The chart under illustrates one of the harmful intervals in fashionable market historical past.

From 2000 to 2009, the S&P 500 primarily went nowhere.

On Wall Road, it turned generally known as “The Misplaced Decade.”

I keep in mind it as a result of I lived by means of it. A lot of you probably did, too.

However right here’s the humorous factor. Due to the way in which our brains are wired, we are inclined to neglect intervals like this.

Those that neglect historical past are prone to repeat it, and an identical hazard is showing on the horizon. So, let’s keep in mind…

After the dot-com bubble burst, there was a chronic interval of market malaise the place primarily nothing occurred.

Through the earlier dot-com increase, firms like Microsoft Corp. (MSFT), Cisco Programs Inc. (CSCO), and Intel Corp. (INTC) turned family names.

However throughout The Misplaced Decade, these shares misplaced buyers’ hard-earned cash.

Cisco by no means regained its prior highs. Intel stagnated for years. Even Microsoft spent a lot of that decade treading water.

In the meantime, issues had been occurring underneath the floor – you simply needed to know the place to look…

- An upstart beverage firm, now generally known as Monster Beverage Corp. (MNST), dominated the vitality drink market and delivered beneficial properties nicely over 1,000%.

- Speedy development in China led to surging demand for copper, and mining firm Freeport-McMoRan Inc. (FCX) soared 1,400% at its peak.

- A bit of-known firm named Google Inc. (GOOG) debuted in the marketplace in 2004. Everyone knows what occurred after that…

These weren’t fortunate exceptions. Market management had quietly shifted.

I name intervals like this Hidden Crashes — and they’re way more harmful than sudden selloffs.

Throughout these stretches, buyers who keep tethered to what labored earlier than usually discover themselves caught in lifeless cash. (Lifeless cash is when capital stays invested however fails to compound meaningfully, the most costly mistake buyers make.)

However buyers who acknowledge the place earnings momentum is accelerating are capable of transfer on and earn money.

Right here’s the factor about crashes. Most buyers keep in mind the violent jolt that occurs when the home of playing cards collapses. What they usually neglect is what comes afterward.

- Years of stagnation.

- False begins.

- And capital caught within the fallacious locations whereas time retains transferring ahead.

My analysis suggests the market could also be organising for the same surroundings a lot prior to most buyers count on.

Let me clarify…

The Hidden Crash Most Buyers Don’t See

You see, people, the danger forming in in the present day’s market just isn’t a standard crash.

There is no such thing as a broad collapse underway. Costs will not be breaking down. Most portfolios nonetheless look intact on the floor.

However my analysis signifies a possible Hidden Crash is heading our approach in 2026. Not a sudden drop in inventory costs, however a slowdown in earnings momentum throughout lots of the largest and most generally held shares available in the market.

Earnings momentum issues as a result of it drives long-term returns. When development is accelerating, shares have a tendency to maneuver greater. When that acceleration begins to fade, the returns flatten out. Over time, portfolios stagnate, making little to no significant progress.

So, why does this matter now? Properly, market management has turn into more and more slender.

A comparatively small group of mega-cap firms carries an outsized affect over portfolio efficiency. As these firms mature, sustaining speedy development turns into harder.

Capital spending rises. Margins come underneath strain. Incremental beneficial properties shrink.

Inventory costs might maintain up for some time. Some might even drift greater. However with out robust earnings acceleration beneath the floor, returns can stall for years… even an entire Misplaced Decade.

We’re already seeing acquainted indicators. Progress is changing into extra concentrated. A small group of mega-cap shares dominates portfolios. Earnings acceleration is starting to gradual in a few of these large names, at the same time as funding spending continues to surge.

And similar to final time, the most important beneficial properties are unlikely to return from the shares everybody already owns.

Let me be clear. I’m not predicting that these firms will collapse. If historical past is any information, a lot of them usually tend to turn into one thing else solely.

Lifeless cash.

