The nationwide debt simply topped $38T… why inflation is probably going understated… checking in on gold and Bitcoin… enjoying offense and protection with debasement… this morning’s occasion with Louis Navellier and the Swan Brothers

One week in the past at this time, to little fanfare, the U.S. nationwide debt crossed $38 trillion.

To place that determine into context, it’s greater than the financial output of China and the complete Eurozone…mixed.

Now, maybe you’re scratching your head…

“Wait, weren’t we simply speaking about hitting $37 trillion?”

Yep – however that was in August.

We then added one other $1 trillion on the quickest tempo in historical past exterior of the Covid pandemic spendapalooza.

For perspective on this pace, right here’s the non-partisan suppose tank Peter G. Peterson Basis:

Taking a look at current historical past, by decade, the U.S. added $1 trillion to the Debt:

- Each 24 months within the 2000s, on common

- Each 11 months within the 2010s, on common

- Each 5 months within the 2020s,on common

Our newest trillion took simply over two months. No superior math is required to see the place that is headed – the expansion is popping right into a runaway practice.

However the pace of our mounting debt isn’t the one downside. The second subject is the scale of our debt service.

Final yr, our authorities spent $880 billion on web curiosity prices, up a staggering 34% from 2023’s $658 billion (Uncle Sam is desperately hoping for an additional price lower tomorrow).

The widely accepted approach we contextualize debt service is by evaluating it to GDP. The all-time excessive was set in 1991 (3.2%). However the Congressional Price range Workplace (CBO) estimates we’ll take that out this yr, hitting 3.2% of GDP.

Again to the Peter G. Peterson Basis:

[Interest costs] at the moment are the fastest-growing a part of the price range.

We spent $4 trillion on curiosity over the past decade, however will spend $14 trillion within the subsequent ten years.

Curiosity prices crowd out necessary private and non-private investments in our future, harming the financial system for each American.

Extreme debt contributes to destroying the buying energy of your wealth – however how a lot, precisely?

Extreme nationwide debt can set off inflation by rising the cash provide (through bond issuance to pay for the debt), which erodes the forex’s buying energy.

On Wall Avenue, this results in the “debasement commerce,” a technique the place buyers flee depreciating fiat currencies and transfer into arduous belongings like gold and actual property to guard their wealth.

On Primary Avenue, the depreciating fiat forex means their financial savings purchase much less over time. So, they have to pay extra for day by day necessities like groceries and fuel as costs rise.

In yesterday’s Digest, we checked out how inflation has destroyed the greenback’s buying energy in current many years. We additionally famous that we have been inflation charges utilizing the Bureau of Labor Statistics’ present methodology, which could camouflage the true inflation price.

However how, precisely?

By altering the way it has calculated inflation through the years.

In brief, the BLS has rewritten its calculation of the Shopper Worth Index a number of occasions through the years – to not present what issues value however to mannequin how shoppers adapt.

The most important sleight of hand is the “substitution impact.” For instance, if steak costs surge, the CPI now assumes you’ll change to lower-cost hen, so inflation seems milder.

In fact, that’s not how actual life works. If you would like a steak, you need to know what it prices, not be instructed you’ll be superb with hen nuggets.

Then, layer on “hedonic changes” that low cost worth hikes for “higher high quality” (suppose computer systems which have extra RAM at this time than yesterday) and “proprietor’s equal hire” that blunts housing ache, and the official inflation quantity turns into a managed phantasm.

True inflation – the one you and I really feel on the checkout line – runs considerably hotter than Washington tells us.

For instance, ShadowStats, which calculates inflation per the 1990 methodology, finds that the Shopper Worth Index for All City Shoppers is almost 8% at this time.

Because of this we urge buyers to be cautious about remaining in money for too lengthy, and play protection with belongings like gold and Bitcoin, and offense with high-quality shares

Now, gold is at the moment correcting as we predicted it could in our 10/15 Digest:

In case you’re contemplating hopping aboard this rocket ship, you would possibly need to look ahead to a extra engaging entry level.

Gold’s Relative Power Index (RSI) and Shifting Common Convergence/Divergence (MACD) indicators are purple sizzling, suggesting a coming pullback…

Don’t be shocked if gold retreats under $4,000 for a stretch.

Certain sufficient, as I write Tuesday, gold trades at $3,960. Whereas it may go decrease within the quick time period, we proceed to induce buyers to have some gold allocation for wealth preservation.

We’ll dive into gold’s worth motion in a coming Digest, however for now, let’s flip to Bitcoin.

Its efficiency has been underwhelming for months. As I write, it trades at about $115K, the identical stage as early July. However our crypto skilled Luke Lango believes an enormous transfer increased is brewing:

Crypto markets are trying bruised proper now. Bitcoin has pulled again to round [$110,000 as of Luke’s writing] …

However step again, zoom out, and the story is definitely one of many strongest setups for crypto we’ve seen in years.

In actual fact, we’d argue that the 12-month outlook has not often been clearer: the U.S. greenback is structurally weakening, Washington is shifting to bipartisan assist for digital belongings, and stablecoins are on the cusp of explosive mainstream adoption.

I need to cowl extra floor at this time, so I received’t flesh out all of Luke’s factors. However right here’s a fast synopsis:

The greenback is having its worst yr in many years:

Because of this Luke frames Bitcoin as each a “threat asset” and a financial hedge. Sure, it trades with threat sentiment day-to-day, however its long-term correlation is with forex debasement.

