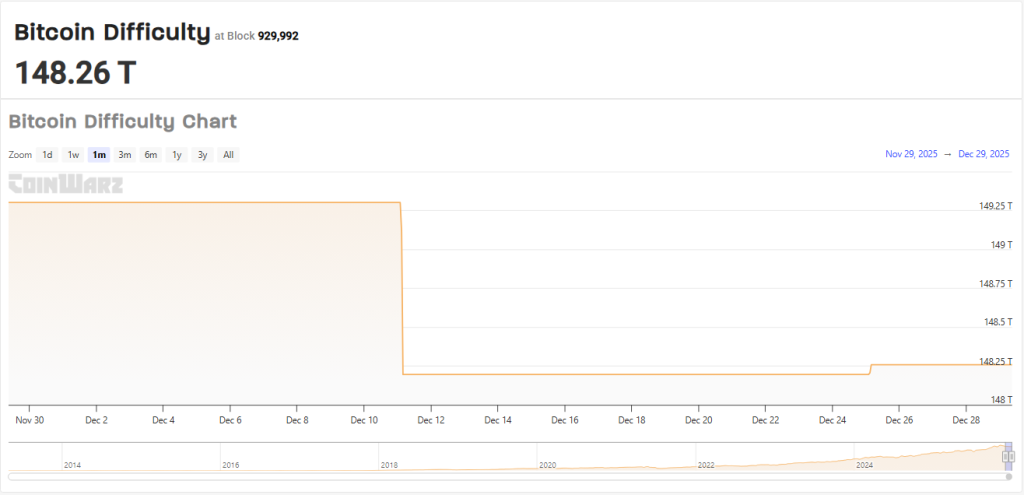

Bitcoin’s community has grow to be barely more durable to mine, with the newest problem rising to a bit of over 148 trillion. Block occasions are presently averaging about 9.95 minutes, a bit of beneath the community’s 10-minute purpose, prompting the adjustment to gradual mining barely.

Projected Issue Rise

Bitcoin adjusts its mining problem each 2016 blocks, roughly each two weeks, to maintain the common block time close to 10 minutes. When blocks are added too shortly, the community raises problem; once they fall behind, it lowers it.

Proper now, miners are including blocks a bit sooner than the goal, which implies the community will enhance the problem to maintain manufacturing regular.

Primarily based on CoinWarz estimates, the following adjustment on January 8, 2026, at block 931,392, is predicted to push the problem to previous 148 trillion.

Source: CoinWarz

Historic Context And Market Strikes

Mining problem has climbed to new highs throughout 2025, with two sharp jumps in September coinciding with Bitcoin’s worth surge earlier within the yr.

Bitcoin hit $125,100 in October earlier than experiencing a big drop. As costs rise, extra mining rigs enter the community, which will increase complete computing energy and prompts difficulty to regulate upward.

Miners’ Prices And Community Safety

Larger problem means miners want extra computing energy and vitality to unravel blocks. This raises prices and might squeeze revenue margins, particularly for smaller operations.

On the similar time, the system protects the community from centralization. If one miner or a gaggle managed an excessive amount of computing energy, they may dominate block manufacturing and even try a 51% assault. By adjusting problem, the community retains mining distributed and safe.

Outlook From The Funding Facet

In line with Bitwise CIO Matt Hougan, Bitcoin could ship regular progress over the following 10 years relatively than huge yearly beneficial properties.

He advised CNBC that he expects “robust returns” with reasonable ups and downs. Hougan additionally maintains that 2026 is prone to be a constructive yr for Bitcoin, reflecting the community’s resilience after latest highs and volatility.

The rise to above 148 trillion will not be dramatic however will barely tighten miners’ margins. Monitoring block occasions, hash price, and problem may give perception into short-term mining profitability.

For traders, problem developments additionally point out the real-world effort securing Bitcoin, which influences provide and potential promoting strain.

The community’s problem changes are routine however very important. They guarantee cash are launched steadily, miners stay challenged, and Bitcoin’s decentralized design is preserved.

Featured picture from Pixabay, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.