For Chinese language firms, the guess is that decrease costs and extra AI options will persuade folks to put on good glasses all day, recording their lives via fixed video and audio. In case you decrease the worth to round $200, “folks will begin to use them day by day,” says Brian Chen, normal supervisor of Appotronics’ innovation middle. That shift would elevate apparent privateness and safety issues that each Rokid and Appotronics have acknowledged, however they see the potential payoff as well worth the threat.

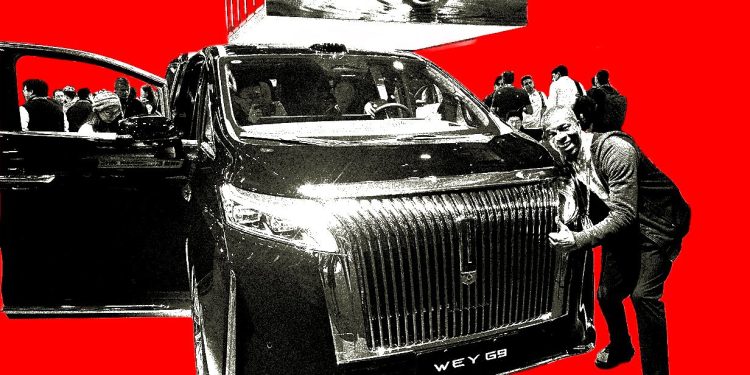

From Vacuums to Automobiles

A number of main Chinese language electrical automobile firms, together with Geely and Nice Wall Motor, introduced their vehicles to CES, however what stole the present have been two manufacturers that nearly nobody had heard of earlier than. Nebula Subsequent and Kosmera each confirmed off modern, luxurious electrical sports activities automotive prototypes, neither of which can be found available on the market but. Each manufacturers have connections to Dreame, a number one Chinese language robotic vacuum firm, however they declare to function independently from it. At CES, nevertheless, the Nebula Subsequent and Kosmera cubicles have been tied to Dreame within the convention’s listing.

Placing apart this difficult company relationship, the concept of a robotic vacuum firm investing in EVs is just not as absurd because it sounds. If something, it’s simply the newest instance of how Chinese language electronics firms are parlaying their current manufacturing experience into making vehicles. The founding father of Roborock, one other Chinese language vacuum firm, began an EV firm in 2023. Xiaomi, the Chinese language smartphone and residential system large, launched its first EV in 2024.

Dreame isn’t the primary and gained’t be the final Chinese language firm crossing over from electronics to EVs, says Lei Xing, an unbiased automotive market analyst and the previous chief editor of the China Auto Evaluation, who checked out Kosmera’s prototypes at CES with me. China’s refined provide chain, engineering expertise, and manufacturing ecosystem make it comparatively straightforward for newcomers to take a shot at constructing vehicles, Xing explains, however just a few will succeed. Others may find yourself extra like Apple, whose long-running automotive undertaking finally collapsed. “Life and dying will likely be a pure final result,” Xing says.

Robovans Are Coming

After I went again to China final yr, I made certain to strive Baidu’s robotaxi service, which is roughly on par with Alphabet’s Waymo within the US. What stunned me in China, nevertheless, was what number of autonomous parcel supply vehicles there have been roaming the identical open streets alongside my robotaxi.

Neolix is the main firm in China making each the {hardware} and software program for robovans. It says the variety of them deployed in China is rising roughly tenfold every year and reached about 10,000 in 2025. (For comparability, there’re about 2,500 Waymo vehicles working within the US.) Neolix claims to characterize greater than 60 p.c of the market and has no main rivals globally, says Zhao You, the corporate’s government president. Neolix introduced three of its vehicles to CES, ranging in measurement from a mini-fridge to a golf cart: tiny, windowless bins perched on outsized wheels, with no driver inside.

Neolix is keen to broaden internationally and already has pilot tasks underway within the Center East, East Asia, and Latin America. It’s eyeing the American market too. Zhao informed me he’s conscious that any self-driving firm within the US will face heavy scrutiny on points like security and knowledge safety, however he’s hoping to work with native companions who may assist navigate compliance necessities right here. “As a tech firm, working with one cloud service supplier for any market is probably the most reasonably priced possibility, however it gained’t work. You must discuss to native regulators and study which cloud suppliers they approve of,” Zhao says.

Producing Viral Movies

When OpenAI launched Sora 2 final yr, it was making an formidable guess that generative AI will be not only a device however a content material style sufficiently big to maintain a complete social media platform. That imaginative and prescient hasn’t absolutely materialized but, however at CES I met with two AI video firms which are competing with OpenAI’s Sora.

Kling is the AI division of Kuaishou, a massively in style Chinese language short-video platform. The Kling app and web site mixed have greater than 60 million registered customers, nearly all of which the corporate says are based mostly outdoors China. About 100 folks attended Kling’s panel occasion at CES with the platform’s energy customers. Jason Zada, an award-winning director who made Coca-Cola’s controversial 2024 AI-generated vacation industrial, mentioned he not too long ago used Kling to generate a YouTube video that includes a hearth calmly burning as Santa, turkeys, astronauts, and snowmen make inexplicable appearances. Zada mentioned he created over 600 clips with Kling and pieced them collectively to make the ultimate 105-minute video. It price about $2,500 in token credit.