Don’t suppose it could occur? I’ve acquired information for you – it already is…

The Hazard Isn’t a Crash – It’s Getting Caught

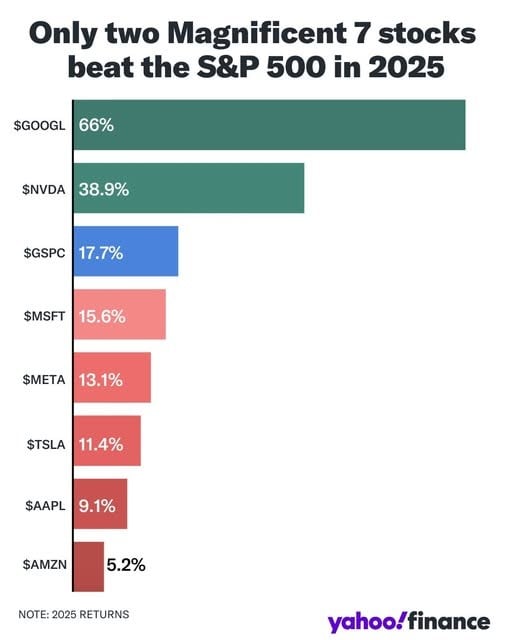

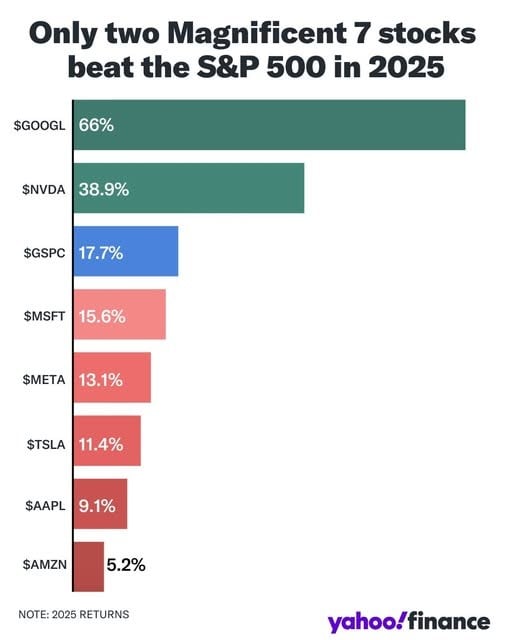

Check out the chart from Yahoo Finance under. It reveals how, after years of robust beneficial properties, all however two of the Magnificent Seven have begun to lag the broader market.

Don’t get me fallacious: The AI Revolution that propelled the Magazine 7 to new highs is actual. The chance isn’t AI — it’s assuming in the present day’s leaders will stay tomorrow’s winners.

Historical past reveals this type of surroundings may be simply as damaging as a pointy decline. From 2000 to 2009, the market didn’t collapse and keep down. It merely went nowhere. Buyers who remained absolutely uncovered to stagnant management misplaced time they might by no means recuperate.

That’s the reason this issues.

A hidden crash doesn’t drive choices. It doesn’t create urgency. It quietly traps capital in shares that look steady, really feel acquainted, and fail to ship.

Recognizing that danger early is the distinction between staying caught and staying in management.

Over time, I’ve realized that navigating intervals like this doesn’t require prediction or panic.

It requires a transparent plan, just like the one I let you know extra about under…

Your Blueprint for the Hidden Crash

In my newest presentation, I’ve laid out what I name the Hidden Crash Blueprint, a easy three-step framework designed to assist buyers keep away from stagnation and keep positioned for alternative as market management shifts.

I stroll by means of why this Hidden Crash is already forming, the precise indicators my analysis is monitoring because it develops, and what buyers can do to arrange – and in addition revenue.

Whereas I can’t present you that full blueprint, right here’s a quick rundown on the way it works.

Step 1: Exit the Hazard Zone

Step one is figuring out which shares in your portfolio are quietly changing into lifeless cash.

These are extensively held firms the place earnings momentum is slowing and future returns have gotten more and more troublesome to attain. They might not collapse, however they will lure capital for years.

Earlier than you may transfer ahead, it’s essential to know the place the danger is. That’s why I’ve put collectively a listing of 20 well-known firms I’ve recognized which can be on the sting.

My system is telling me they’re lifeless cash proper now – and also you don’t wish to be caught holding these shares in 2026.

Step 2: Place for Explosive Progress

As soon as stagnation is eliminated, the main target shifts to the place development is accelerating.

Capital leaving mature, overextended shares doesn’t disappear. It rotates into firms with bettering fundamentals and increasing alternatives. That is the place the subsequent part of market management emerges.

These innovators function on the edges of main financial shifts – just like the AI Revolution. They sit deep inside provide chains. They remedy essential issues that the giants can not effectively deal with themselves.

And in my new Hidden Crash 2026 broadcast, I clarify how I recognized 5 of those firms – and the way they might ship explosive beneficial properties as we enter 2026.

Step 3: Grasp the System

Markets change. Management evolves.

The ultimate step is to make use of a disciplined system to constantly monitor shares, establish new alternatives as they come up, and acknowledge when situations start to weaken.

That’s the place my Inventory Grader system is available in.

It’s primarily based on a framework I’ve relied on for many years to establish shares transitioning from stagnation to acceleration.

And in 2025, we used it to make triple-digit beneficial properties on under-the-radar shares like:

- Sezzle Inc. (SEZL) – 555.57%

- SPX Applied sciences Inc. (SPXC) – 119.77%

- M-tron Industries Inc. (MPTI) – 102.06%

- UFP Applied sciences Inc. (UFPT) – 98.05%

- Powell Industries Inc. (POWL) – 93.76%

- And extra…

I think that 9 out of 10 buyers haven’t heard of those shares. However these are the sorts of under-the-radar alternatives Inventory Grader is designed to floor early.

It’s additionally why I’m sharing a deeper take a look at this Hidden Crash proper now – earlier than it reveals up within the averages and earlier than most buyers understand what’s occurring beneath the floor.

On this presentation, I stroll by means of the precise warning indicators my analysis is monitoring, find out how to establish which shares have gotten lifeless cash – and find out how to discover the hidden innovators that can ship outsized returns whereas most buyers are treading water.

If you wish to perceive the place the true danger is forming – and find out how to keep in management as market management shifts – I encourage you to watch now while this window is still open.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this e-mail, the Editor, immediately or not directly, owns the next securities which can be the topic of the commentary, evaluation, opinions, recommendation, or suggestions in, or that are in any other case talked about in, the essay set forth under:

Cisco Programs Inc. (CSCO), Powell Industries Inc. (POWL) and Sezzle Inc. (SEZL)