Washington is lastly pivoting towards crypto:

Between appointing a “crypto czar” and pushing the GENIUS Act by Congress, the chief department is clearly signaling that it needs digital belongings to develop on U.S. soil.

Stablecoins are rising:

Stablecoin settlement volumes at the moment are rivaling – and in some instances surpassing – Visa and Mastercard networks. U.S. politicians are starting to view stablecoins not as a risk however as a strategic weapon within the international forex race.

Right here’s a important level for skittish crypto buyers…

Don’t attempt to time Bitcoin.

Simply maintain it by its volatility. In case you don’t, you’ll doubtless miss its greatest strikes – with disastrous penalties.

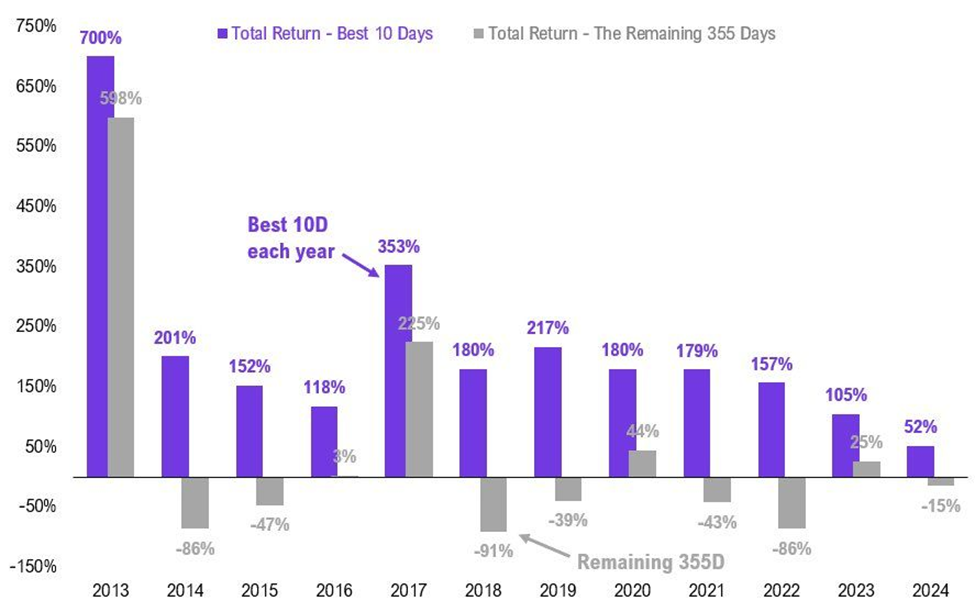

Tom Lee at Altcoin Every day not too long ago made this level, displaying that the majority of Bitcoin’s good points come from simply 10 days annually. And if you happen to miss these 10 days, Bitcoin’s common annual return doesn’t simply drop considerably – it goes damaging.

Supply: Tom Lee / Altcoin Every day

Bitcoin is likely to grind higher as the dollar weakens, with the potential for explosive upside once legislation passes and institutional flows accelerate.

Base case: $200K+ within 12 months.

As to playing offense…

This morning, investing legend Louis Navellier sat down with market experts Andy and Landon Swan to offer an idea – their “Ultimate Stock Strategy.”

Louis has built one of the most respected quantitative track records in modern investing – pinpointing companies with the kind of fundamental strength that fuels life-changing gains. His Stock Grader system has uncovered 676 stocks that could have doubled your money or more, including early signals on giants like Apple, Amazon, Netflix, and Nvidia.

Meanwhile, brothers Andy and Landon Swan of LikeFolio have taken a different but equally powerful approach – using real-time consumer behavior to predict Wall Street’s next big winners.

By analyzing millions of social media posts, web searches, and online mentions, their Social Heat Score identifies when brand enthusiasm surges long before it shows up in earnings reports. This helps them find surging momentum stocks just as their gains begin to snowball.

When the Swans and Louis compared their approaches, they discovered that some of the same stocks were being flagged by both systems. And this elite group of stocks was producing outsized returns.

Backtesting showed that this “Ultimate Stock Strategy” would have identified more than 240 double-your-money opportunities over just five years, averaging gains of 244%.

This morning, Louis, Landon, and Andy went live, revealing exactly how the strategy works, and even gave away two new buy recommendations – one from Louis and one from the Swan brothers.

If you didn’t catch it, just click here now to watch the free replay and see how Louis and the Swans are combining two confirmed techniques into one highly effective method to play “offense.”

Coming full circle…

Once you zoom out, all the pieces we’ve coated in at this time’s Digest connects.

Washington’s runaway spending and a weakening greenback are eroding the true worth of your money – at the same time as official inflation knowledge understate the injury.

Because of this buyers can’t afford to take a seat nonetheless or cover out in money.

And whereas defensive belongings like gold and Bitcoin assist protect buying energy, to actually develop wealth on this atmosphere, you additionally want clever offense – publicity to stocks with both fundamental strength and real-world momentum.

Backside line: In a world the place debt and inflation distort all the pieces, proudly owning the correct belongings isn’t simply good investing, it’s monetary self-defense.

Now, the massive query…

Will our nationwide debt hit $40 trillion by Christmas?

We’ll report again.

Have an excellent night,

Jeff Remsburg