Bitcoin’s 50-week check… Eric Fry’s portfolio strikes for a two-track economic system… the Google-Meta chip deal that rattles Nvidia

As I write on Tuesday morning, Bitcoin has retaken $91,000 after falling beneath $85,000 yesterday.

Whereas it’s up as we speak, even seasoned crypto traders have been shifting nervously of their chairs throughout the latest drawdown.

So, is that this a buyable rebound or a precursor to a steeper fall and an extended crypto winter?

Stepping again, since its early-October excessive of just about $124,000, Bitcoin has been grinding decrease as a number of crosscurrents hit the crypto market without delay. However essentially the most important affect has been deleveraging.

That October excessive didn’t come from hundreds of thousands of various, excited crypto traders pouring recent cash into the market. A lot of it got here from merchants stacking on extra borrowed {dollars} to chase the rally.

However that leverage buildup additionally made the market fragile. So, when Bitcoin lastly began to slide, these extremely leveraged positions have been shortly pressured to unwind, triggering a wave of automated selloffs that accelerated the transfer.

Contemporary issues from yesterday

Macro fears hit onerous. Merchants frightened that Japan would possibly increase charges, threatening the carry commerce – a unfavourable improvement for Bitcoin.

To verify we’re all on the identical web page, with the Japanese carry commerce, traders borrow cash in yen, the place the price of borrowing was just about zero for many years (till just lately, although it’s nonetheless low). Then they put money into higher-returning belongings elsewhere across the globe – principally, the U.S. inventory market, but additionally in different belongings like Bitcoin.

They take their hefty returns, pay again their low cost mortgage in yen, then pocket the distinction.

However when Japanese charges rise, the commerce unwinds. And Bitcoin is likely one of the first belongings that merchants promote when they should liberate capital.

The final time the Japanese carry commerce bumped into hassle was in the summertime/fall of 2024. Throughout that deleveraging, Bitcoin fell from over $66,000 to round $54,000 in only a few days, virtually a 20% drop.

The second drag on Bitcoin from yesterday was a concern that Technique (previously MicroStrategy), which has been an enormous Bitcoin purchaser, could must promote a few of its Bitcoin to cowl dividend and curiosity funds.

Neither concern holds a lot water. Deleveraging occasions occur often, and markets bounce again. In the meantime, in accordance with Benchmark analysis, Bitcoin must crash to $12,700 earlier than Technique confronted funding hassle.

So, we view yesterday’s drop beneath $85,000 as volatility – not structural breakdown.

The larger situation for Bitcoin as we speak

Our crypto skilled Luke Lango flagged Bitcoin’s 50-week shifting common as a key line within the sand again in mid-November.

In keeping with Luke, the most important pink flag for traders is how Bitcoin has fallen beneath its 50-week shifting common, “a degree that, in previous cycles, has typically marked the tip of the social gathering.”

Excluding the COVID anomaly, each significant break-and-close beneath the 50-week shifting common with the slope rolling over has marked the tip of a increase cycle.

As you may see beneath, Bitcoin misplaced its 50-week common in early November and hasn’t been in a position to retake it.

Supply: StockCharts.com

So, is that this a buyable dip or a “get out earlier than it will get worse” second?

The reply is determined by your objectives and holding interval.

For merchants – particularly these utilizing leverage – this isn’t an “all clear” purchase second.

Momentum is clearly bearish (regardless of as we speak’s bounce), macro information is unfavourable, and technicals are weak. Bitcoin might drop decrease from right here.

Right here’s Luke’s take from yesterday’s Early Stage Investor Every day Notes:

The tape proper now in cryptos is ugly. From that perspective, we urge persistence AND warning right here.

We don’t suppose it is a time to be plowing new cash into the dip. It is a time to remain sidelined.

However for longer-term Bitcoin bulls, scaled accumulation (not an all-at-once cannonball) from right here is a brilliant technique. In spite of everything, this pullback is exactly the kind of cooling interval that long-horizon traders sometimes use to their benefit.

Bear in mind – as we speak’s volatility is a short-term story. However the long-term narrative facilities on adoption, which continues to strengthen.

On that word, right here’s JPMorgan:

Crypto is shifting away from resembling a enterprise capital-style ecosystem to a typical tradable macro asset class supported by institutional liquidity somewhat than retail hypothesis…

One speaker famous that it might doubtlessly attain $240k over the long run, thus indicating it as a multi-year development play.

However Bitcoin as a “typical tradable macro asset class” means these early days of multi-thousand-percent returns are seemingly behind us. We’re previous these early “Wild West” years when just a few new whales might push costs up 1,000% in a matter of months.

Now, this doesn’t imply that Bitcoin isn’t engaging. With the world awash in file debt, deficit spending, and fiat debasement, Bitcoin’s function as a storehouse of wealth will solely strengthen as huge institutional {dollars} proceed to pour in. However acknowledge that Bitcoin’s function in your portfolio is evolving.

Let’s return to Luke for his backside line:

The basics are fairly optimistic. That’s the reason we’re holding the road with our crypto picks on the present second.

We expect that is only a very painful correction earlier than a robust rebound…

Watch for Bitcoin to retake its 50-week shifting common. Then strike. Till then, no have to attempt to catch falling knives.

We’ll proceed bringing you Luke’s evaluation.

Now for the economic system: America’s widening two-track actuality

America’s two-track economic system is widening, and portfolios that don’t adapt will endure.

So says our macro funding skilled Eric Fry, of Fry’s Investment Report.

He has been monitoring this for years by his “Technochasm” framework – the increasing wealth hole pushed by expertise, which is now exploding due to AI.

Latest information confirms the break up is accelerating.

