losses throughout markets and triggered one of many largest liquidation occasions in crypto this 12 months.

Featured picture from Gemini, chart from TradingView