There’s lower than one week till Christmas.

Airports are jammed. Procuring carts are full. And most traders are already midway out the door – mentally checked out, able to cease watching each tick and go be with their households.

That’s when markets are inclined to get harmful, people.

As a result of the headlines don’t cease simply because the calendar says “vacation.” And the largest surprises usually land when no one’s paying consideration.

Living proof – the Federal Reserve.

Even after final week’s fee reduce, a number of Fed members are nonetheless sounding uneasy. They’re pointing to lacking inflation knowledge from the federal government shutdown… and so they’re warning inflation could keep above their 2% goal for years.

In the meantime, you could have unscrupulous brief sellers and members of the media who’re making an attempt to throw water on the AI increase, which may be very actual – and in reality, accelerating.

In different phrases, there are a number of Grinches lurking across the market – and inside the Fed – and so they’re threatening to spoil a possible Santa Claus rally for the remainder of us.

That’s why this week’s financial reviews had been so essential: employment, U.S. retail gross sales and the Shopper Value Index (CPI).

As a result of after delays brought on by the federal government shutdown, these reviews ought to lastly shed some gentle on what’s actually occurring.

So, in at this time’s Market 360, I’ll dig into the most recent numbers and break down what they’re actually telling us. I’ll clarify what the Fed now has to confront heading into 2026, why the labor market issues greater than inflation at this level and the way that shift adjustments the place one of the best alternatives are prone to emerge subsequent 12 months. Then, I’ll stroll you thru a revenue alternative constructed particularly for this transition.

Let’s dive in.

What’s Actually Occurring within the Labor Market

The U.S. economic system has been resilient this 12 months, and GDP progress is heating up. The Atlanta Fed at present anticipates 3.6% GDP progress within the third quarter, for instance.

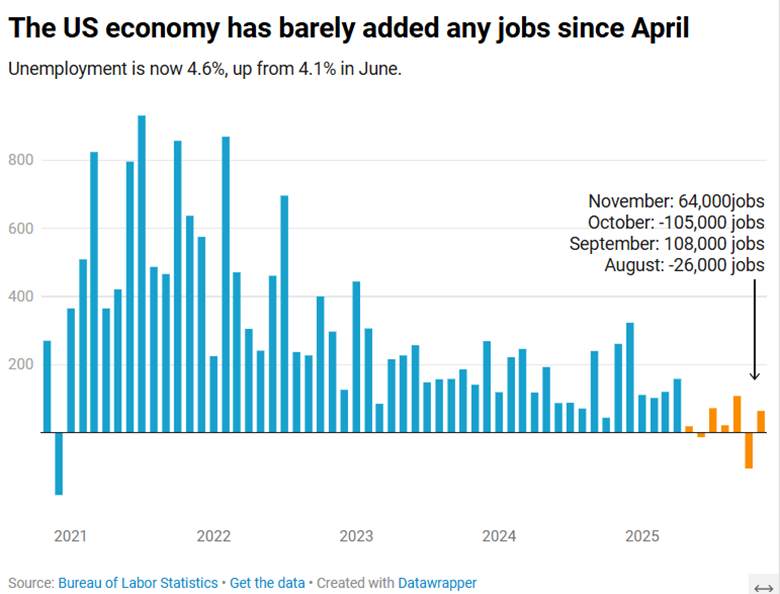

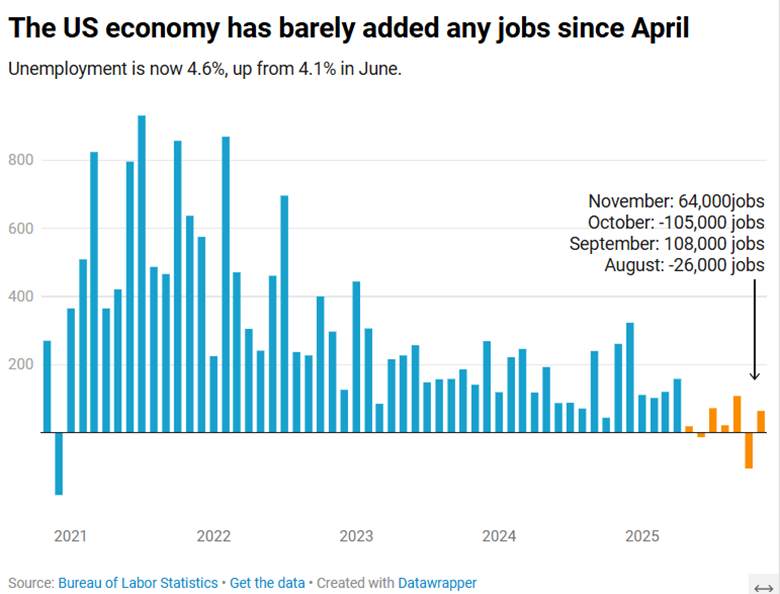

However regardless of the strong financial progress, the U.S. economic system will not be firing on all cylinders. The roles market, particularly, has struggled of late. ADP lately reported that 32,000 personal payroll jobs had been eradicated in November, in contrast with estimates of 10,000 jobs added.