Again to Eric:

The Boston Federal Reserve finds that America’s wealthiest 10% now account for about half of all shopper spending – the best on file. Which means the economic system more and more is determined by the procuring habits of a small, asset-rich cohort…

Rising inventory costs are only one instance of the “enjoyable” type of inflation that delights prosperous households. Alternatively, middle- and lower-income households not often benefit from the enjoyable type of inflation, solely the un-fun sort…

In keeping with official figures, nationwide meals prices are about 35% larger than they have been 4 years in the past, which suggests a procuring cart stuffed with groceries that price about $130 in 2021 now prices about $200.

Past grocery payments, many Individuals face rising job insecurity. However Eric factors out that this isn’t like prior intervals of labor market weak point:

What makes this spherical of job losses really feel completely different, and considerably ominous, is the sense that many of those jobs aren’t “coming again later.”

They’re entering into an incinerator.

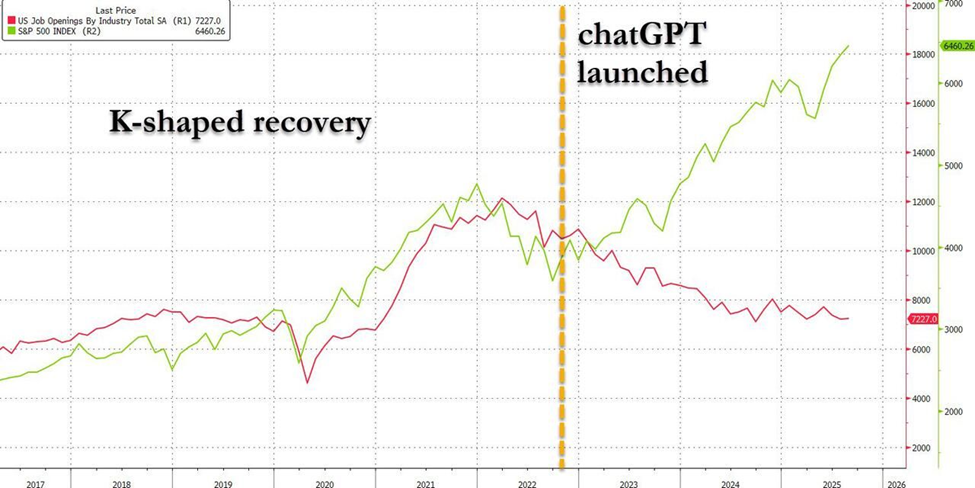

A chart I discovered just lately illustrates this. It’s a fantastic encapsulation of each the Technochasm and the roles “incinerator” that Eric simply highlighted.

Beneath, discover how U.S. Jobs Openings (in pink) and the S&P 500 (in inexperienced) largely monitor each other till 2022, when one thing occurred…

The launch of ChatGPT.

The divergence is unmistakable…

Supply: Zerohedge / Charlies-Henry Monchau

Eric’s portfolio recommendation?

Don’t panic-sell, however reassess allocations:

The cautious investor would possibly wish to loosen up on the businesses with heavy publicity to stretched households. That group would come with industries like mass-market eating places, discretionary retail, subprime credit score, and auto finance.

Trimming positions in high-flying AI stocks may additionally be a prudent plan of action. As a result of many of those shares are “priced for perfection,” even small doses of dangerous information may cause outsized selloffs.

General, Eric recommends a shift towards the sectors and firms that possess defensive qualities or underappreciated development potential, even when the patron fails to seem.

Eric has three concepts for you in a particular presentation he just lately launched, which you can access here. He calls them “under-the-radar, early opportunities that might multiply your cash within the coming months due to their means to adapt.”

Lastly, because the smoke clears, what’s the takeaway from GOOGL’s new TPU chips?

Final week, I highlighted a major improvement: Meta (META) is now in talks with Alphabet (GOOGL) to doubtlessly purchase billions of {dollars}’ price of Alphabet’s TPU chips somewhat than the business commonplace GPU chips produced by companies comparable to Nvidia (NVDA) (disclaimer: I personal GOOGL).

In brief, Google’s TPUs (Tensor Processing Models) may very well be considerably cheaper to function than GPUs. And if that proves true at scale, the consequences are profound for NVDA – and the broader AI ecosystem.

In the meantime, this morning, Nvidia noticed a brand new shot throughout the bow when Amazon unleashed its personal AI chip – the Trainium sequence. It immediately challenges Nvidia’s maintain on AI {hardware}.

I’m going to dig into all this extra tomorrow due to detailed evaluation from Luke (who, past crypto, is our expertise skilled). However for now, listed here are some highlights.

Again to Luke’s Early Stage Investor Every day Notes:

Let’s get one thing clear: Nvidia continues to be promoting the very best AI coaching chips on Earth.

Full cease.

Its development story isn’t damaged … simply the market’s assumption of monopoly-level domination…

These chips don’t kill Nvidia. They merely take slices of the market Nvidia was by no means going to personal perpetually.

Luke goes on to jot down that Nvidia will nonetheless develop income >20% and EBITDA >25% for years. So, whereas its monopoly is perhaps ending, its period of super-growth stays robust and regular.

However this does rattle the AI sector as two distinct camps are starting to emerge. Extra on that tomorrow.

By the way in which, Luke simply launched his newest AI choose – free – in a recent research briefing. You’ll uncover the corporate’s identify, ticker image, why it’s important to the brand new U.S. AI industrial technique, and why it might soar 10X-20X.

We’re more likely to take down the briefing within the subsequent day or so; that is your final name. Just click here for the details.

We’ll preserve you up to date on all these tales right here within the Digest.

Have night,

Jeff Remsburg