So, because of this people had been desperate to get their fingers on the employment numbers launched on Tuesday.

The Labor Division revealed that 64,000 jobs had been added in November, in comparison with estimates of 45,000 jobs. The delayed October knowledge, although, confirmed that 105,000 jobs had been misplaced that month.

In flip, the unemployment fee rose to 4.6% in November, up from 4.4% in September. The consensus estimate solely anticipated an unemployment fee of 4.5%.

That is the very best unemployment fee reported in 4 years.

As you recognize, the roles knowledge was delayed as a result of shutdown, and lots of didn’t belief the latest numbers, together with Fed Chair Jerome Powell, who prompt there could also be an overstatement within the Labor Division’s numbers.

However the backside line is that there hasn’t been any substantial job progress since April.

The federal government shutdown could have distorted the info. Nevertheless it’s not the entire story. Extra corporations are slowing hiring and trimming headcount as they give attention to effectivity – producing extra with fewer employees. That helps clarify why GDP progress can stay sturdy whilst job creation cools.

Federal Reserve Chair Jerome Powell has acknowledged this risk, noting that it’s nonetheless too early to measure the complete affect of latest applied sciences on employment. On the identical time, he warned of “important draw back dangers” if these traits speed up sooner than anticipated.

For employees, particularly youthful Individuals getting into the job market, this has made circumstances really feel harder. However with a pair extra key rate of interest cuts to assist, this can look much less like a collapsing labor market and extra like one in transition – and I’ll clarify why in a second.

However first, the subsequent query turns into apparent: Are customers really pulling again?

Chopping Again or Splurging?

This brings us to our subsequent report, U.S. retail gross sales, launched Wednesday morning.

For October, retail gross sales had been unchanged from the earlier month. Economists anticipated a 0.1% improve.

A 1.6% decline in gross sales at motorcar and auto components dealerships weighed on the headline quantity, reflecting partially the expiration of federal incentives for electrical automobiles.

However when automobiles and auto components are excluded, retail gross sales rose 0.4% month over month – double economists’ expectations.

Digging additional beneath the hood, spending remained agency in a number of key classes. Furnishings retailer gross sales climbed 2.3%, meals and beverage shops rose 0.3% and clothes and accessories gross sales elevated 0.9%.

On the flip aspect, there was a 0.4% decline in meals companies & consuming locations, suggesting customers have gotten extra selective with discretionary spending.

Taken collectively, this doesn’t seem like a client in retreat. It appears like households are adjusting how – and the place – they spend, whilst job progress cools.

Why Inflation Is Cooling Off

Lastly, we flip to the CPI report. It was a bit difficult to interpret as a result of it coated two months of knowledge as a result of authorities shutdown. Even so, the outcomes got here in notably higher than anticipated.

Headline CPI rose 2.7% on a yearly foundation in November, nicely beneath economists’ expectations for a 3.1% improve. Core CPI, which strips out meals and power costs, rose 2.6% over the earlier 12 months, additionally beneath forecasts.

One part I at all times pay shut consideration to is house owners’ equal hire, or OER. This measures the imputed hire householders would pay in the event that they rented their very own properties.

Now, shelter prices general make up a few third of the CPI. They usually’ve been accountable for a big chunk of inflation readings for a lot of this 12 months.

However I’ve pounded the desk, saying that these numbers would fall and that the Fed must get forward of this.

Properly, people, OER studying has now fallen for 4 straight months.

What Must Occur Subsequent

Some traders proceed to query the CPI knowledge. However the greater subject isn’t whether or not inflation is easing – it clearly is. The true query is what comes subsequent.

The Fed has a twin mandate of taming inflation and maximizing employment. At this level, inflation pressures are cooling, whereas the labor market is displaying clear indicators of pressure.

So, I feel the Fed wants to chop charges two extra instances in 2026, bringing it right down to a “impartial” fee, which ought to assist stabilize the economic system.

However the principle factor I would like you to do is to cheer up and benefit from the experience.

I’m unbelievably bullish for the New Yr.

Sure, unemployment is the very best it’s been in 4 years. Why? As a result of we’re getting extra environment friendly, and people productiveness good points will additional add to GDP progress.

As I discussed earlier than, corporations are actually relying extra on AI. Is that this disruptive? After all it’s, but it surely’s an enormous funding alternative that you just shouldn’t overlook.

It’s what I’m calling the Economic Singularity.

It’s a full-scale reset of how work will get finished – the place software program more and more outperforms people at pace, scale and value. Duties that after took hours are actually accomplished in minutes. Typically seconds. And this shift is already reshaping which corporations will thrive – and which of them will fall behind – in 2026 and past.

That’s why I’ve put collectively a special presentation to stroll you thru precisely the best way to place your self for this transition. In it, I clarify which shares are most susceptible as this shift accelerates – and which corporations are finest positioned to learn as effectivity turns into the dominant aggressive benefit.

If you wish to be on the proper aspect of this modification heading into the New Yr, I encourage you to watch the presentation now.

Sincerely,

Louis Navellier

Editor, Market 360